A cryptocurrency whale earned $1.71 million in just a few days. So how did he do it? He bought 4T PEPE at a cost of 2.1 ETH ($4,410). But, it’s a meme-coin. Well, we are not interested! However, according to crypto analyst Lawrence Mike Woriji, it is possible to make some serious money if you follow whales. The analyst shares three altcoins that whales are currently accumulating.

First cryptocurrency: DAI

The first token DAI may come as a surprise. However, on-chain data shows that this stablecoin is the new favorite of cryptocurrency whales. So, Santiment statistics reveal an interesting fact. Addresses with 100,000-10,000,000 DAI increased their supply by 6.4% over the previous six weeks.

🐳🦈 Even with #crypto markets rollercoastering in April, top #stablecoins like $DAI are being accumulated by sharks & whales. Since $DAI was exchanged for pumping $BTC & $ETH in mid-March, $100k-$10m DAI addresses have added 6.4% of the supply back since. https://t.co/JfQREYLKpW pic.twitter.com/r6zqXb7zo1

— Santiment (@santimentfeed) April 24, 2023

Addresses with 100,000-1 million DAI control more than 13% of the supply. Those with 1-10 million DAI hold more than 25% of the supply.

So why the interest in DAI?

There are several reasons why whales are turning their focus to DAI.

- There has been a switch from USDC to DAI. After the SVB collapsed, USDC’s market value dropped by nearly $10 billion. Circle was exposed to the collapsed bank. This situation created fear among users. Many have switched sides with DAI.

- Uncertainty surrounding the value of the USD. China and a number of other countries are developing a new economy. This new move affects the value and strength of the dollar. Therefore, cryptocurrencies such as USDT and USDC faced some concerns. DAI holds a mix of different cryptocurrencies. This way, it has less risk.

- DAI’s decentralized nature makes it a popular option among the big three. You don’t have to trust the team to tell you how much is in circulation. You can print your own money.

1/ MakerDAO is a decentralized finance (DeFi) protocol that allows users to generate and borrow a stablecoin called DAI, which is pegged to the value of the US dollar. In this thread, we'll take a look at how the MakerDAO protocol works.#DeFi #MakerDAO #Stablecoin pic.twitter.com/T4ijnvAhvT

— SJH (@SJH_live) April 23, 2023

Leading cryptocurrency Bitcoin is also on the list

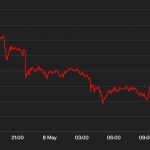

Bitcoin will always attract attention. And things don’t look too bad for BTC. Data from Santiment shows that April ended with Bitcoin whales accumulating the asset. Interestingly, these whales questioned their position when BTC dropped below $30,000 in mid-April. However, they continued their BTC purchases at the end of April.

🐳 #Bitcoin whales have quietly accumulated again since profit taking above $30k on April 11th. Since this date, as prices wavered and dipped down slightly, addresses holding 100 to 10,000 $BTC have collectively added 64,094 coins back to their bags. 💰https://t.co/Lx3msF58Wo pic.twitter.com/zUQC4BaW6F

— Santiment (@santimentfeed) April 29, 2023

Bitcoin whales have collected a total of 64,000 BTC over the past few weeks. This happened despite the uncertainty in the market. It’s encouraging for whales to end April strong. This shows that important investors still have bullish belief.

Why interest in Bitcoin?

cryptocoin.com As you follow, Bitcoin’s halving is approaching. This will push the price of the asset up. Secondly, there is a positive outlook in the market. The dollar is having a hard time and people are turning to crypto. Bitcoin is the most preferred option because it is widely accepted. And it has the potential to be adopted for enterprise use.

I think most people underestimate the importance of a completely neutral payment system & currency outside of government control …. for nations themselves

We've seen Gold seized

We've seen gov bonds seized

We've seen SWIFT weaponisedMore & more nations will turn to #Bitcoin

— Alistair Milne (@alistairmilne) May 1, 2023

Latest cryptocurrency: DYDX

Since March 2023, large dYdX wallet holders have been increasing their holdings. Experts predict an uptrend in dydx.

As dYdX garners massive whale attention, what’s brewing for the token? https://t.co/uzeFKDrrcS

— CryptoNewz (@cryptonewz_io) April 30, 2023

There are two key on-chain metrics that support dYdX’s bullish view.

- Exchange reserves.

- Whale wallet assets.

Large wallet investors holding 100,000-1,000,000 dYdX tokens are consistently buying the asset. This situation has been going on since March 2023. Santiment data shows this group of whales currently has close to 5.6% of the supply. Decreasing stock market reserves often reduce selling pressure on an asset over time. The supply of dYdX exchanges decreased by more than 10 million between February and April 2023. The drop in supply eased the selling pressure on the asset.

Why is DyDx rising?

There are several reasons for this growth in Dydx, by the way. This project will complete the transition from Ethereum to Cosmos by the end of September this year. This move created a new sensation. Dydx cited the lack of scalability in Ethereum as the reason for the move. The move to Cosmos enables dYdX to offer a token on its own Blockchain and governance system.

We’re excited to announce that dYdX V4 will be developed as a standalone Cosmos-based blockchain! 🔗🎉https://t.co/zQzZMIpzWO

— dYdX (@dYdX) June 22, 2022