Bitcoin price has been consolidating since the May 12 crash and has remained relatively stable in macro terms. As a result of this consolidation, BTC may be preparing for a volatile move that will shock investors, according to analyst Akash Girimath.

$35,000 or $23,000, which CME gap could Bitcoin fill first?

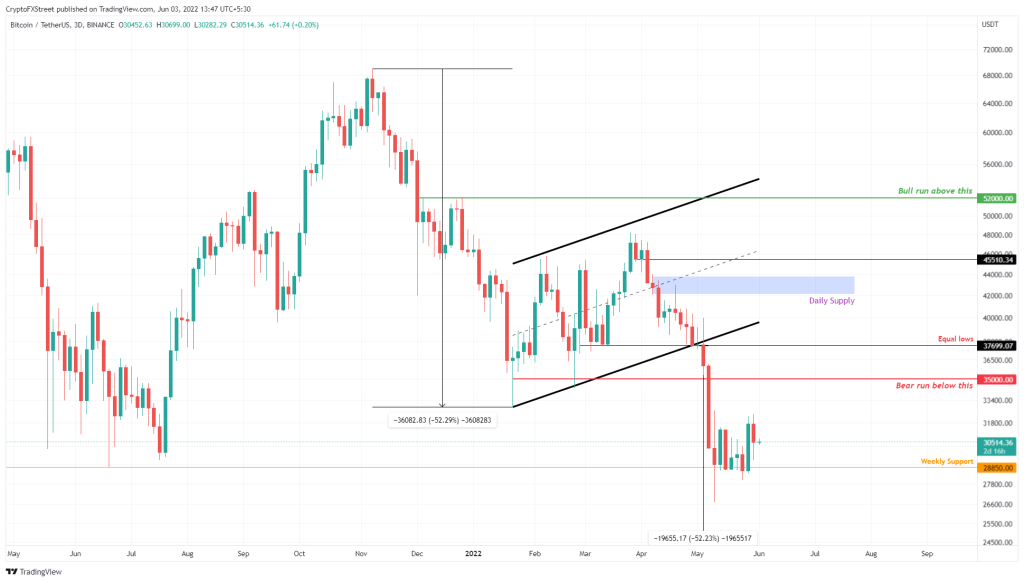

Bitcoin price broke the bottom of a bear flag pattern on May 1, signaling more downside to come. Although obvious in retrospect, the crash from $37,699 to $26,700 caught many investors off guard.

As the chart shows, the bear flag pattern is down 52% to $17,975 as its final price target, but predicts more downside yet to come. So far, BTC is halfway through this theoretical target and is currently consolidating above the weekly support level of $28,850.

Also, BTC was able to bounce 13% from this support zone and formed a swing high at $32,399. While impressive, the macro outlook remains bearish despite many anticipating a relief rally. Investors were split into two groups who believed a rally would hit $35,000 or $36,000; the other is that the collapse will continue and the recent increase is just a deviation from the ongoing consolidation.

Analyst Akash Girimath, for the second group’s predictions, thinks that after breaking $28,850, 2017 levels can be seen:

28.850 for the bearish view to materialize. Breaking the dollar support level is not only very important, but also an essential requirement. If such a development precedes a relief rally, there is a good chance that Bitcoin price will hit the forecast target of $17,975, just below the 2017 ATH of $19,798.

How can market makers position themselves in this outlook?

While the above bearish view makes sense, it does not affect the smart money or market makers’ perspective. Markets tend to move the other way around, with the most brutal crashes occurring when the majority of individual investors are bullish and anticipating a bull rally, and in a downtrend. This is because individual traders are often wrong and smart traders trade in the opposite direction. This gives more confidence in the possibility of a rebound despite the bearish indicators mentioned above.

Reasons for a possible Bitcoin rally

Bitcoin, which we have included in the analysis of cryptokoin.com , recovery rally It has recorded nine consecutive weekly downward candlesticks without Also, the Bitcoin price has dropped 45% since March 28 and shows no signs of a easing trend. This could indicate that the drop is overextended and a small bounce looks likely. The CME difference of $34,445 to $35,180 is another reason to expect a small increase. It is said that the market hates a gap and the price tends to fill them. CME gaps occur on weekends when the Chicago Mercantile Exchange closes its trading space but crypto exchanges are open.

Another reason is that the higher timeframe resistance of $35,000 was not tagged after the crash. Usually, when a support level is flipped to a resistance level, retesting the newly created blockade adds confirmation to that flip. Therefore, a spike that retests the $35,000 resistance level could solidify this level as a major hurdle. Interestingly, the CME gap overlaps the aforementioned hurdle and lends credence to a potential retest that will likely be rejected.

Finally, a sudden sell-off at such an optimistic stage would not only catch these market participants off guard, but would also allow smart money to fill orders for a major crash to the psychological level of $20,000 or less.

On-chain metrics reveal panicked investors

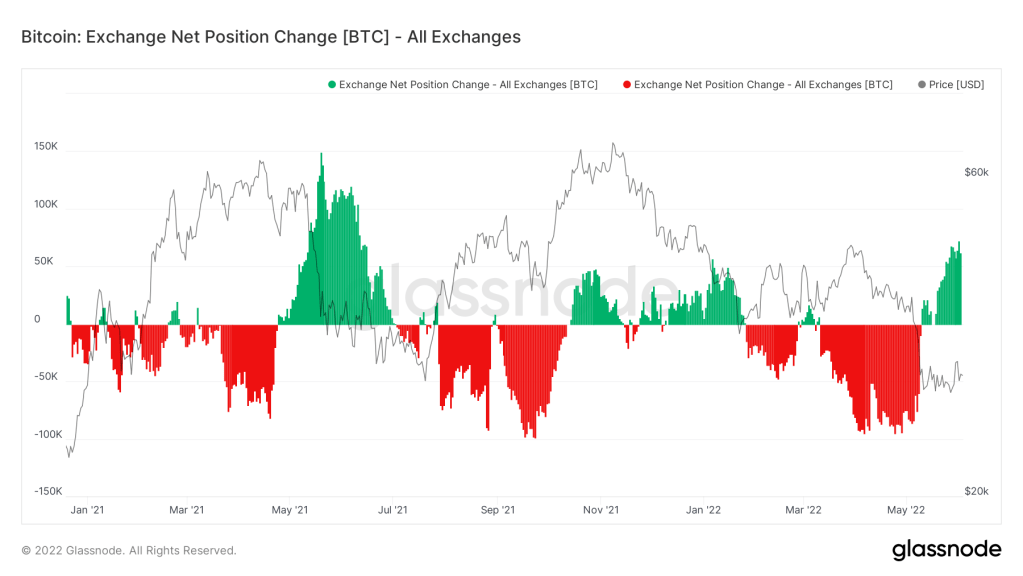

However, while a relief rally to $35,000 seems possible, the bearish the macro trend seems to be firmly established. Both outlooks described in this article predict a similar endgame – a drop to $20,000 or less. Supporting this macro downtrend for bitcoin price is the net currency position change. This index tracks the number of BTC flows to exchanges and can serve as an indicator of investor sentiment and also predict the probability of a sell-off.

Since May 9, the number of BTC inflows has increased, pushing net flow to 72,815 as of June 1. Such a level was last seen in the second week of May 2021, when the Bitcoin price was heading towards the ATH level. $64,854. Therefore, if these investors start selling Bitcoins in a panic, leading to further capitulation, it could result in a selling pressure.

On the other hand, although the outlook for Bitcoin price seems wildly bearish, things could turn in the bulls’ favor if certain conditions are met. The first and foremost requirement is for BTC to produce a higher value in the macro view. A daily candlestick above $53,000 will technically produce a higher top (HH).

The second requirement is for the bulls to produce a higher low (HL) than the $26,700 drop on May 12. If these two conditions are met, things could turn around and allow the buyers who stayed on the edge to step into a higher bottom and start a bull run for Bitcoin price. In such a case, market participants can expect BTC to climb higher and retest the psychological level of $60,000 and perhaps even higher to revisit the ATH level of $69,000.