The Bitcoin price has been falling over the past few days, with the recent announcement of the 30 percent tax on electricity used for BTC mining proposed by US president Joe Biden, and in particular the collapse of Silvergate and Silicon Valley Bank. So, what’s next for Bitcoin (BTC) as we enter the new week? Here is the weekly Bitcoin forecast and the latest situation in the market…

This Bitcoin forecast points to the critical support of $18,500

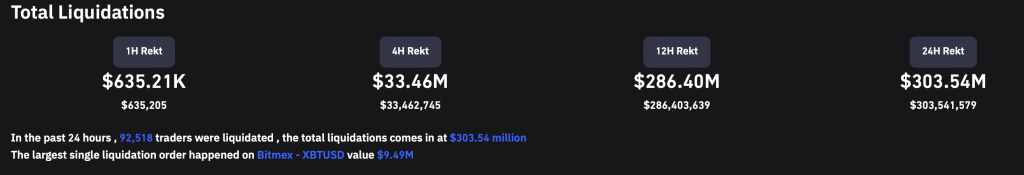

cryptocoin.com As we have also reported, Bitcoin and altcoins declined towards the end of the week we are about to leave behind. The value of the total cryptocurrency market has lost almost 8 percent. Meanwhile, Bitcoin failed to hold the critical support level at $21,500, causing a sharp drop below $20,000. Ironically, a few days before this drop, the price of BTC had recorded a massive one-day increase of around $1,500.

#Bitcoin Update

(D) As $21.6k didn't hold, price did reach the lower line of the cloud & even managed to exit it. $19.8k support is the level to watch. If lost, next strong support's at $18.5k.

(W) Inside bar's breakout to the 📉. Weekly candle must close above Kijun 🔵. https://t.co/jRhdE2r8bp pic.twitter.com/XKHmmL1L6I— Titan of Crypto (@Washigorira) March 10, 2023

So what’s next for Bitcoin (BTC) price? Will the price continue to drop and mark new lows? Or is the price action just a short-term effect that can be quickly reversed? A clear recovery is needed right now as Bitcoin price moves towards the critical support level of $19,800. If the price fails to hold these levels, a popular analyst at Titan of Crypto believes the price will drop to the next strong support level, $18,500.

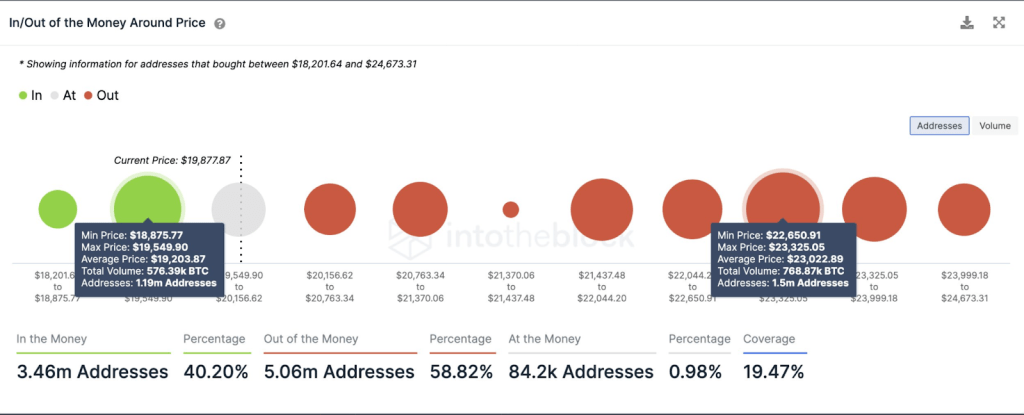

However, analysts say that a weekly close above the “Kijun line” at $20,358, a component of the Ichimoku cloud indicator, could also be significant. Currently, Bitcoin seems to have reached support levels between $18,900 and $19,600. Because here, 1.2 million addresses bought 576,390 BTC. Therefore, if the price fails to hold at these levels, a mass liquidation may be triggered, which will drive the price down. There is also a stiff resistance at $23,000, where 1.5 million addresses hold 768,870 BTC if the price makes a healthy recovery.

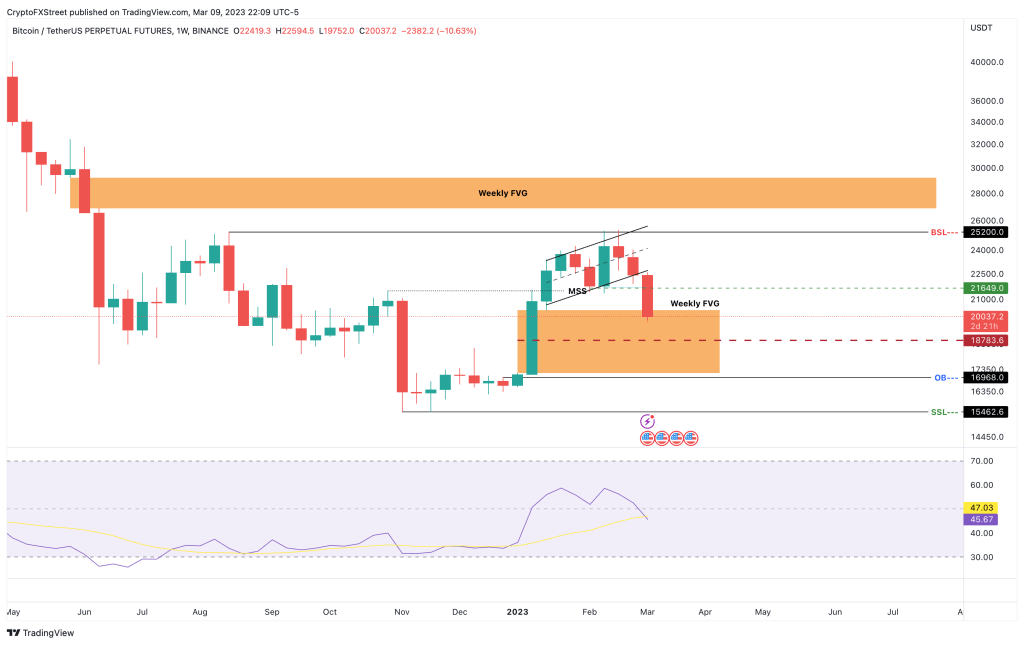

Analyst points to FVG in BTC price

On the other hand, analyst Akash Girimath also announced a Bitcoin prediction. According to the analyst, Bitcoin price indicates that it has entered the weekly Fair Value Gap (FVG), which has increased from $ 20,386 to $ 17,181. FVG is an imbalance that occurs when one side of the investors takes control. In this case, there was an imbalance created by BTC buyers in early January that led to a 21 percent return on a weekly candlestick. As the Bitcoin price skyrocketed, it left a gap untouched by the next candle and then left an imbalance. Typically, these gaps are filled as the asset returns to it, and returns are rebalanced.

Interestingly for Bitcoin price, this FVG caused a shift in the market structure in favor of the bulls, meaning BTC set a higher high than the $21,473 high on Oct. This development indicates that the bullish outlook is still on a high time frame and the current correction is a good opportunity to accumulate. According to the analyst, a savings of between $20,000 and $18,800 seems to be the best route. However, traders should also keep a close eye on the weekly Relative Strength Index (RSI), which has dropped below the midpoint after the recent sell-off. If the bulls are in control, the weekly RSI should rise above the 50 level and hold.

What does it take for Bitcoin to recover?

On the daily chart, Bitcoin price is currently supported by the 200-day Exponential Moving Average (EMA) at $20,068. Just below that, the 200-day Simple Moving Average (SMA) is at $19,320 and the midpoint of the weekly FVG is $18,783. The above-mentioned levels will act as support, but if it fails to hold above all these levels, Bitcoin price could tag the weekly order block at $16,968. From a conservative perspective, investors should assume that the Bitcoin price could drop as low as $17,000 and plan their accumulation journey accordingly. According to the analyst, the recovery of Bitcoin price will depend on two things:

- Non-Farm Employment (NFP) and Consumer Price Index (CPI) macroeconomic events.

- Investors’ capacity to accumulate.

Macroeconomic events are likely to increase volatility again, so investors need to stay put until these events are over. After the CPI announcement on March 14, investors need to look at a few things to gauge their capacity to save.

On-chain signals are important for Bitcoin prediction

According to the analyst, the following three on-chain metrics are important for Bitcoin prediction:

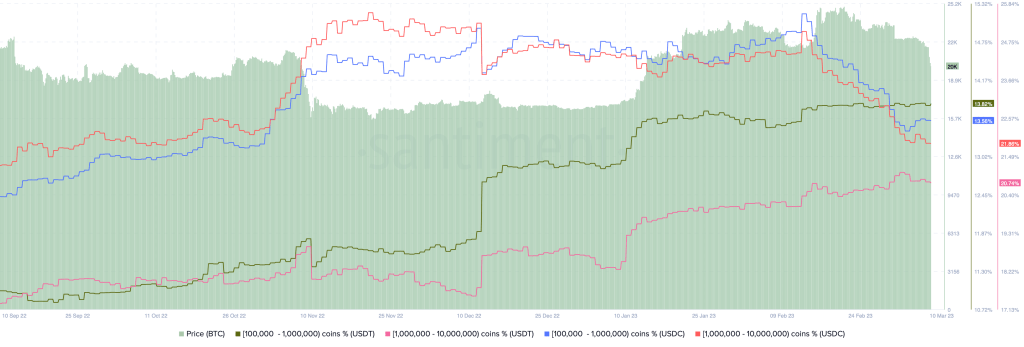

- Stablecoin whales accumulation pattern: This indicator will show whether high net worth individuals are willing to save. Whales holding 100,000 to 10,000,000 stablecoins most recently saw a spike in late January and early February pushing BTC to $25,000.

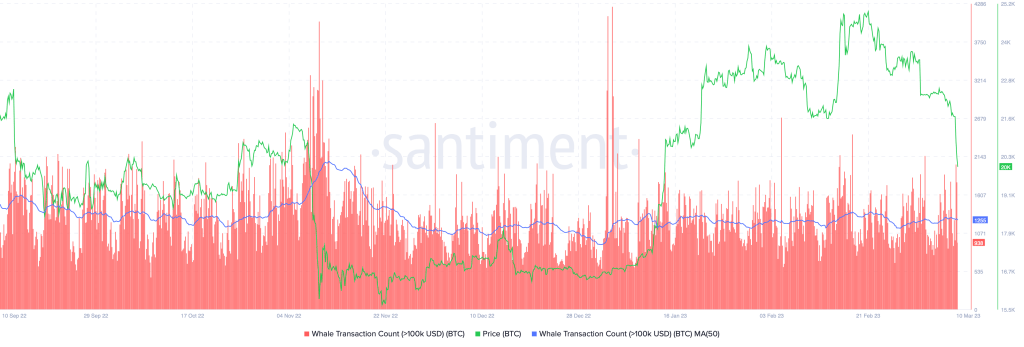

- Number of whale transactions: This on-chain metric tracks the number of transactions worth $100,000 or more and serves as a representative of these whales’ investment interests. If this indicator is up after a big drop, it could signal a buying opportunity. This metric has been steadily increasing above the 50-day average since the beginning of February, suggesting that investors moved their holdings long before the March 9 crash. If this indicator burns out after a sharp correction, it may indicate the opposite, that is, investors are accumulating.

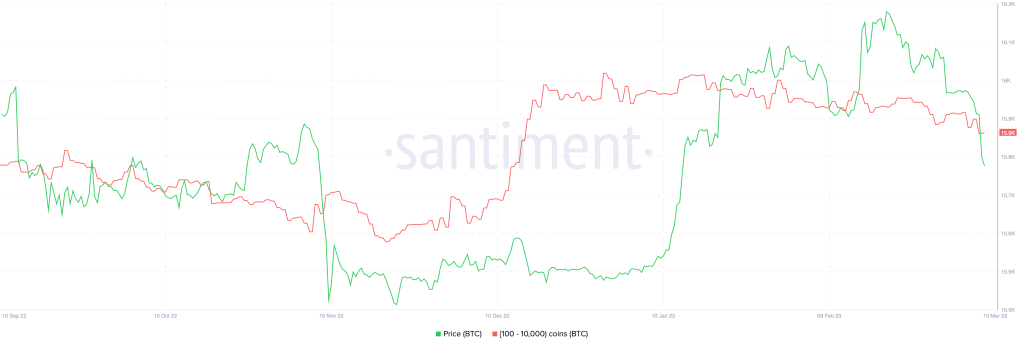

- BTC supply breakdown: These ten chain metrics show BTC whales holding between 100 BTC and 10,000 BTC. An increase in the number of wallets holding that much Bitcoin could indicate an accumulation pattern at current levels and suggest a potential recovery rally. According to the analyst, the only way for Bitcoin price to invalidate its long-term bullish outlook is if it breaks below the $15,462 barrier. Failure to stay above this level on a weekly timeframe will confirm that there is no buying pressure and invalidate the bullish argument. According to the analyst, this development could allow the Bitcoin price to drop to the next immediate support level, $12,898.