Cryptocurrency whales are currently active. Especially the recent declines seem to have enabled them to move again. The leading altcoin project is ETH and this altcoin is following whales. As Kriptokoin.com, we transfer the altcoins on the radar of crypto money whales to you.

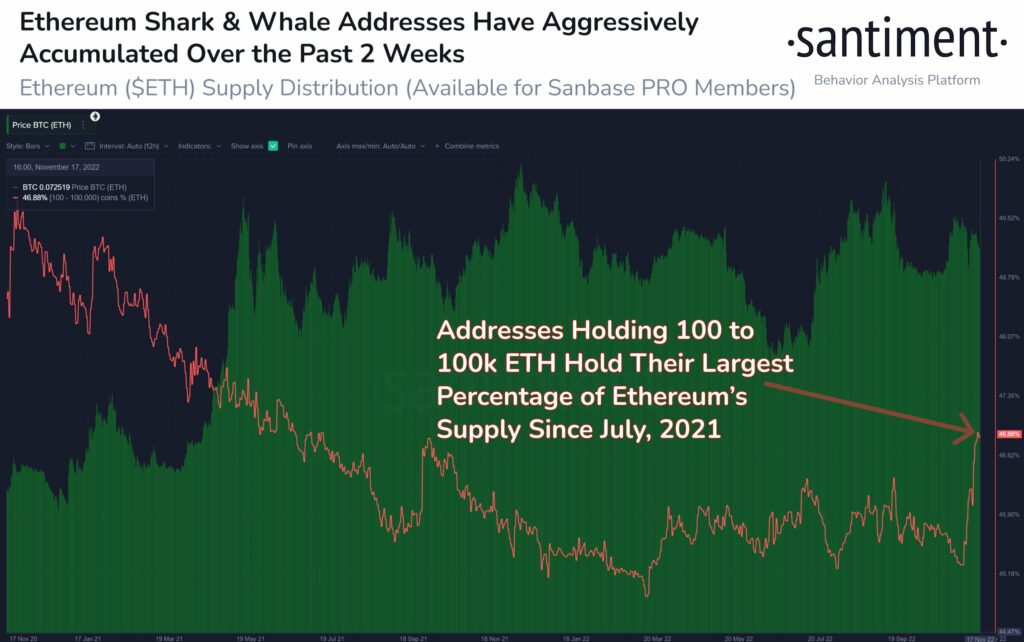

Whales’ accumulation of leading altcoin Ethereum gains momentum

Cryptocurrency whales continue their savings with the recent drop in the price of the leading altcoin Ethereum. ETH is near the psychological support level of $1,200 and analysts are expecting a recovery in the price of the leading altcoin. Meanwhile, owners of major wallets on the Ethereum blockchain collected the altcoin. Ethereum price is approaching the $1,200 psychological support level.

Meanwhile, the altcoin has slumped 7 percent in the past week and 21 percent in the last two weeks. What happened in FTX negatively affected the prices of Bitcoin, Ethereum and most altcoins.

Tether moves tokens to the ETH blockchain

Tether, the largest stablecoin by market cap, has announced a chain swap that moves USDTs from one blockchain to another. On Friday, November 18, 1 billion USDT tokens were sent from the Solana blockchain to Ethereum.

This move by the stablecoin giant comes after Binance’s decision to temporarily remove USDT from the Solana blockchain. Numerous cryptocurrency exchanges following Binance have delisted Solana-based stablecoins without any explanation. Also, this unconventional move followed the FTX collapse and filing for bankruptcy. Subsequently, BitMEX, OKX, and Bybit were among the exchanges that delisted USDC and USDT on the Solana blockchain.

Binance stated that the temporary delisting of stablecoins based on the Solana blockchain was due to “internal evaluation and review.” Tether’s move of Solana-based stablecoins to the Ethereum blockchain is likely to increase on-chain activity and utility.

Analysts predict rally for leading altcoin

Cryptocurrency analysts evaluated the Ethereum price trend. After the assessment, he predicted a recovery in the altcoin. Analyst Simon Chandler believes that Ethereum price will likely bounce back to the 200-day Moving Average (MA) of $1,600.

Chandler argues that Ethereum’s 30-day MA is below 200 days, indicating that ETH is in a prolonged bear market. According to the analyst, Ethereum price is likely to recover sooner or later.

After its fall, this altcoin has the potential to rise

Uniswap price is showing optimistic signals as the third trading week enters the weekend. A final liquidity exit awaits for the decentralized DEX token. Cryptocurrency analysts identify key levels to gauge UNI’s next potential move. If you are looking for opportunities in the crypto markets, Uniswap price is on your watchlist. Between June 14 and August 12, Uniswap rallied 200 percent.

However, afterward, the Ethereum-based swap token dropped 50 percent. After those dates, it was traded in a certain range. UNI price has seen minor gains within the newly established range. Price action is likely to be the catalyst for a much larger rally towards $10 and potentially the $12.50 liquidity zone.

UNI price prepares for upward move

As a result, UNI is likely to experience a rise, according to Glassnode data. According to analysts, huge increases were observed in withdrawals across all exchanges this year. According to the indicator, 1,656,000 transfers were made on 13 November. The indicator last showed these comparable metrics in September 2021.

The FTX crisis shed light on centralized exchanges and their inefficiencies. Uniswap and decentralized tokens may witness a temporary upward movement for purchasing and liquidity flow in the coming weeks. If the bears maintain liquidity below $4.60, the bullish view is likely to be invalidated. According to analysts, if the bears are successful, the Uniswap price will drop by 45 percent as a result.