The gold price slumped to $1,855 on Monday after hitting the highest levels since May 9th. By the way, there is the Federal Reserve (Fed) monetary policy meeting this week. Previously, the US dollar has made large gains, while the mood of risk aversion continues. Market analyst Anil Panchal sees the latest weakness of the precious metal as likely linked to this environment. Additionally, the analyst states that a short-term trendline resistance is also pushing bullion buyers.

What do the economic and geopolitical developments show?

However, the US Dollar Index (DXY) is extending the previous three-day uptrend. DXY renews monthly highs around 104.50. As we reported at Kriptokoin.com , the dollar indicator supports the wave of risk aversion. It also uses Friday’s hot inflation data to refresh the multi-day high.

DXY rallied on Friday amid growing fears over the Fed’s aggression towards skyrocketing US inflation. However, the headline US Consumer Price Index (CPI) rose to 8.6% year-on-year versus 8.3%. In addition, core CPI increased by 6.0% month-on-month, compared to an expected 5.9% decrease from 6.2% in the previous month. The University of Michigan Consumer Sentiment Index fell to a record low of 50.2 versus a revised 58.1 for June. On the other hand, the analyst states that this will not stop the US dollar bulls.

On the other hand, Beijing witnessed a jump in Covid numbers over the weekend. In addition, he reminded us of some virus-related activity restrictions along with mass tests. Shanghai is on the same line. Recently, Xu Heijian, spokesperson for Beijing’s local government, said a covid outbreak linked to a bar in Beijing was wild. Also, the new US-China fight over Taiwan is also seeking out gold bulls, according to the analyst.

“Gold is possible to reverse recent gains”

Amid these games, Wall Street fell and US Treasury yields soared. This triggered the safe-haven demand for the US dollar. However, S&P 500 Futures fell 1.0%, while US 10-year Treasury yields were mostly unchanged at around 3.16%. The analyst makes the following assessment:

Gold traders are likely to watch for risk catalysts ahead of Wednesday’s FOMC. If the Fed manages to keep the bulls happy, it’s possible for gold prices to reverse recent gains.

“Gold price benefits from shift to defensive haven position”

OANDA senior analyst Jeffrey Halley said that gold is safe from moving against the US dollar. refers to disconnection. The analyst states that this indicates that the markets have lagged into a much stronger risk aversion mode. According to the analyst, the reason for this situation is strong inflation data. Continuing his comments in this context, Halley says:

The data has given financial markets an unsympathetic wake-up call that inflation is both entrenched and carries real upside risks. The gold price is benefiting from a shift into a defensive haven position as stocks and cryptos plummet.

Technical analysis of gold price

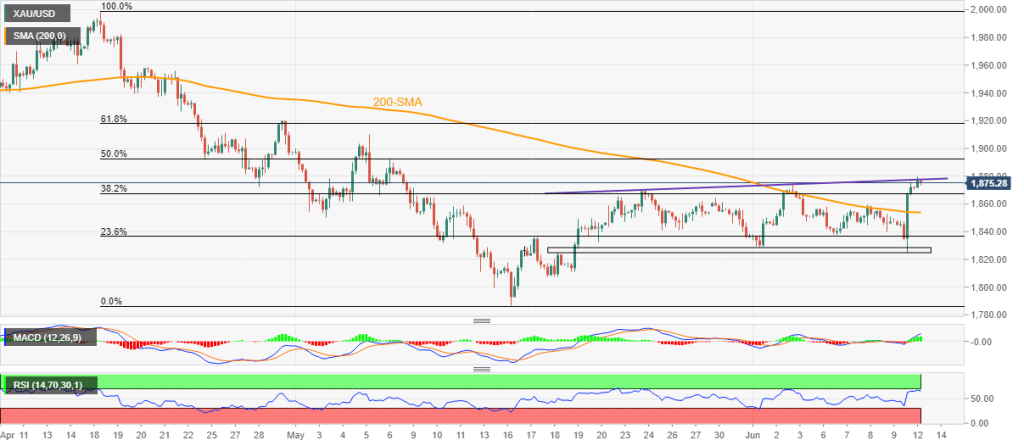

According to market analyst Anil Panchal, gold is backing off from the overbought zone of the RSI (14) as it crosses the 200-SMA, but is still in a tight spot. unable to sustain the rebound of the monthly horizontal support. The analyst says there is another challenge to precious metal prices. He notes that this is the three-week ascending resistance line near $1,880. Anil Panchal continues his analysis in the following direction.

Even if yellow metal prices manage to break the $1,880 barrier, the 50% and 61.8% Fibonacci retracement around $1,893 and $1,918, respectively, in the April-May period is likely to push gold buyers.

Alternatively, pullbacks remain unclear until the price breaks beyond the 200-SMA surrounding $1,853. Following this, a horizontal area with multiple levels around $1,825-30 marked since May 18 will regain the attention of the gold seller. If the metal sinks below $1,830, the possibility of a drop to $1,786 from the previous month’s low cannot be ruled out.

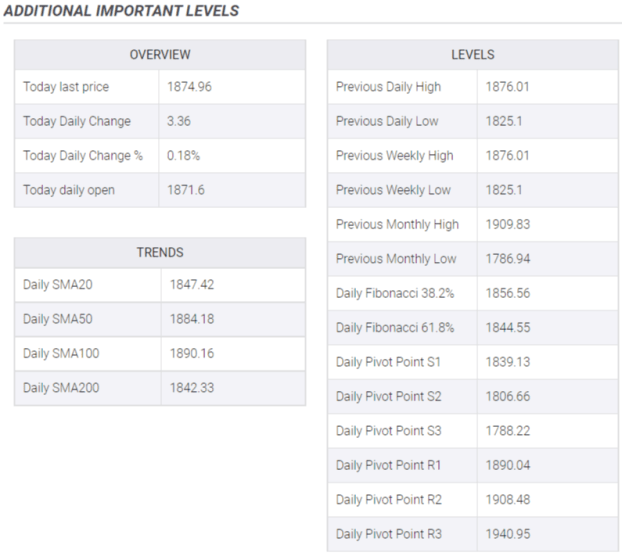

Additional key levels for gold price

Additional key levels for gold price