Bitcoin (BTC) price managed to regain $16,000 despite heavy whale sales. During the day, the last two-year low of $ 15,480, pulled the price support to $ 12,000. This reveals how close the sudden drops are to the breakout.

Bitcoin returns to $16,000 amid whale selloff warnings

Data from TradingView shows that Bitcoin quickly climbed to $16,200 after falling to $15,480 during the day. Momentum pushed the price above $16,000 before consolidation. Thus, it pointed to 3.7% gains from daily lows. Analysts’ concerns are tied to the Digital Currency Group family, including Grayscale, which has been at the center of rumors about the impact of the crashed FTX. BTC’s move above $16,000 keeps the uneasiness at bay for now.

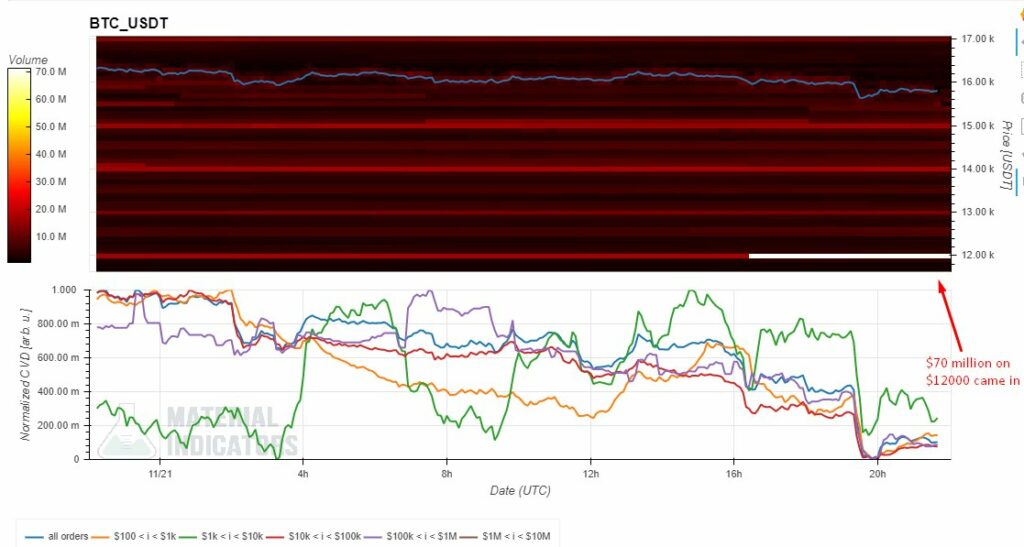

According to Material Indicators, if a major capitulation occurs during the Thanksgiving holiday period in the US, a drop to $12,000 could be the scenario that protects the market. “Over $300 million in BTC offering liquidity between here and $12,000,” says Maartunn, an analyst at CryptoQuant.

Maartunn shared a heatmap of the Binance order book that shows the various active trading levels. Here, downside targets for BTC are mostly focused at $14,000 or below as the week begins.

BTC investors feel the pressure

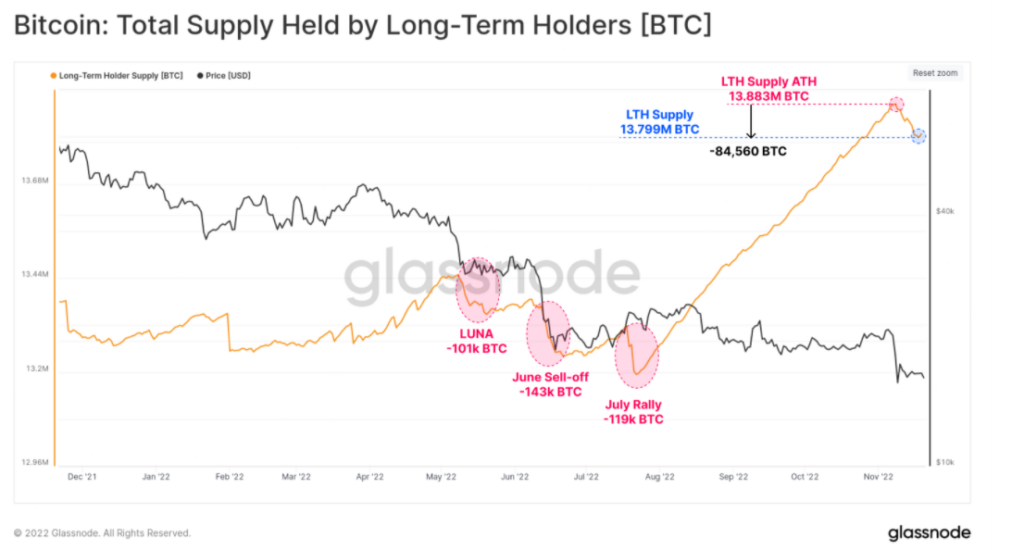

Other growing concerns focused on long-term investors (LTHs) of Bitcoin. Analytics firm Glassnode warned in its weekly newsletter that “non-junk spending” from old hands is on the rise. “Post-FTX supplies have decreased by 84,560 BTC. “This remains one of the most significant declines in the past year,” he said. Firm analysts also add that the decline is “still continuing.”

Likewise, whales, the biggest BTC investors, were also distributing net money to the market. This comes despite previous data showing that some assets are already starting to buy the dip. Glassnode said, “Whale sales are currently in a net distribution mode. They send between 5 and 7 thousand more BTC to exchanges,” he says.

Glassnode’s weekly newsletter also addresses concerns around FTX:

Meanwhile, the amount of coins flowing through exchanges by nearly all whales is at an all-time high. The whirlwind of the FTX crash continues to take hold, and we’ll see how far-reaching the shake-up in investor confidence is.