The altcoin market is breathing a sigh of relief as Bitcoin is about to hit $20,000 again. Meanwhile, a few altcoins such as DOGE and MATIC have had the opportunity to recover from last week. The prominent whale trades of the day reveal another picture.

Altcoin whales attacked this coin as the price rose

Altcoin whales continue to carry large amounts of XRP. Due to the positive course of the SEC case, whales have rallied around XRP again. In the past 24 hours, major XRP has flowed from whale wallets to exchanges. On-chain data provider Whale Alert detected tens of millions of XRP transfers in 3 separate transactions today.

According to Whale Alert data, a total of 70.33 million XRP transfers took place between Bitstamp and anonymous wallets in the last 24 hours. At its current price of $0.52, the funds are worth approximately $36.57 million.

Transaction details

Whale Alert tracked the movement of 25 million XRP from an anonymous wallet to Bitstamp, one of Ripple’s official ODL partners. The fund was valued at approximately $12.88 million at the time of transaction.

25,000,000 #XRP (12,884,144 USD) transferred from unknown wallet to #Bitstamphttps://t.co/Vx2Xglgxwr

— Whale Alert (@whale_alert) October 7, 2022

In a similar development, 20 million XRP was transferred from an anonymous wallet to Bitstamp. This transaction carried roughly $10.33 million worth of XRP.

20,000,000 #XRP (10,330,656 USD) transferred from unknown wallet to #Bitstamphttps://t.co/JLuDFBpvSL

— Whale Alert (@whale_alert) October 7, 2022

A few minutes later, a total of 25.33 million XRP worth $13.13 million was sent from an address on the Bitstamp exchange to an anonymous wallet. It was worth $13 million in the transaction.

25,339,320 #XRP (13,135,037 USD) transferred from #Bitstamp to unknown wallethttps://t.co/dM0ETMVuPQ

— Whale Alert (@whale_alert) October 7, 2022

XRP price gains momentum amid bear market

More than 5% price action from last week comes in the middle of a bear market. cryptocoin.com XRP has been showing bullish signals ever since Ripple publicly presented its summary judgment motion in a lawsuit against the SEC. XRP is currently trading at $0.5218, up 5% in the last 24 hours.

On the technical side, XRP price finally broke above the $0.38 baseline after breaking the shackles of the extended low volatility phase. The late September updates on the case are proving to be a catalyst for the solid bull run over the past few days. After returning from the $0.51 level, the altcoin has drawn a bullish pattern on its daily chart. According to analysts, the 200 EMA (green) could rekindle recovery trends in the coming sessions.

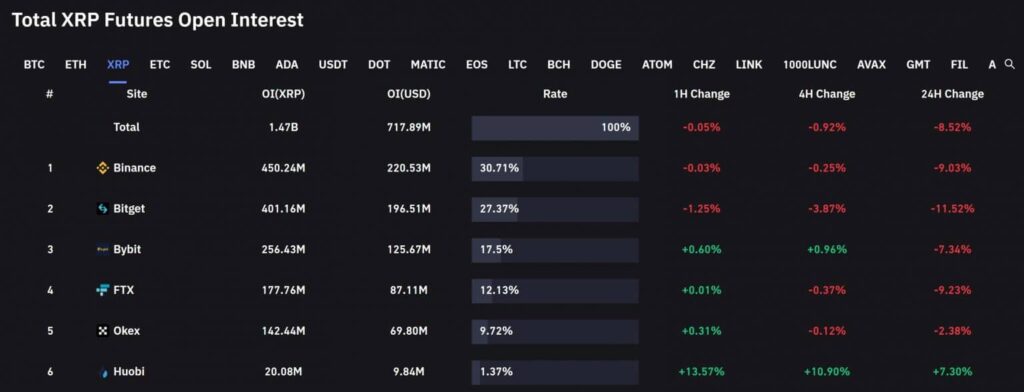

Meanwhile, the XRP Futures Open Rate analysis revealed a total drop of 8.78% over the past 24 hours. Accordingly, price action has dropped about 2% during this time.

Generally, a drop in both price and Open Position indicates liquidation by discouraged traders holding long positions.

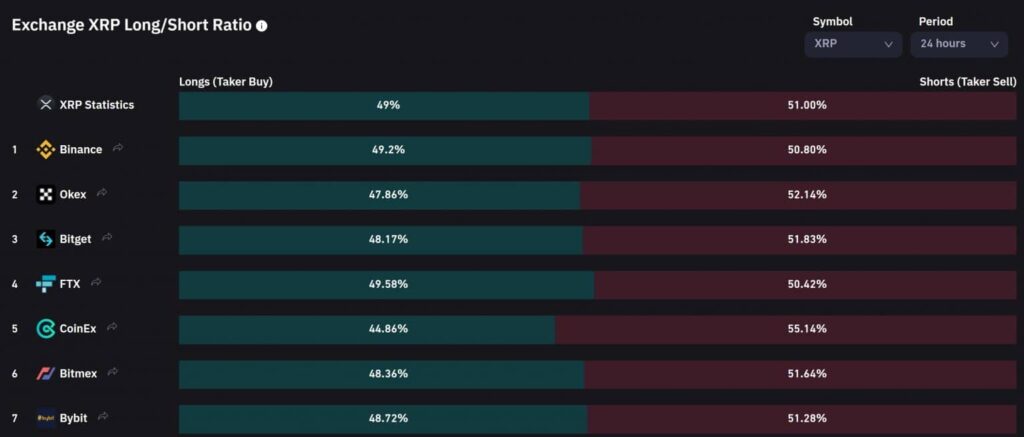

Additionally, the long/short ratio for XRP on all exchanges in the last 24 hours revealed a slight advantage for shorts. As a result, XRP’s jump above the 20/50/200 EMA highlighted the increased buying pressure. However, the decreasing Open Position and long/short ratio revealed the underlying bearish trend in the Futures market. Either way, the goals and triggers will remain the same as discussed. Finally, investors need to watch Bitcoin’s movement closely to make a profitable move. The effects on the wider market should also be considered.