Bitcoin price has been consolidating for about a month now and shows no signs of a breakout move. While short-term moves are easy to predict, the long-term outlook is interesting given the opportunities surrounding the potential approval of a Bitcoin spot ETF. So what’s next? Here is the Bitcoin forecast for the upcoming period.

Bitcoin forecast: What affects the price?

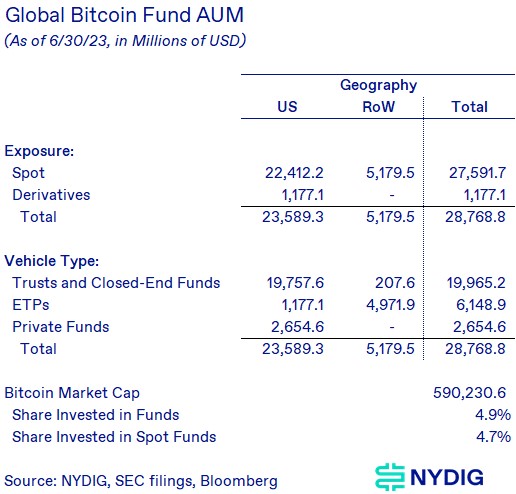

A recent report from NYDIG explores the impact of the Bitcoin spot ETF on BTC price by drawing analogies with Gold and ETF approval. Simply put, the report shows that spot Bitcoin funds such as the Grayscale Bitcoin Trust (GBTC), or spot ETFs outside the United States, total $28.8 billion. On the other hand, gold accounts for $210 billion in managed assets (AUMs) worldwide as of June.

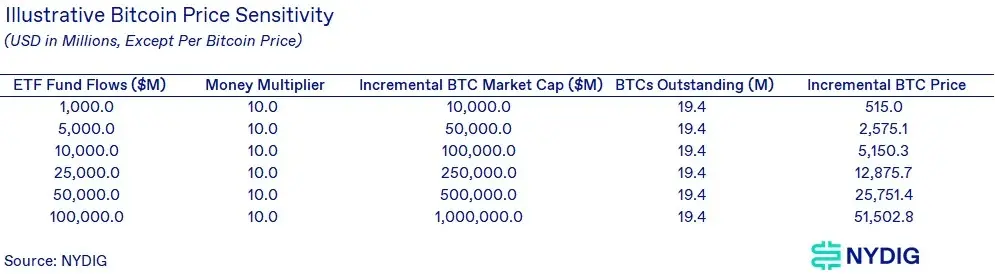

The research also adds that the comparison between gold and Bitcoin is “stunning.” While Bitcoin is 3.6 times more volatile than gold, “investors would need 3.6 times less Bitcoin than gold in dollar terms to incur the same risk.” Based on this, approximately $30 billion in additional demand will arise for the Bitcoin ETF. The report takes this one step further, suggesting that “for every $1 of AUM flowing into a Bitcoin ETF, it affects the value (market value) of Bitcoin by $10.”

What does the Ecoinometrics report say?

NYDIG’s report takes a more open approach when comparing Bitcoin to gold, while Ecoinometrics’ newsletter takes a more cautious stance. In their report, they state that the impressive rise in gold in the 2000s was due to a combination of factors such as a weak US dollar, favorable macroeconomic conditions and the launch of a new ETF. Hence, they state that it is unfair to compare gold with Bitcoin.

Ecoinometrics instead points out that the total AUM is about $20 billion, even though it owns products like Grayscale’s GBTC or uses MicroStrategy as a proxy for BTC. They add that even if BlockRock’s Bitcoin ETF is launched, it will not attract a lot of capital inflows, it will only cause the available capital to move. Ecoinometrics’ newsletter states that BlackRock’s ETF alone will not push the price of Bitcoin to $100,000.

The big picture remains the same in Bitcoin

Bitcoin price has been consolidating around the psychological level of $30,000 for about a month, according to analyst Akash Girimath. This dull price action is contained within the weekly bearish breakout pattern stretching from $29,247 to $41,273. So any upside move will be met with selling pressure. But so far the bulls have been extremely persistent and have not given up. From a conservative perspective, investors can expect a short-term pullback to $27,947. But a better buying opportunity would be a correction that retests the $25,000 psychological level. This level is key and must be defended by the bulls at all costs.

A jump from that mainstay will be critical to continuing the 2023 run. Extending the ongoing rally will push Bitcoin price to retest the midpoint of the bearish breakout pattern at $35,260. Depending on the prospects for the Bitcoin spot ETF, Bitcoin price could either stop at $35,260 or target the $40,000 barrier. While a bullish outlook is possible for Bitcoin price, disruption of the $25,000 psychological level would signal bullish failure as it would create a lower level. In such a case, BTC could decline to the $21.313 support level. In fact, in a dire scenario, the Bitcoin price could even drop to $17,311.

What is the Bitcoin prediction of the Bollinger indicator?

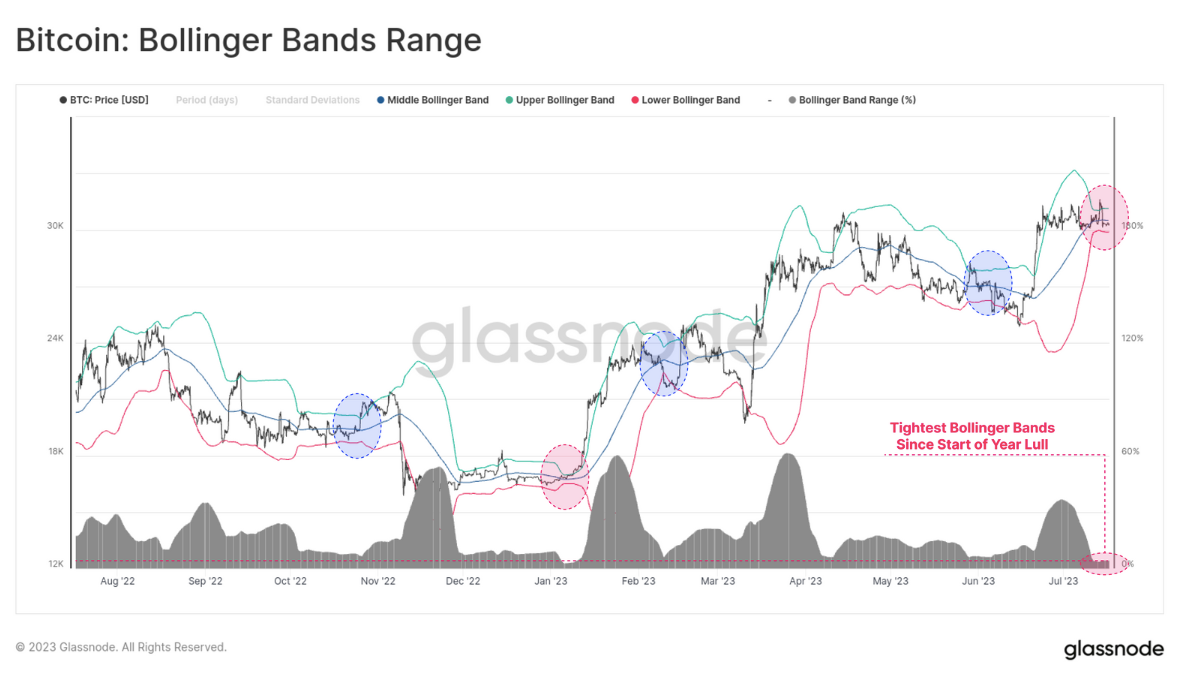

On the other hand, data shows that Bitcoin is experiencing a burst of volatility that could rival its January 40% gain. In the latest edition of its weekly newsletter, The Week On-Chain, analytics firm Glassnode revealed its narrowest Bollinger Bands since early 2023. BTC price has been moving in a tight range for an entire month, using $30,000 as the focus for sideways behavior. Popular analyst Aksel Kibar says this puts both bulls and bears to the test. This is often seen before strong movements. “Still, I am not sure about the direction. I will stick to my well-defined boundaries. “I know that increased volatility is imminent,” he said.

According to Bollinger Bands behavior, this volatility should come sooner rather than later. The classic volatility indicator is currently giving an indication that the days when BTC price action is range-bound are numbered. Bollinger Bands use the standard deviation around a simple moving average to determine when an asset’s price will change its trend. On BTC/USD, the upper and lower bands are unusually close to each other right now. In fact, it’s tighter than it has ever been since Bitcoin began its rise in 2023.