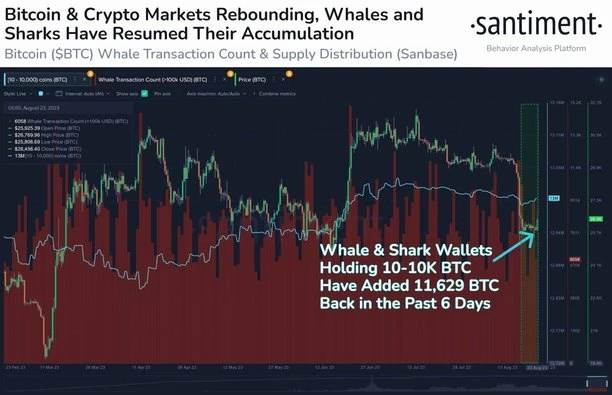

Santiment’s latest analysis reveals that there is a resilient trend among Bitcoin investors with significant cryptocurrencies. Despite the recent market downturn, Santiment’s data points to a striking improvement. It shows that some whales have actively accumulated over 11,600 BTC from August 17 to date. Let’s look at the details.

Stable Bitcoin accumulation amid market fluctuations

The surge in backlog comes on the heels of significant activity in the cryptocurrency space, triggered by BlackRock’s announcement of its intention to launch a spot Bitcoin exchange-traded fund (ETF) in the United States. Santiment’s analytics platform focused on cryptocurrencies has forecast.

Accordingly, these big investors, classified as those with 10 to 10,000 BTC, have moves. Santiment estimates that it has collectively purchased 11,629 BTC since August 17. At current market rates, the total value of this accumulated stash of BTC is approximately $308 million.

Strategic accumulation models

A closer look at Santiment’s graphics reveals something interesting. It turns out that these whales accumulate BTC not only during bearish market periods, but also during price rallies. This strategic build is in line with the recent market-wide pullback triggered by speculation about SpaceX’s potential sale of its remaining Bitcoin holdings.

After these rumors, Bitcoin instantly dropped over $3,000. It also hit $25,300, its two-month low. Some altcoins like XRP were also affected. Accordingly, their weekly losses exceeded 20%.

Effect of BlackRock’s ETF filing

There is a point where the growing appetite for Bitcoin among these big investors coincides. It coincided with BlackRock’s application to offer a spot Bitcoin ETF in the US. This application demonstrates the wealth manager’s ambition to enter the cryptocurrency space. On the other hand, the application seems to have attracted more interest from investors.

As previously reported by cryptokoin.com, these whales have accumulated over $2 billion in Bitcoin between June 17 (the day after BlackRock’s ETF application) and July 10. This strategic accumulation takes place independently of short-term market fluctuations. It also underlines their confidence in the long-term potential of the cryptocurrency.

In summary, Bitcoin whales are accumulating substantial amounts of BTC even during market downturns. Accordingly, they have demonstrated flexibility and strategic thinking. In particular, BlackRock’s ongoing accumulation following ETF targets draws attention. All this underscores the enduring confidence of major investors in the future of cryptocurrencies.