Bitcoin (BTC) price has been in a stable consolidation for more than two weeks. It showed no signs of a directional trend in the process. However, institutional investors have not yet taken action to buy, despite all the drops. On top of that, the October 7th Non-Farm Employment (NFP) announcement sets more volatile ground.

Bitcoin price and the big picture

Bitcoin price remains above the highest trading volume level of $19,157 in October. Breaking this level will open the doors for a steep correction to $15.551 due to lack of volume. Beyond this frightening forecast, the next macro lows for BTC are at $13,575 and $11,989. Bitcoin hasn’t given any assurance that it will protect itself from these levels on the three-day chart anyway. However, traders need to follow the critical supports at $19,157 and $15.551.

The next important chart is the eight-hour chart of Bitcoin price combined with the RSI, which accurately predicts the local top/bottom formation since May 30. After a brief consolidation between the 18,000 and 19,000 levels, Bitcoin price surged to $20,400. The resulting rally here formed a local top at $20,500. This move coincided with the RSI forming a seventh top at 65 to 72 hurdles.

A closer look at Bitcoin price reveals a bear flag

As the name suggests, this technical formation includes a flagpole. This pattern was formed when BTC dropped 18% between September 12 and September 19. Consolidation in the form of an ascending parallel channel resulted in the formation of the flag. This technical pattern suggests an 18% drop achieved by adding to the breakout point at $19,417. If this happens, the BTC price will drop to $15,800.

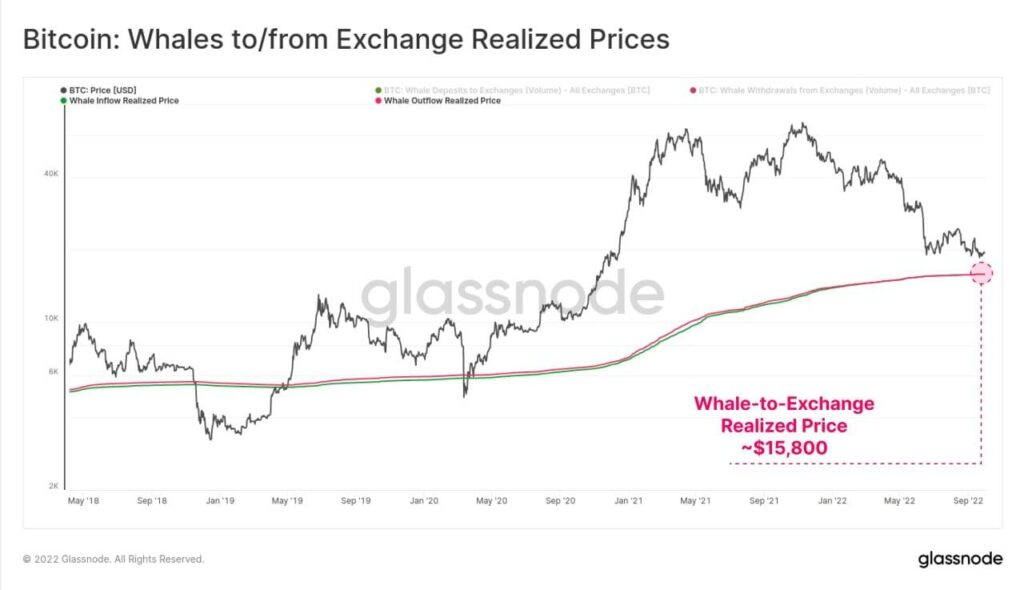

Additionally, the actual price of whales holding more than 1,000 BTC is around $15,800. The actual price of these BTCs is calculated taking into account the volumes entering and exiting the exchanges and the current Bitcoin price. Interestingly, this number matches the technical forecasts perfectly. As a result, it adds more confidence to the possibility of a steep correction to $15,800.

Opportunities in the altcoin market will open when BTC drops to this level

Based on the above analysis, we see that the initial view of Bitcoin price is to the downside. However, analyst Akash Girimath recommends that investors wait for $15,800 to accumulate BTC and altcoins at a discount. The increase in buying pressure resulting in a U-turn at this level is the best buying opportunity before Bitcoin price starts an uptrend to fill the CME gap from $27,365 to $28,740.

These gaps are forming in Bitcoin price as the CME halted over the weekend. Therefore, rebalancing these inefficiencies is another key factor triggering a reversal to $15,800.

On the other hand, selling pressure continues to increase due to escalating geopolitical tensions and worsening economic conditions. If this negative outlook persists, Bitcoin price will head towards $15,800. Analyst Girimath says it will have little chance of rebounding. This drop would also invalidate the bullish thesis detailed above if it forces BTC to turn the $15.551 support level into a resistance barrier. In such a case, investors can expect a possible collapse at the $13,575 and $11,989 levels. Similar analyzes were part of a new report from CryptoQuant analyst MAC.D.

Bitcoin prepares for further declines

One CryptoQuant analyst suggested that the last rally was unsustainable. The analyst says that Bitcoin may decline again after the next Fed rate hike announcement. CryptoQuant’s MAC.D warned of a possible price drop as the Fed announced rate hike for November. He stated that institutions have not yet started to rise in the Bitcoin market.

According to the analyst, the recent rally in BTC price is unsustainable. In particular, the analyst bases his claims on the absence of significant changes in the Coinbase Premium Index and Fund Volume Index. MAC.D notes that while the former is positive, there has been no significant change since June and the latter remains on the decline:

Looking at the two indicators above, it would be hard to think of this as an upside loop conversion because there is no clear Institutional investor buying trend. If prices rise before the FOMC rate announcement in November without being bought by Institutional investors, it is likely to lose its bullish momentum and abandon it.

Institutional investors not yet buying $BTC

"If prices rose without buying by Institutional investors before the FOMC rate announcement in November, it is likely to lose its upward momentum and dump it."

by @MAC_D46035Read More👇https://t.co/V1BoIUxvTu

— CryptoQuant.com (@cryptoquant_com) October 6, 2022

The miners have reached the desired area again

Bitcoin has outperformed other stock markets recently. It also managed to get back and hold $20,000. As such, it has sparked expectations among some investors that the bull is imminent. Also, among the positive developments is the data on the selling pressure, which has eased with the miners taking a break from selling. Additionally, BTC has already seen significant and sustained accumulation throughout the week. On-chain analyst Ali Martinez said in a new tweet that miners are putting on hold rather than selling:

Bitcoin miners’ reserves have been stable at 1.86 million BTC, maintaining this level for about a month. The inactivity among miners came after a significant sell-off in August.

According to @cryptoquant_com data, #Bitcoin miners’ reserves have plateaued at 1.86 million $BTC, holding around this level for nearly a month. The inactivity among miners follows a significant selloff in August. pic.twitter.com/6YSPWWyehy

— Ali (@ali_charts) October 1, 2022

However, despite these positives, as the CryptoQuant analyst highlighted, it is still too early to get excited. While October has historically been seen as a good month for Bitcoin, it’s worth noting that this isn’t usually the case in bear markets, as popular Bitcoin analyst Ali Martinez has emphasized.

#Bitcoin | Notice that in all previous bear markets, $BTC doesn't perform well in October. 👀 pic.twitter.com/Dug2ILtfrs

— Ali (@ali_charts) October 2, 2022

cryptocoin.com As you follow, BTC is currently trading at $19,663. It has lost around 2% in value compared to the last 24 hours.