After a small rise due to the FOMC meeting on May 5th, the Bitcoin price suffered a major retracement. While the Fed increased interest rates by 50 basis points, the volatility it brought with it caused the stock market and BTC to collapse.

Bears take control after MicroStrategy’s margin call woes

Twitter users discuss what would happen to MicroStrategy’s $205M loan to buy BTC in the event of a major crash . The company’s CFO, Phong Le, notes that $21,500 will be a level at which MicroStrategy will have to add more collateral to avoid a margin call:

Quite a lot of unsecured Bitcoins we can contribute if we have too much downside volatility. we have So I think we’re in a pretty comfortable place where we are right now.

Bitcoin price under bears control

Bitcoin price has emerged from an ascending parallel channel after more than three months in it. This setup is achieved by combining three high lows and two high highs formed since January 24 using trendlines. Unlike the last two retests, the third retest slowly lifted the 200 SMA, showing buyers losing control.

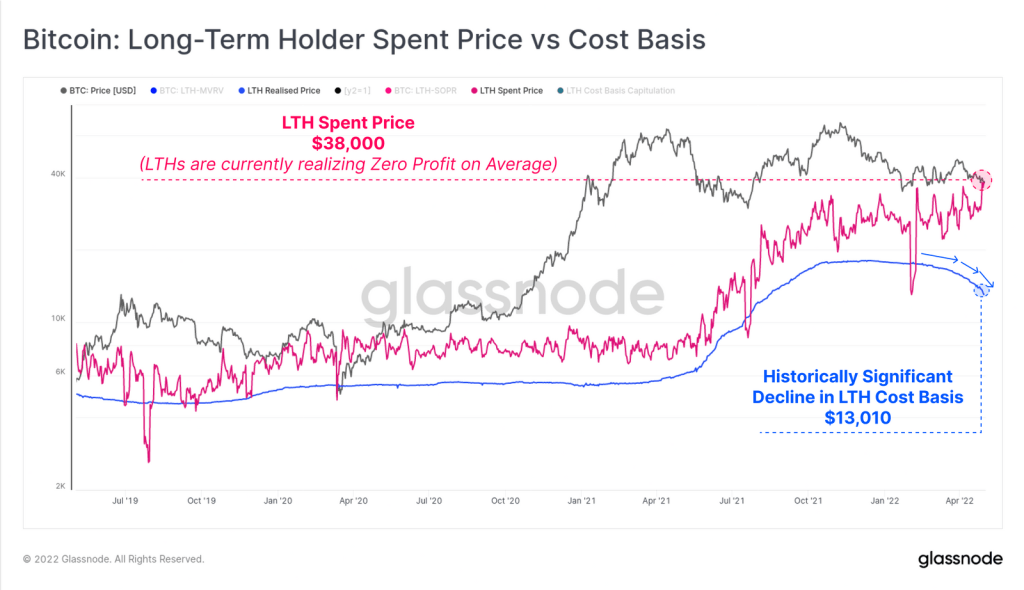

Another important on-chain metric that signals and supports this bearish outlook for bitcoin price is the trend in Long Term Holder (LTH) sentiment. LTH Price Spent (pink) shows that the average purchase price of coins spent by these traders is at par as it meets the spot price. This development shows that LTHs accumulating BTC in 2021 and 2022 averaged break-even panic selling.

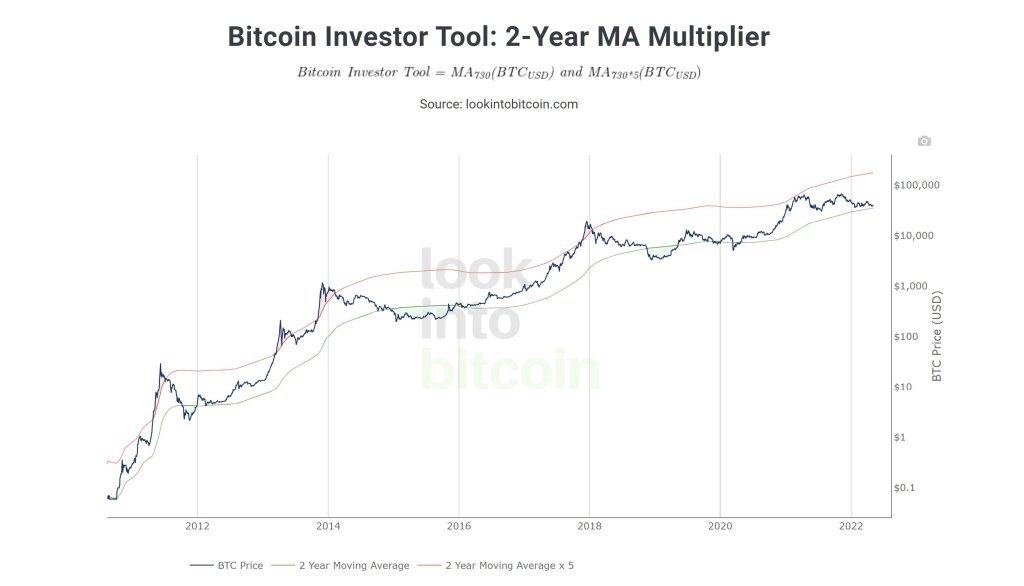

Further questioning the validity of a bullish and adding confidence to the bearish outlook is a recent retest of the 2-year Moving Average. In its eleven-year history, Bitcoin price has fallen below this barrier every cycle or before a major bull run begins.

Levels needed by bulls for trend change

to Akash Girimath, whose analysis we shared as Cryptokoin.com The only way for the bulls to make a comeback is to move Bitcoin price above the intermediate resistance levels and close a weekly candlestick above $52,000. This move will produce a higher value than those formed in late December 2021, invalidating the drop. In such a case, BTC can be expected to produce a higher bottom near the $45,000 resistance and skyrocket to revisit the ATH level of $69,000 or even a new level of $100,000.