Crypto analyst Akash Girimath says that Bitcoin (BTC) has produced three consecutive lows since Sept. However, he also notes that the Relative Strength Indicator (RSI) is showing a positive increase, indicating a lack of underlying bearish strength. According to the analyst, this lack of validation is a sign that a possible reversal is in sight. It also shows that BTC is starting to climb higher. We have prepared Akash Girimath’s Bitcoin analysis for our readers.

Bitcoin price and technical woes

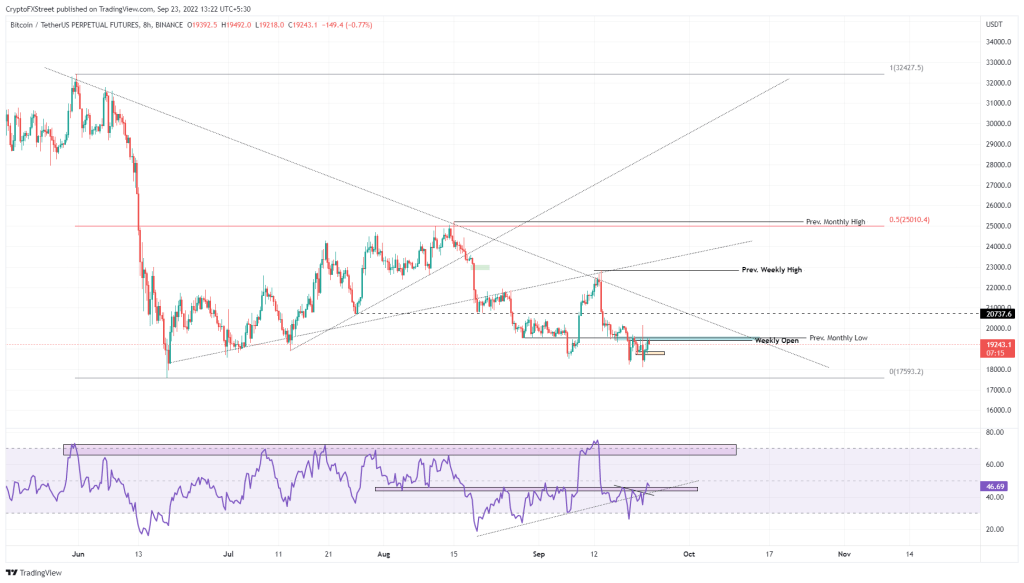

cryptocoin.com As you follow, Bitcoin is slowly trying to gain momentum. However, it needs to overcome a significant hurdle to accelerate the uptrend. BTC is technically in a tight corner. BTC is up 7% after forming another low at $18,804. It is currently grappling with the $19,405 to $19,599 resistance box. As you can see, the August lows of $19,539 are key to the outlook. Here are two things investors should pay attention to:

- The conversion of the $19,539 barrier to a support level.

- RSI stays above the 43 to 46 support boxes as BTC changes the aforementioned level.

If both of these conditions are met, Bitcoin gets ready for a higher move. In such a case, BTC will face a key confluence of resistance at $20,737, along with the descending trendline connecting the swing highs since May 31. Overcoming these obstacles will not be easy. However, it will need to clear the way to retest and sweep $22,850.

Beyond this level, market participants should shift their focus to the August high of $25,200. This level is significant as it includes the midpoint of the $32,427 to $17,593 range from the $25,010 high. A retest of this level will likely set a local high for Bitcoin.

BTC 1-day chart

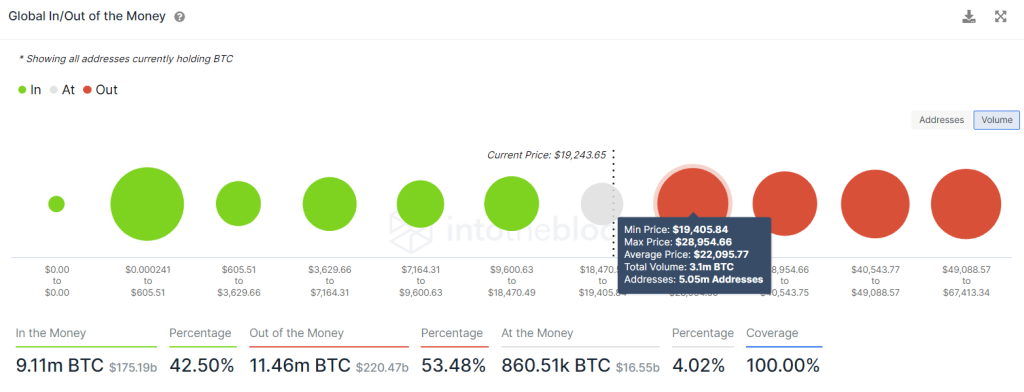

BTC 1-day chartIntoTheBlock’s Global In/Out of the Money (GIOM) model supports this rally in Bitcoin price. This indicator shows that the close support level stretching from $9,600 to $18,470 is not as strong as the resistance level. However, it also hints that it can produce a bounce. However, the close hurdle stretches from $19,405 to $28,954. Here, roughly 5.05 million addresses are “At a Loss” that received 3.1 million BTC at an average price of $22,095.

Is an uptrend possible for BTC?

This set of resistances is in line with the stated objectives from a technical point of view. It also adds more confidence to the possibility of a bounce. However, investors should not forget that the transition to this cluster may lead to selling pressure for these underwater owners who want to break even.

BTC GIOM

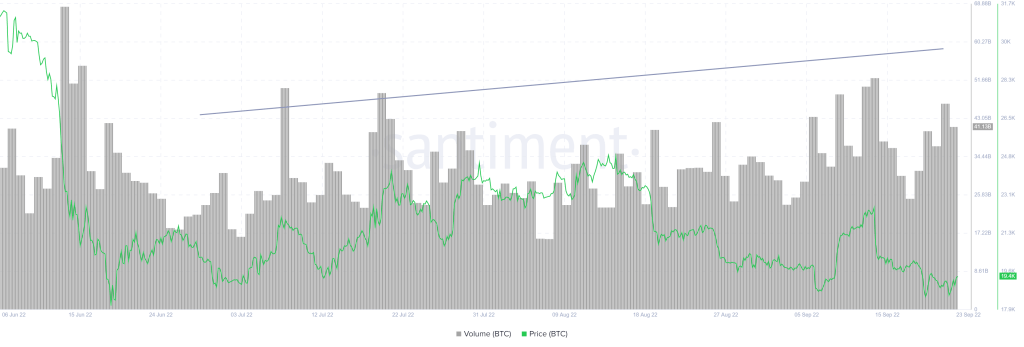

BTC GIOMThere is another interesting metric that supports this ascension narrative. This metric is on-chain volume, which is in a steady uptrend. After falling to 16.39 billion BTC in the first week of July, it rose steadily to where it is now, to 41 BTC. This increase indicates that more investors are interacting with the BTC Blockchain. Therefore, it is a sign of an increase in capital inflow, which is a bullish sign depending on the market structure.

BTC on-chain volume

BTC on-chain volumeMeanwhile, traders need to be prepared for a trial scenario that includes a sweep from June 18 low of $17,593. If BTC rallies and continues rapidly above this level, this move will be a good opportunity to buy.

However, a daily candlestick near that level turns it into a resistance level. Thus, it invalidates the bull thesis. In such a case, it is possible for Bitcoin to drop to the next stable level of support at $15,500. If the selling pressure continues to build, BTC is likely to trigger a sell-off to $13,500 and $11,989, where a macro bottom could form for a bear market.