Bitcoin price has been on the roller coaster ride since June 18. With the latest spike, BTC quickly recouped its losses. However, analyst Akash Girimath notes that Bitcoin is in a downtrend on the three-day chart after the recent sell-off. But he says it’s also possible for things to turn around. We have prepared Akash Girimath’s BTC analysis for our readers.

“Bitcoin price prepares for another volatile move”

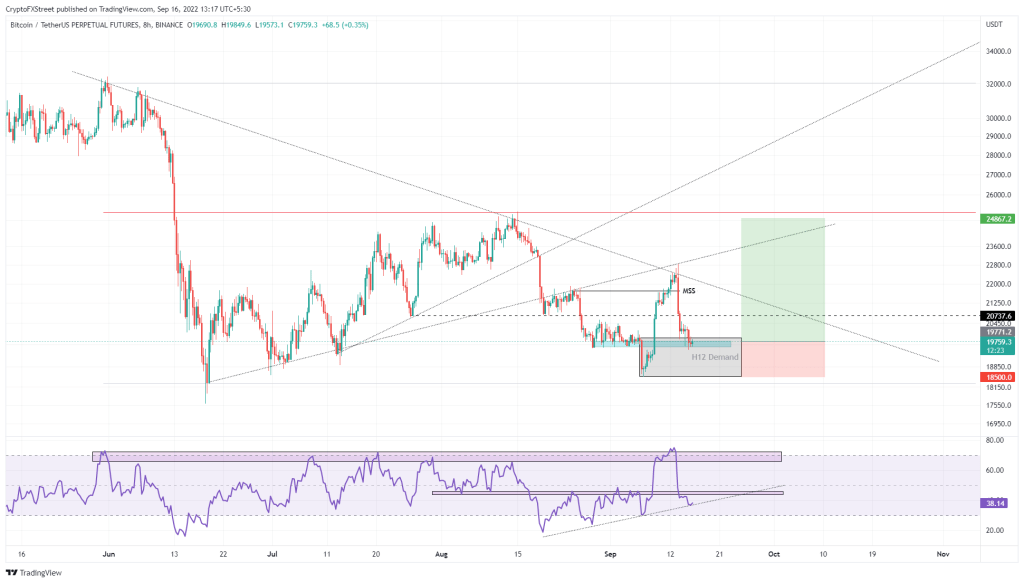

cryptocoin.com As you follow, Bitcoin increased by 23% between 7-13 September to $ 22,850. This higher volatility caused a shift in the market structure to higher higher than the $21,750 swing high on August 24, as seen in the eight-hour chart below.

Macro bearish outlook continues. Despite this, this development signals that there is still a force that buyers and bulls have to contend with. It also shows that investors should prepare for another bullish possibility in BTC. Interestingly, the twelve-hour demand zone stretching from $18,500 to $19,909 is one of the main reasons investors see it as a possibility.

BTC 1-day chart

BTC 1-day chartA confirmation of the trend reversal will likely come from the $19,547 high to $19,784 support area. If this level holds, it will signal that buyers are looking to push BTC higher. The first hurdle on the bull path is $20,737. Breaking this hurdle will likely open the way to potentially create a double top at $22,850. However, if the bullish momentum is strong, it is possible that this surge will push BTC towards the $25,000 psychological level. This level is the midpoint of the 45% slump that occurred between June 1 and 18.

Further supporting this bullish thesis is the Relative Strength Index (RSI), which has been consistently producing higher lows since Aug 20. The 15% crash over the past two days seems to have pushed the RSI to retest the trendline in question. This suggests that a reversal is highly likely here.

Macro view and slippery slope

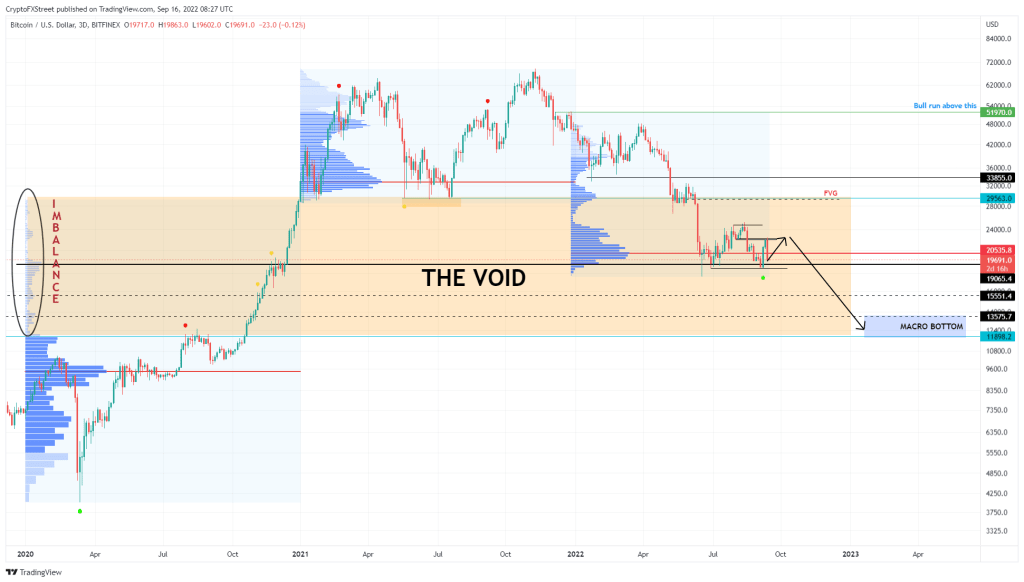

While the short-term outlook is bullish for BTC, the long-term outlook remains bearish. The recent crash in BTC pushed it below the 2022 highest trading volume level of $20,535. Without a rapid recovery, BTC is showing signs that it will continue to hold on to the bearish outlook. The first level that market makers will be interested in is the double bottom formed at $18,638.

Once this barrier is breached, there will be a direct drop to retest the minor support level at $15.551. Once this barrier is broken and Bitcoin falls, BTC is likely to potentially create a macro bottom. Accordingly, BTC is likely to reach the support range from $13,636 to $11,785.

BTC 3-day chart

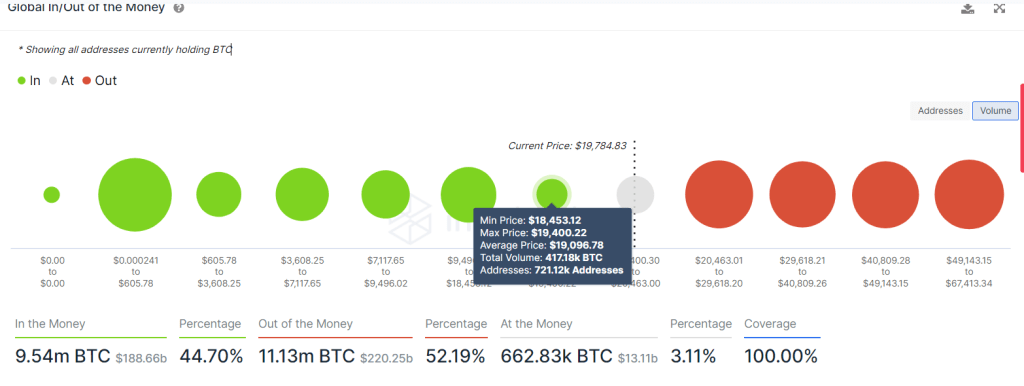

BTC 3-day chartIntoTheBlock’s Global Money In/Out (GIOM) model supports this steep 45% collapse in Bitcoin price. This records the next support level at $19,096. It also shows that only about 721,000 addresses bought 417,800 BTC.

A breakdown of this level reveals that the next stable support base stretches from $9,496 to $18,453. Here, about 4.95 million addresses bought about 1.72 million BTC at an average price of $12,072. This is in line with the projected target from a technical point of view.

BTC GIOM

BTC GIOMThe macro bearish trend is persistent. It is likely to continue until the Bitcoin price produces a higher value on a higher timeframe. The first sign of this trend reversal is when the $25,000 resistance level is turned into a support base. Doing so will attract a fair amount of sideline buyers. It is also possible for it to create a positive feedback loop that pushes Bitcoin price to $29,563. If this increase occurs, BTC is likely to retest the $30,000 psychological level.