Altcoin bulls have been busy pushing prices above critical resistances since last week. This effort has been successful on Bitcoin and Ethereum so far. Technical analysis shows that the 4 altcoins are in a downtrend on the contrary.

Floki Inu (FLOKI) will determine his next move at $0.0000337

FLOKI price made a significant 70% gain on April 24. Thus, it once again reached above the $0.0000420 zone. The impressive rally was soon followed by old lows.

FLOKI is currently trading just under $0.0000337. The demand zone between $0.0000281 and $0.0000303 will play a key role in FLOKI’s next price movements. Finding new buyers in the demand zone is an important development for the bulls. The bulls need to clear the $0.0000337 resistance later. Such a move would clear the way for the $0.0000420 zone. In total, that would mean a 40% gain for the Floki Inu price.

On the other hand, if Floki Inu price fails to clear $0.0000337 or bounces from $0.0000281 to 0.0000303, it will signal weakness on the buyer side. This development will lead the range to test the low of $0.0000255.

A sharp turn of the above level into a resistance will invalidate the rally thesis. Such a development could cause the Floki Inu price to drop further and return to the $0.0000233 and $0.0000205 support levels.

Altcoin bulls abandon Litecoin (LTC): Price drops

Litecoin price is in a bearish trend. However, it managed to maintain the $84.17 support for two consecutive weeks. If the seller momentum continues, the price will drop below this support. A break of this level will force LTC to test the $73.40 support level, which is down 15%.

The RSI position at 43 below the average line also supports the bearish view. The downtrend of this trend signaled an ongoing downtrend.

Conversely, if investors who have been waiting on the sidelines step in, the Litecoin trend will reverse. In such a case, the upside move will lead the bulls towards $100.00. The bulls then have targets at $102.68, which represents a 20% rise from the current price. Meanwhile, cryptocoin.comAs we have reported, only three months are left for the next Litecoin.

Fxstreet analyst Lockridge Okoth identifies upside opportunities for LTC and FLOKI, while warning investors of a potential drop.

Altcoin bulls abandon Chainlink (LINK): Price drops

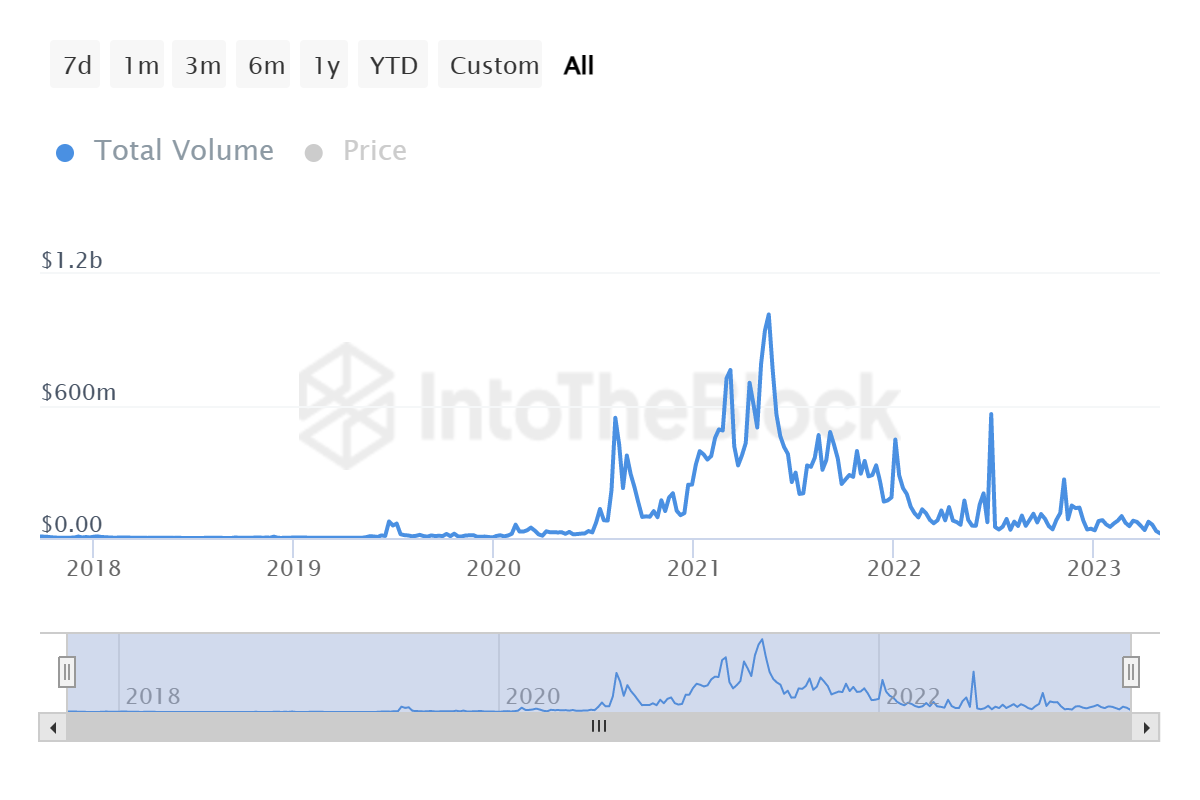

On the other hand, Chainlink price extended the decline that started in mid-April by dropping below $7. The altcoin has lost 20% over the past three weeks. It’s also not showing any signs of recovery anytime soon, which raises concerns for the network.

This worry was a result of the price failing to retrace the November 2022 high of $9. As the altcoin started posting red candles, investor participation also began to wane.

With declining participation, on-chain transactions are declining. As a result, daily volume fell to a two-year low of $21.24 million, the figures last recorded in April 2020.

One of the reasons behind this drop is the lack of volatility, which is a byproduct of a diminishing correlation with Bitcoin. The correlation, which dropped from 0.9 at the beginning of April to 0.5 at the time of this writing, indicates that the altcoin has not benefited from the end-April rally that BTC has witnessed.

Therefore, if Chainlink price volatility climbs back from monthly lows, it could make LINK susceptible to uncontrolled fluctuations. But it will also give the altcoin a chance to rebound. This is very important for the altcoin. Because the whale, which has been declining since the start of the second quarter, is actively losing its confidence.

Between the second week of April and May 3, about 5 million LINKs were spilled by addresses holding between 100,000 and 1 million LINK, with a total value of approximately $35 million. Their supply has dropped from the 109 million collected by smaller wallet holders to 104 million LINK. Holders of 10,000 to 100,000 LINK have accumulated more than 2 million LINK in the same period, bringing their total assets to 75 million LINK.

Avalanche (AVAX)

Meanwhile, AVAX price is hovering at a critical point. The price is seeing the pressure increase relentlessly at $16, especially with the 200-day SMA in sight. This 200-day SMA was significant on previous occasions in February and March. Once the bears overcome the bulls, there is a risk that AVAX will quickly drop to $14.50. The bears will then target the double bottom pattern at $13.80. This will inflict a loss of around 15% on AVAX investors.

The 200-day SMA will mean the bulls regain control and push it higher to $18.50. Regarding positioning, it already makes sense as RSI supports this situation. Technical analysis suggests a bounce back above $17.50 and the next $18.50 in the short term.