Whales, which sell a large amount of Chainlink (LINK) in recent days, when whale activity is high, has created significant pressure on the market. In the last 48 hours, 4.3 million LINK sales took place, while this movement led to anxiety among investors. So, can the LINK price have a bigger drop?

How do whale sales affect the market?

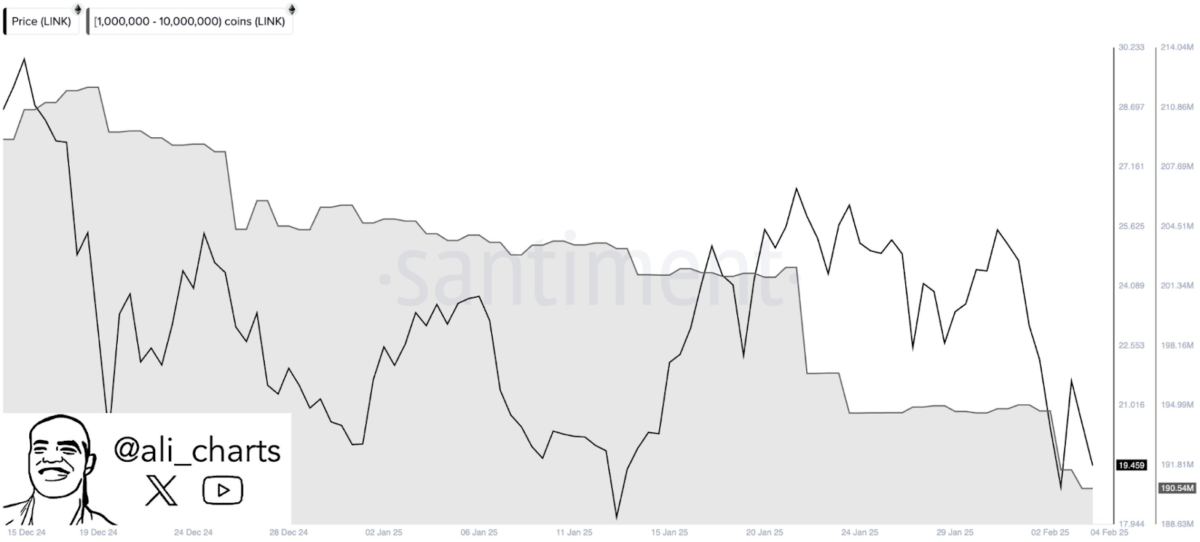

According to centimeter data, the amount of LINK in their hands of large investors fell from 200 million to 181 million. This shows that the rise pressure on the price is reduced and that whales are realizing profit.

However, the LINK trading volume is very high. 1659 transactions made over $ 100 thousand, while active LINK addresses exceeded 9500, reached the highest level of the last four weeks. However, the decrease in whale accumulation may cause the price to lose the acceleration of the rise.

Critical levels in LINK Price

Link price is trying to maintain the $ 19 level that has been supporting for a long time. However, technical indicators show that downward risks increase.

If the price loses $ 18.97 support, sales pressure may increase and the price may be withdrawn to $ 15. On the other hand, if a strong purchase of $ 19, the price of the LINK may enter a recovery process for $ 25 again.

What do the technical indicators say?

Technical analysis indicators indicate that the pressure of decrease for LINK has increased.

- The RSI indicator shows that the sales pressure continues by making lower peaks.

- The OBV indicator created a bear mismatch before the price reached local peaks.

- Volume fluctuations reveal that market volatility has increased and the price direction is not clear.

These indicators show that the rise momentum in the LINK price is reduced and the possibility of downward movement increases.

Short -term expectations for LINK despite whale sales

The last sales wave of whales have led to the test of the LINK price to test significant support levels. If the level of $ 18.97 cannot be maintained, the price may decrease to $ 15 with a decrease of 17 %. If a larger sales pressure occurs, it may also be possible for the price to fall to the $ 13-14 range.

On the other hand, if the price of the Link recovers from existing levels and remains above $ 19, a new purchase wave in the market may start and the price can move towards $ 25. However, existing market dynamics show a strong purchase pressure for the realization of the upward movement.