Gold markets fell throughout the week, especially on Friday. However, market analyst Christopher Lewis states that we see a lot of buyers to support this market once again. Christopher Lewis draws the technical drawing of gold. We present it to our readers with the narration of the analyst.

“Gold market shows signs of weakness”

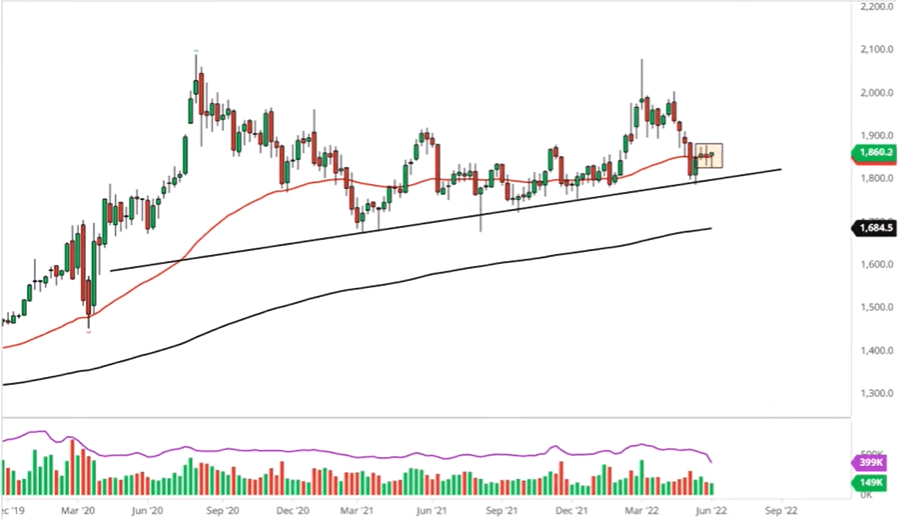

Gold markets fell pretty hard during the week. At the same time, he again showed signs of weakness. Ultimately, this is a market that threatens a trendline just below it. Also, a market that continues to boom in a very short-term consolidation area.

This consolidation area is between $1,830 and $1875. As it continues to circumnavigate this area, it sits right there above the 50-Week EMA. In addition, it is worth noting that the EMA is flat. What this tells me is that we need to see an impulsive candlestick to start trading for a longer term move.

“I would be a buyer today and from a long-term perspective”

Gold has a good chance of going up. Also, I think this is a guesswork assumption. However, that doesn’t necessarily mean it should be.

Also, gold moves sideways for a while and then suddenly explodes. If I had to take a position today and from a long-term perspective, I would be a buyer. I think that’s what happened on Friday, when we first fell and then suddenly reversed.

What if the price breaks up?

However, if we break below the $1,800 level, then at least it opens a significant drop to the $1,700 level. This will almost certainly be accompanied by a large increase in interest rates, which we have seen before and which as a result is probably somewhat limited.

What happens if we break upwards? I think it’s possible that gold will eventually try to reach the $2,000 level. However, this is likely to take some time. There are some double peaks in this general environment. So it will be very bullish for longer term holders to make money.

Gold investor’s eye will be on the Fed this week

By the way Follow the news on Cryptokoin.com As you mentioned, the US CPI came in above expectations. The data marked the highest level in the last 40 years. Gold initially responded with a decline. However, it later recovered and rallied 1.24% above $1,870. THIS short-term rally got investors excited.

On the other hand, this week all eyes will be on the Federal Reserve. It is considered certain that the Fed will increase the Federal Funds Rate by 50 basis points. On the other hand, cards can also have 75 basis points. But we’ll see if it comes as a surprise.