The Federal Reserve said that after the rate decision, future monetary policy will continue to depend on data. Thus, the Fed preferred to play his cards close to his chest. After these developments, gold prices maintain their solid gains.

Gold prices did not find Fed and Powell hawkish enough!

cryptocoin.com As you follow, the US Federal Reserve increased interest rates by 25 basis points. At a press conference after this decision, Powell said that at this point, the probability of the committee increasing interest rates in September is as high as the probability of not changing it. However, he also reiterated the Fed’s stance that it will not cut any interest rates this year. In this context, Powell used the following statements:

We need to stay on track and keep policy at restrictive levels for a while. The process still has a long way to go.

The gold market was unaffected by Powell’s neutral comments. Accordingly, it remained close to session highs. Some analysts say gold is holding its gains as investors expect a more hawkish trend at the press conference.

Are we at the end of the tightening period?

Jerome Powell said the Fed would need to see a credible and sustained decline in inflation for it to even consider cutting interest rates. Meanwhile, US Consumer prices fell sharply in June. However, Powell added that despite the decline, this is just a report. His message to markets was clear: The Federal Reserve needs to see more data. In line with this, “Many people have written off the rate cuts for next year. But that will be a decision we have to make next year.”

While the US central bank keeps its options open, many economists and market analysts expect this to be the last rate hike in this tightening cycle. Degussa’s chief economist, Thorsten Polleit, says the fall in the US money supply and tightening credit conditions mean inflation will likely continue to slow. Polleit adds that he expects slower economic growth to keep the Fed on the sidelines. Based on this, the economist makes the following assessment:

The very restrictive monetary environment signals a slowdown in the economy, perhaps even an approaching recession. Because the US economy, to put it bluntly, can no longer withstand high interest rates. From this point of view, it seems highly probable that the highest level in the current interest rate cycle may have been reached and the next rate hike will be downwards.

Because of this, gold prices may rise!

Edward Moya, senior market analyst at OANDA, says that while the Fed keeps its options open, it is unlikely to raise interest rates again. Moya said, “As the economy weakens, the disinflation process will continue. Also, the corporate world will begin to feel the impact of tighter credit conditions.” Also, Moya comments on its impact on gold:

Presumably, gold prices will remain range-bound until November. The Fed will likely not see a change in interest rates in September. Thus, once the market is confident that there will be a pause in November, gold could be bullish.

Gold shows little reaction to Fed rate hike

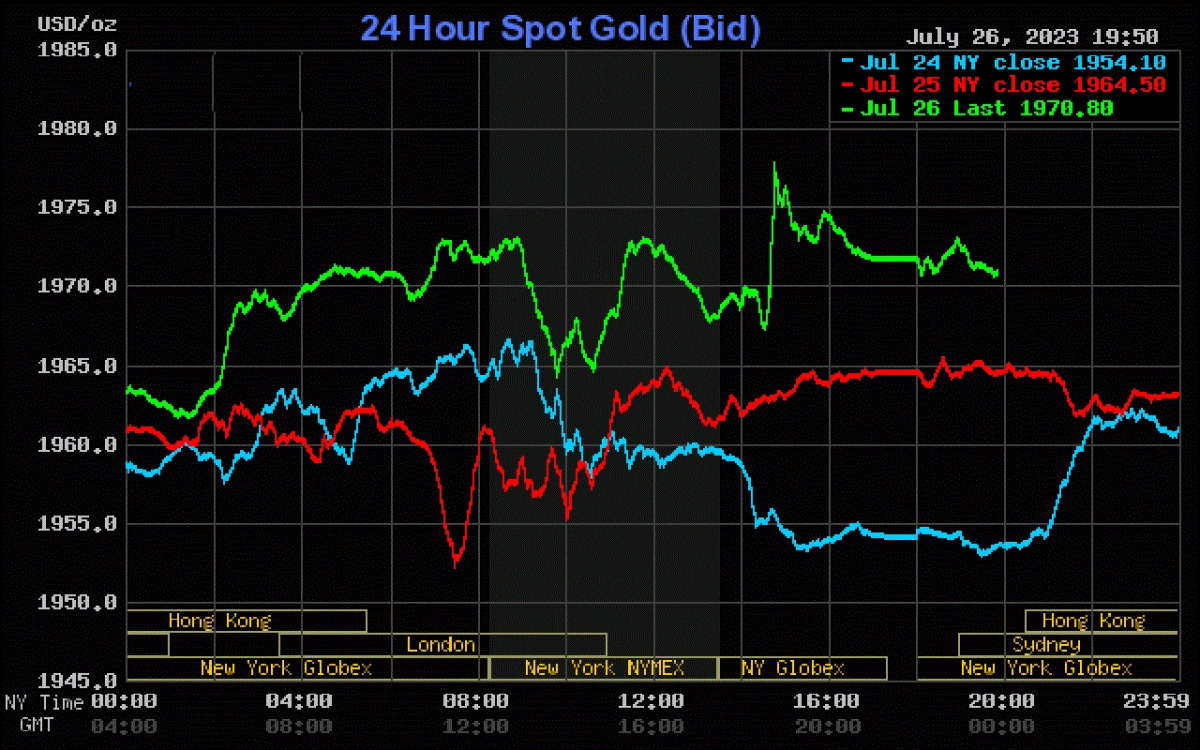

Senior analyst Jim Wyckoff evaluated the market after the Fed decision. Today, it is seen that the US dollar index weakened in foreign markets. Meanwhile, Nymex crude prices are weaker, trading around $79.00 a barrel. The benchmark 10-year US Treasury bond yield is currently at 3,887%. Also, the Fed moved little after the rate hike and the FOMC announcement.

Technically, August gold bulls generally have the short-term technical advantage. But to maintain it, they must soon show new strength. Prices are in a three-week uptrend on the daily bar chart, but very slightly. The bulls’ next upside price target is to close above the solid $2,000.00 resistance. The bears’ next near-term downside price target is to push futures prices below solid technical support at $1,900.60, the June low. Initial resistance will be at today’s high of $1,976.30, followed by July’s high of $1,989.80. Initial support will be at today’s low of $1,963.20 and then this week’s low at $1,951.60.