Bitcoin price continues to move between $28,600 and $30,600. The threat of further disruption increases as on-chain metrics decrease. Meanwhile, one analyst Akash Girimath cites that although unlikely, investors could keep their eyes open for a potential dead cat bounce to $35,000. Here are the details…

Bitcoin price at risk of correction

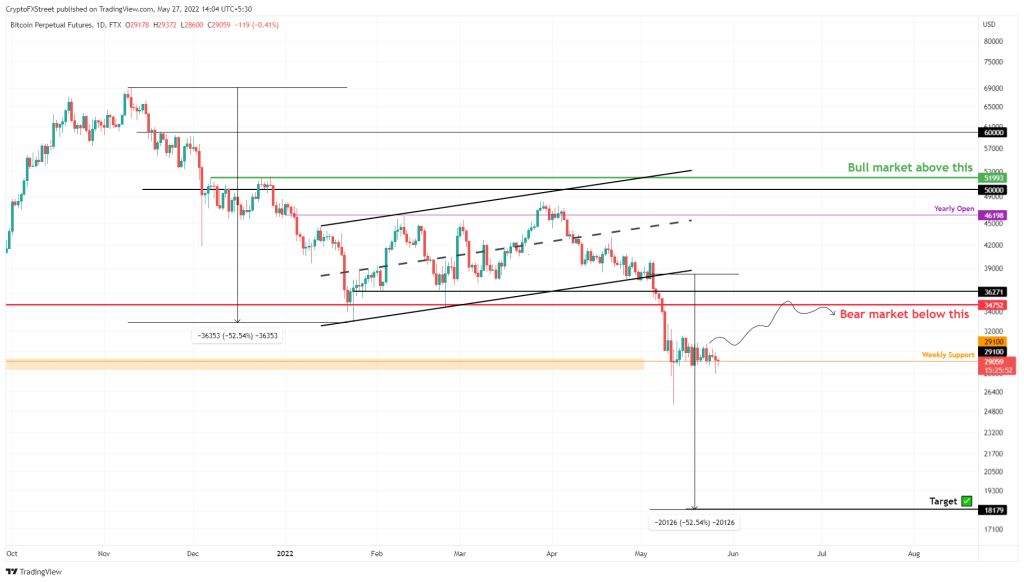

After the LUNA-induced crash on May 12, Bitcoin price is consolidating above the weekly support level. According to the analyst, this spiraling price action could trigger a downward move for BTC, causing investors to deepen their frustrations. Bitcoin price broke out of a bear flag setup on May 6. It led to a 36 percent collapse within a week. BTC fell from its all-time high of $69,000 to $32,837 between November 10, 2021 and January 24, 2022. According to Girimath, he created the model’s flagpole. Meanwhile, consolidation in the form of higher lows and higher peaks between January 14 and May 22 formed an ascending parallel-like structure known as the flag.

This technical formation predicts a target of $18,179, which was confirmed the moment the Bitcoin price fell below $38,305. So far, the sell-off has allowed bitcoin price to consolidate around $29,147, just above the weekly support level of $29,100. A daily candlestick close below this support will trigger further declines to the target at $18,179. According to the analyst, this move will constitute a 37 percent loss. Most likely, it’s a place where fringe buyers can come to collect discounted BTC.

Ten chain metrics weaken

There is also something supporting this bearish narrative observed in Bitcoin price. The decrease in the number of new addresses joining the BTC Blockchain last year. The 7-day Simple Moving Average of this metric fell from 620,122 to 381,857 between January 9 and May 26. This 38 percent drop in new active addresses joining the Bitcoin network marks a clear drop in investor sentiment around BTC. It also shows that market participants are not interested in BTC at current price levels.

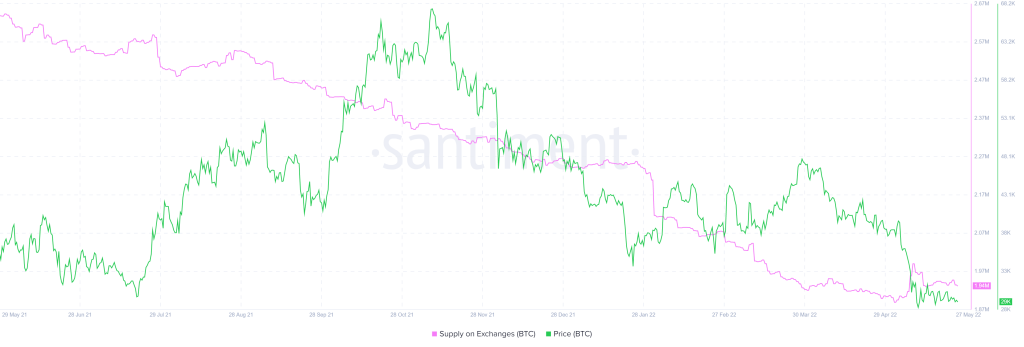

Also, the number of BTC held on exchanges has increased from 1.89 million to 1.94 million since May 2. This 2.6 percent increase in supply held at central institutions poses a sell-side threat. In the event of a sudden collapse, these holders could panic sell. It could add more pressure and exacerbate the downtrend. Therefore, these ten chain metrics show that the odds in favor of the bears are increasing.

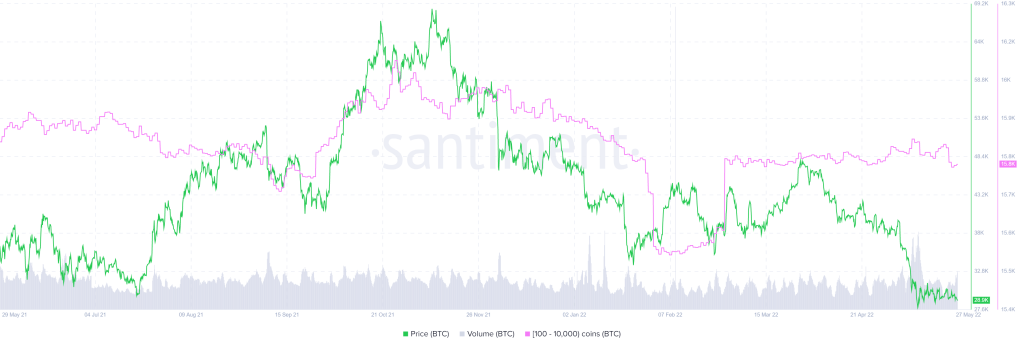

Another bearish picture for bitcoin price is the lack of accumulation of whales. Interestingly, these high-net-worth investors are dumping their holdings. Wallets holding 1,000 to 10,000 BTC tokens fell from 15,870 to 15,856. This represents 14 wallets emptying their assets. This decline indicates that these investors are making profits. He also reveals that he believes further reductions in Bitcoin price are possible.

Hope for a dead cat to come out

While most of the on-chain metrics are bearish, investors can hold on to one last hope, which is the dead cat bounce scenario. In this outlook, market participants can expect the Bitcoin price to face significant hurdles between $33,000 and $36,000. When the Bitcoin price finally makes a U-turn, this move is likely to create liquidity for smart money shorts. According to the analyst, in such a scenario, latecomers will likely get stuck holding their bags. According to the expert, this can result in a long squeeze. However, this rapid rise is a chance for individual investors to empty their bags at a much better price than now, at least until a solid bottom for Bitcoin occurs.

However, if this spike breaks further to produce a daily candlestick above the $53,000 barrier, it will create a higher top from a macro perspective. It will invalidate the decline thesis. Such a development will pave the way for marginal buyers to step in, potentially pushing BTC to retest its all-time high of $69,000.