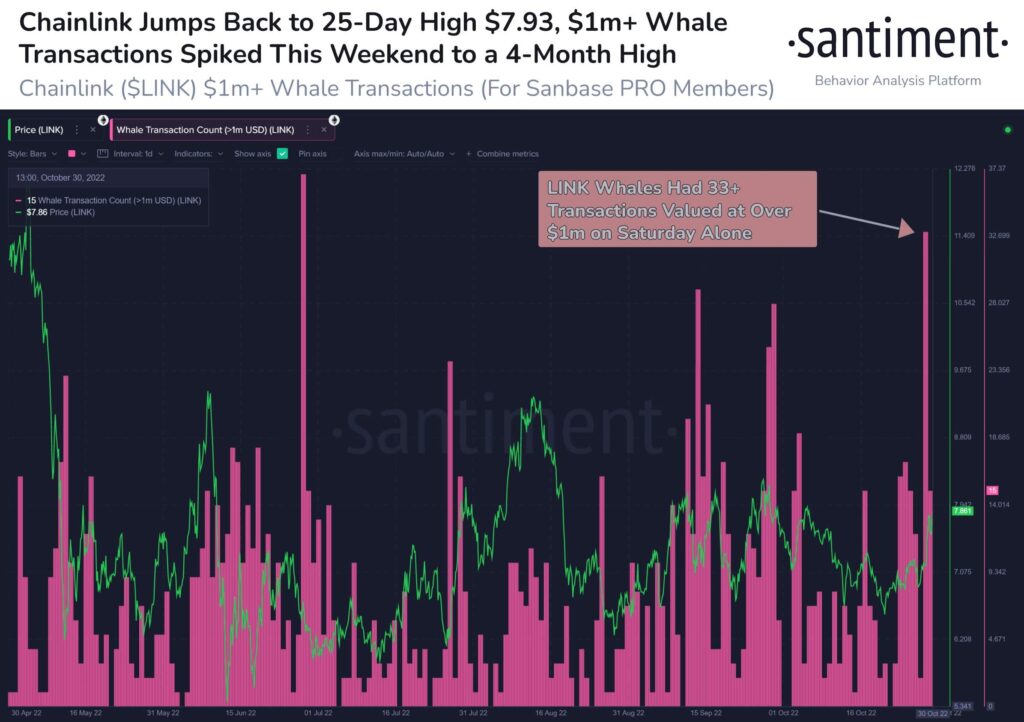

On-chain data indicates that cryptocurrency whales are concentrated in this altcoin project. Decentralized Oracle Chainlink (LINK) hit a 4-month high over the weekend as a result of whale activity. After the whale movements, it shows that there is a rally in the LINK price.

Whales rushed to this altcoin project

As we have reported as Kriptokoin.com; Last weekend, Oracle service provider Chainlink (LINK) hit as high as $8. Having experienced a strong rise, LINK caught the attention of crypto investors. LINK continues to trade at $8.18 with a market cap of $4,064 billion. The rally in LINK price continued throughout the weekend. It is reported that this is due to a strong whale activity. Whale transactions in the altcoin hit a 4-month high at the weekend, according to Santiment data. Santiment shared:

Chainlink whales have been quite active this weekend, with the market price hovering around $8 a few times. On Saturday we witnessed 33 different LINK transactions worth over $1M. This was the highest day of whale activity since June 27.

Over the past month Chainlink (LINK) has been on the radar of crypto investors. Whale activity remained strong from October to this month. Currently, the $8 level is stated to be a strong resistance zone for Chainlink. A break above this level could prepare LINK for a strong rally in the future. For a long time, the altcoin has been consolidating strongly in the $6 to $8 price range. Along with these, Chainlink seems to be in competition with the crypto exchange Binance introducing Oracle Network last week.

Chainlink and other altcoins

Last week, the altcoin market witnessed a strong rally. Of the meme coin projects, both Dogecoin (DOGE) and Shiba Inu (SHIB) have experienced significant increases. DOGE was trading with over 100 percent gains on the weekly chart. However, looking at the current situation, it seems to be facing a sharp correction. Dogecoin (DOGE) is down 5% in the last 24 hours with a market cap of $13.8 billion. SOGE price is currently trading at $0.1207.

In addition to meme coins, Ethereum (ETH) was also bullish, gaining around 20% on the weekly chart. The leading altcoin project has shown a clear price dominance over Bitcoin this month. The information in the on-chain data provider Santiment report is as follows:

Ethereum’s price dominance over Bitcoin and most cryptocurrencies continued as October approached. This happened after the spike in new ETH wallets created. Address activity will likely need to pick up in the name of the confidently continuing rally.

📈 #Ethereum's price dominance over #Bitcoin and most of #crypto has continued as October is coming to a close. This has come following a spike in new $ETH addresses created. Address activity will likely need to recover for a confident continued rally. https://t.co/4Um6wxFez8 pic.twitter.com/FggrM0u6wU

— Santiment (@santimentfeed) October 30, 2022