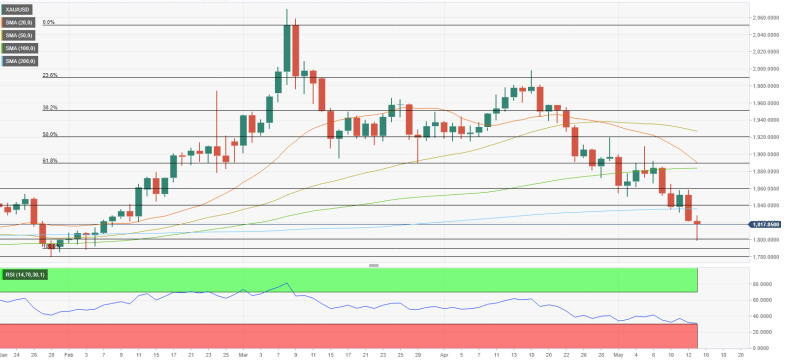

Gold rallied after falling below $1,800 on Friday, but it lost more than 3% on a weekly basis, posting the second-largest one-week decline of the year. According to market analyst Eren Sengezer, closing below the 200-day SMA for two days could be seen as a significant bearish development and could leave buyers on the sidelines in the near term.

What happened last week that affected the gold price in the markets?

The dollar benefited from safe-haven flows earlier in the week, causing gold to continue its downward move. In a report released over the weekend, the International Monetary Fund (IMF) warned that global economic growth could slow faster than expected and inflation will stay higher for longer than forecast. Additionally, data from China showed that Exports rose 1.9% year-on-year in April, narrowly missing the market expectation of 16.4%.

Reports on Tuesday that Chinese authorities are tightening restrictions on coronavirus in the city of Shanghai, despite falling infections, did not allow risk sentiment to improve. Meanwhile As you’ve followed in the news on Cryptokoin.com , several FOMC policy makers voiced their support for two 50 basis points (bps) rate hikes at the next two policy meetings, helping the dollar maintain its strength. In addition, Cleveland Fed President Loretta Mester noted that they will not rule out 75 basis points increases forever.

The modest improvement in risk sentiment caused the dollar to lose its appeal midweek and opened the door for a recovery in gold. US President Joe Biden said on Tuesday that he is considering removing Trump-era tariffs on Chinese imports to help curb inflation. Data released Wednesday by the U.S. Bureau of Labor Statistics revealed that inflation, as measured by the Consumer Price Index (CPI), fell to 8.3% year-on-year in April, from 8.5% in March. After these data, the 10-year benchmark US Treasury bond yield fell below 3%, and the gold day managed to close in the positive zone.

The risk rally was short-lived, however, and the worsening market mood on Thursday provided support for the safe-haven dollar, causing gold to suffer heavy losses and close below the 200-day SMA for the first time since February. Meanwhile, FOMC Chairman Jerome Powell reiterated that he expects two more rate hikes of 50 basis points in June and July, and noted that they are ready to do more if the data ‘turns in the wrong direction’. As a result, the US Dollar Index hit its highest level in nearly two decades at 104.92 late Thursday.

Markets were relatively calm on Friday and gold moved sideways near its two-month low set at $1,810. The yellow metal briefly slumped below $1,800 in the US session, but managed to erase some of its daily losses after the University of Michigan’s monthly publication showed consumer confidence in the US faltering in early May.

What will be on the agenda for the next week?

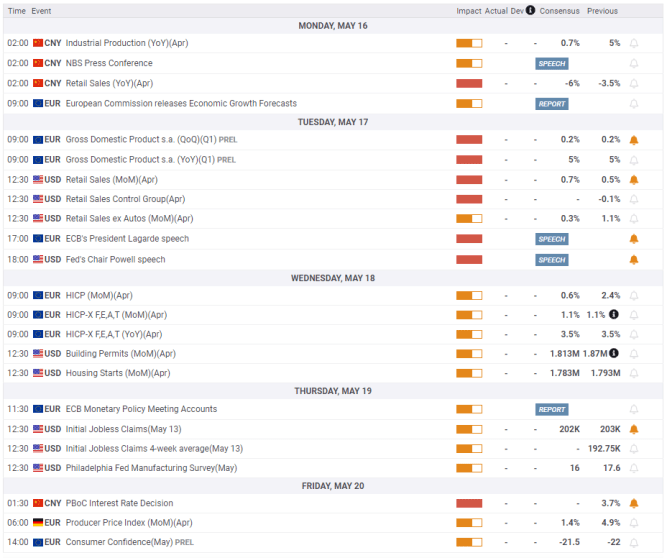

Investors will be keeping a close eye on China Retail Sales data early Monday, which is expected to decline 6% year-on-year in April. For the past few weeks, gold has struggled to find demand as data from China reminded investors of the negative impact of lockdowns on economic activity. The analyst states that if there is a larger-than-anticipated decline in sales, a similar reaction can be seen at the beginning of the week. A positive data could limit gold’s losses, but it’s unlikely to trigger a risk rally unless Chinese authorities begin to relax restrictions in Shanghai and Beijing, he said.

On Tuesday, the US Census Bureau is expected to report a 0.6% month-on-month increase in US Retail Sales in April. Again, it will be surprising to see a significant change in risk sensitivity at a single data point. According to the analyst, even if an optimistic data helps US stocks gain momentum, it will also confirm the view that the Fed can continue to tighten the policy rate at an aggressive pace without worrying about hurting the economy. More importantly, healthy consumer demand can be seen as a factor that can increase inflation.

Later in the week, the US economic report will present the weekly Initial Jobless Claims and the Philadelphia Federal Reserve Bank’s Manufacturing Survey for May. The analyst does not see a prolonged weakening of the dollar in the current market environment. That’s because rising inflation fears amid the factors driving the dollar’s valuation, namely the ongoing Russia-Ukraine conflict, the lockdowns in China and the Fed’s tightening expectations, will remain intact for the week ahead. Therefore, the analyst states that it would be logical to expect gold’s recovery attempts to remain limited in the short term.

Gold technical analysis and gold sentiment survey

Relative Strength Index (RSI) indicator on daily chart, following this week’s price action in August It dropped to 30 for the first time since last month. The analyst says that this shows that gold is likely to make a technical correction before the next drop. He points out the following technical levels:

On the upside, the 200-day SMA forms dynamic resistance at $1,840, which can be seen as a recovery target. As long as gold fails to make a daily close above this level, the downtrend may remain intact. $1,800 is aligned as initial technical support ahead of $1,790 and $1,780. On the other hand, if buyers manage to turn the $1,840 support, further recovery gains towards $1,860 and $1,880 could be witnessed.

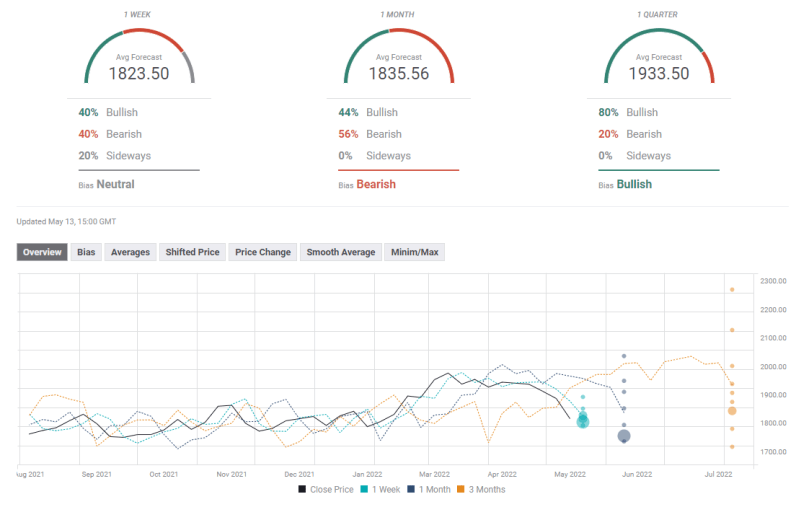

FXStreet Forecast Survey paints a mixed picture for gold in the near term. A few analysts predict the yellow metal will rebound next week, while others think it will test $1,800. There is a slight bearish bias in the one-month view, but the average target is $1,835.