Gold fell sharply at the beginning of the week and touched its weakest level since mid-February at $1,850. Although the yellow metal managed to recover in the second half of the week, broad-based dollar strength did not allow gold to end its two-week losing streak. Market analyst Eren Sengezer states that ahead of next week’s important US inflation data, gold may struggle to make a decisive move in either direction. We have prepared the analyst’s technical gold forecast and market comments for our readers.

What was important for gold on the agenda last week?

The risk-averse market atmosphere supported the dollar on Monday and the US Dollar Index (DXY) erased the previous Friday’s losses. Chinese PMI data revealed that private sector activity continued to contract in April. Data from the US showed that the manufacturing sector grew at a softer-than-expected pace in April, but this had little or no impact on the dollar’s valuation.

Markets remained relatively calm on Tuesday, ahead of the US Federal Reserve’s policy announcements, and gold fluctuated in a narrow range below $1,900 after losing nearly 2% on Monday. On Wednesday, Kriptokoin.com , the FOMC increased the policy rate by 50 basis points to the range of 0.75-1.00%, as expected. The Fed also announced that it will begin trimming the balance sheet on June 1, starting with the $47.5 billion cap in the monthly runoff and rising to $95 billion monthly three months later. Experts had expected the US central bank to reduce its assets by $95 billion from June.

As the 10-year US Treasury yield turned south after the Fed event, the dollar came under strong selling pressure and opened the door for a decisive recovery in gold. Gold climbed to a five-day high of $1,909 during Asian trading hours on Thursday, but closed the day in negative territory at $1,877.

The Bank of England (BOE) increased the policy rate by 25 basis points for the fourth time in May, but noted in its policy statement that the UK economy is expected to enter recession in 2022 with inflation rising above 10%. The BOE’s recession warning reminded investors of the fact that the Fed may continue to tighten its policy at a more aggressive pace than the BOE and ECB before it has to shift its priority from taming inflation to spurring growth. In response, the dollar regained its bullish momentum and forced gold to turn south.

The US jobs report revealed on Friday that Non-Farm Employment rose 428,000 in April, compared to the market forecast of 391,000. The underlying details of the data showed that the Labor Force Participation Rate fell to 62.2% from 62.4% in March, and annual wage inflation as measured by Average Hourly Earnings remained almost unchanged at 5.5%. With these numbers confirming tight labor market conditions, the 10-year U.S. T-bond yield climbed over 3.1% to its strongest level since November 2018, causing gold to lose its recovery momentum ahead of the weekend.

What is important for gold on the agenda of the next week?

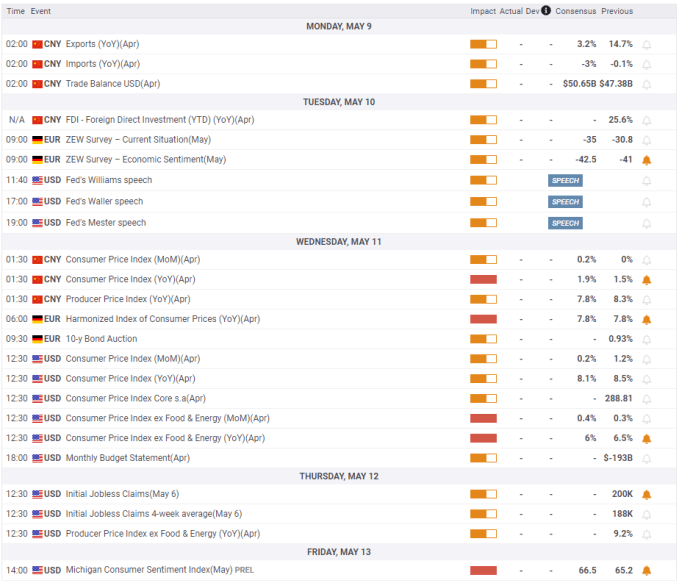

China will release its April international trade figures on Monday. Should the data show the negative impact of coronavirus-related restrictions on the trade balance, the negative change in risk sensitivity could help the dollar find demand and cause gold to start the new week badly.

On Wednesday, the U.S. Bureau of Labor Statistics will release April Consumer Price Index (CPI) data. On an annual basis, CPI is expected to fall to 8.4% from 8.5% in March. Core CPI, which excludes volatile food and energy prices, is expected to decline sharply from 6.5% to 6%.

While FOMC Chairman Powell has backed out against rate hikes by 75 basis points, the CME Group FedWatch Tool shows markets are still priced at 87% probability for a 75 basis point increase in June. The analyst states that if CPI figures confirm the view that inflation may have peaked in March, investors may face reselling pressure as they reevaluate the Fed’s rate decision in June. , U.S. T-bond yields are likely to fall, causing gold to rise. On the other hand, if the CPI data surprises to the upside, the markets may stick to a 75 basis points increase outlook in June.

Meanwhile, investors will pay close attention to Fed speeches and new developments regarding the quarantine in China and the Russia-Ukraine conflict. According to the analyst, the relaxation of Covid-19 restrictions in China could help the yellow metal gain momentum in improving the demand outlook and vice versa.

Technical gold forecast and gold sentiment survey

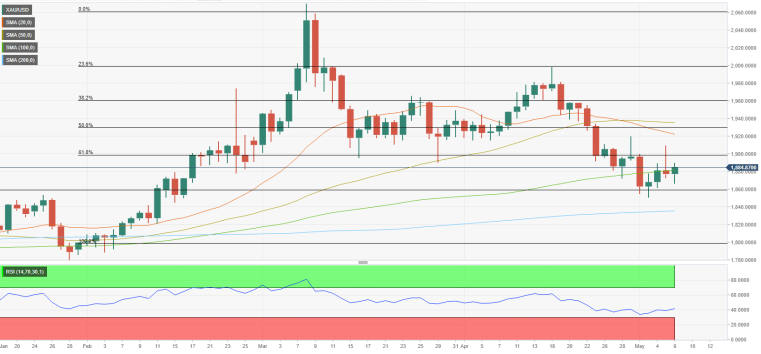

According to the analyst, the technical outlook suggests that gold’s downtrend remains unchanged despite the modest recovery seen in the second half of the week. shows that it hasn’t changed. Stating that the Relative Strength Index (RSI) indicator on the daily chart remains below 50 and the price is currently struggling to withdraw from the 100-day SMA, which is around $1,880, the analyst draws attention to the following technical levels:

Gold is 1.880 as support. If it starts using the dollar, it could extend its recovery to $1,900. Only a daily close above the second level could open the door for additional gains towards the $1,920/$1,930 area. On the downside, key support seems to be formed at $1,860. If this level fails, gold is likely to test the 200-day SMA at $1,840.

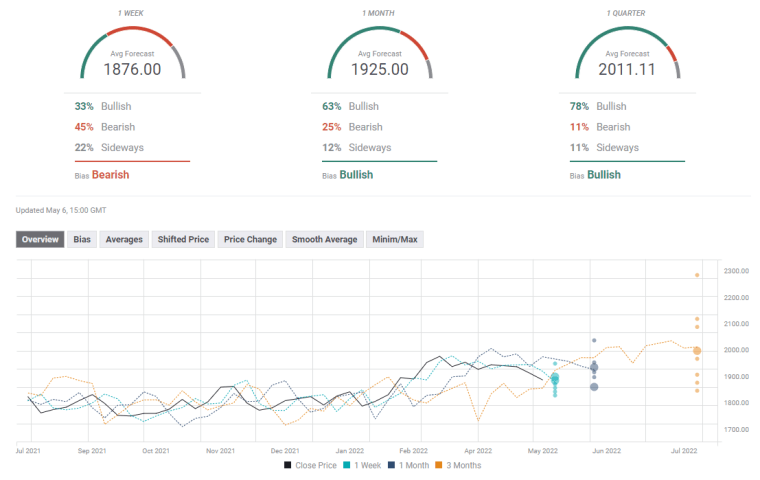

FXStreet Gold Forecast Survey shows that almost half of the experts surveyed predict gold will be lower next week. However, the one-month view points to a bullish shift with the average target at $1,925.