Bitcoin price has hovered around the same level for the past six days with no signs of directional bias. That’s why crypto analyst Akash Girimath says Bitcoin is showing continued consolidation. According to the analyst, it is possible that a breakout from this tightness range could cause a bearish move that could see the sell-stop liquidity slide below recent lows. We have prepared Akash Girimath’s IT analysis for our readers.

Bitcoin price at inflection point

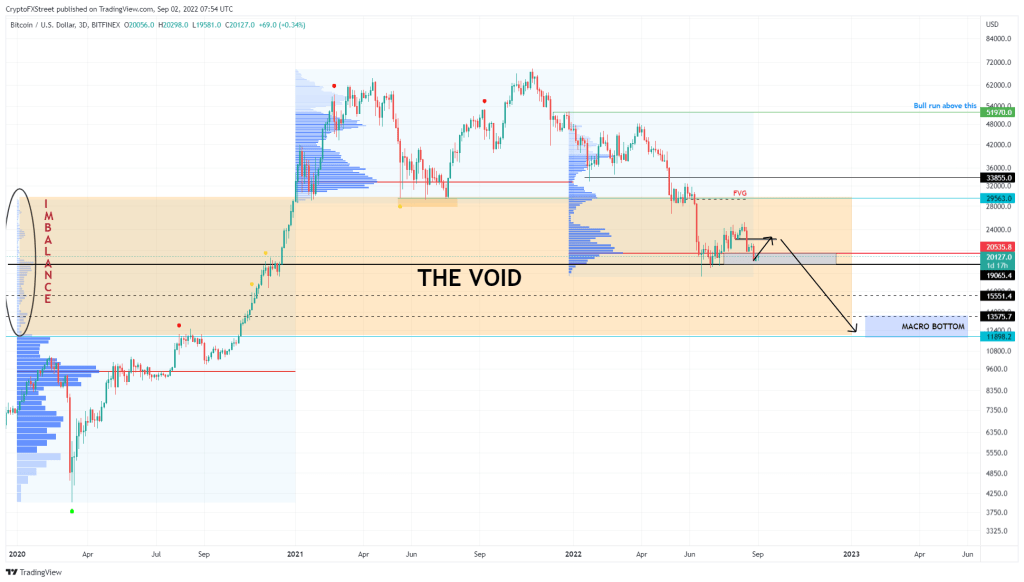

cryptocoin.com As you follow, Bitcoin recently broke out of another range-bound move on August 26. It then entered into a tight consolidation. This collapse pushed BTC below the checkpoint (POC) at $21,535, the highest level of trading volume since 2022.

Crypto markets are bearish. Therefore, if buyers fail to step in, it will result in another drop that pushes Bitcoin price into the $17,585 range. This means a 12% decrease. In this case, it is likely to be met with buying pressure from investors who want to buy BTC at a discounted price.

BTC 1-day chart

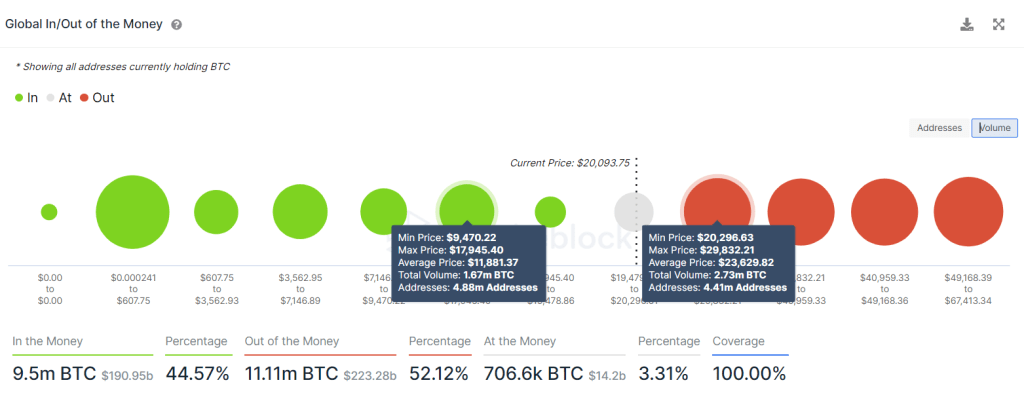

BTC 1-day chartFrom a chain perspective, this downtrend is likely to happen sooner or later. IntoTheBlock’s Global Money In/Exit (GIOM) pattern shows that the close support level at $18,925 is weak relative to the $23,629 resistance cluster.

The first cluster contains 673,210 addresses holding only 421,840 BTC. In the second cluster, there are 2.73 million BTC bought by approximately 4.41 million addresses. This outlook suggests that a downtrend is more likely, especially if there is a spike in selling pressure.

Interestingly, the next cluster of support extends from $9,470 to $17,945. In this cluster, about 5 million addresses have received 1.67 million BTC at an average price of $11.881. Therefore, a drop to $18,900 is possible resulting in a steep correction to levels two years ago.

BTC GIOM

BTC GIOMHowever, if the bulls bounce back at the current level, they are likely to avoid a bearish view. What is the first confirmation of a bull trend or a recovery rally? For this, Bitcoin price needs to rise above the POC at $21,535, as seen in the chart above.

If BTC price fails to hold above $18,900…

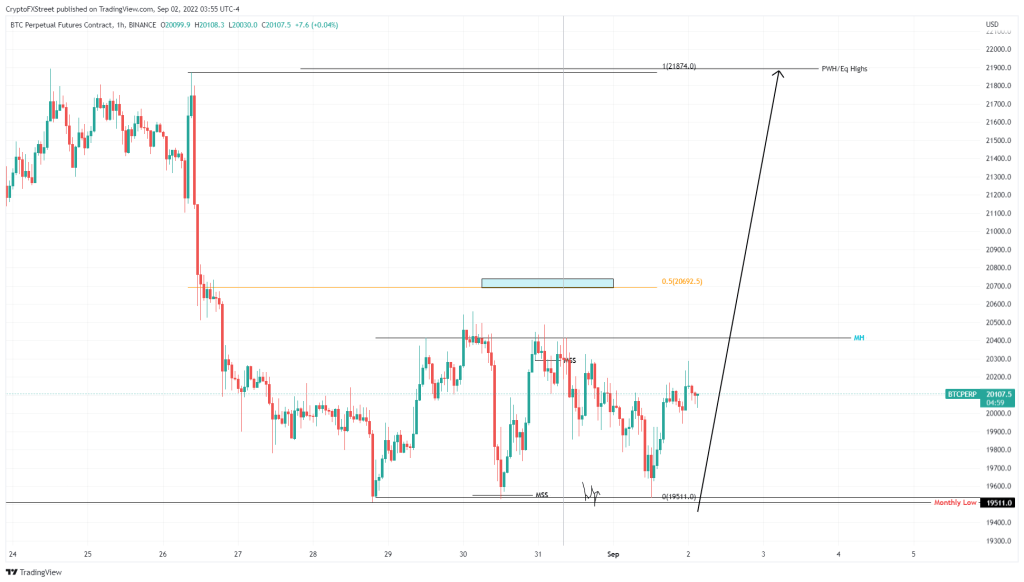

Additionally, the hourly chart shows that Bitcoin has yet to collect the buy-stop liquidity standing above the equal highs of $21,874. Therefore, a sweep below the $19,511 level is likely to provide the necessary buy signal that could potentially predict a liquidity move just above $21,874.

BTC 1-hour chart

BTC 1-hour chartOn the other hand, if Bitcoin fails to hold above the $18,900 level, on-chain measurements predict it will go to $11,881. This means a 36% decrease. Interestingly, this level coincides with the technical outlook that predicts a collapse to the $11.898 support level.