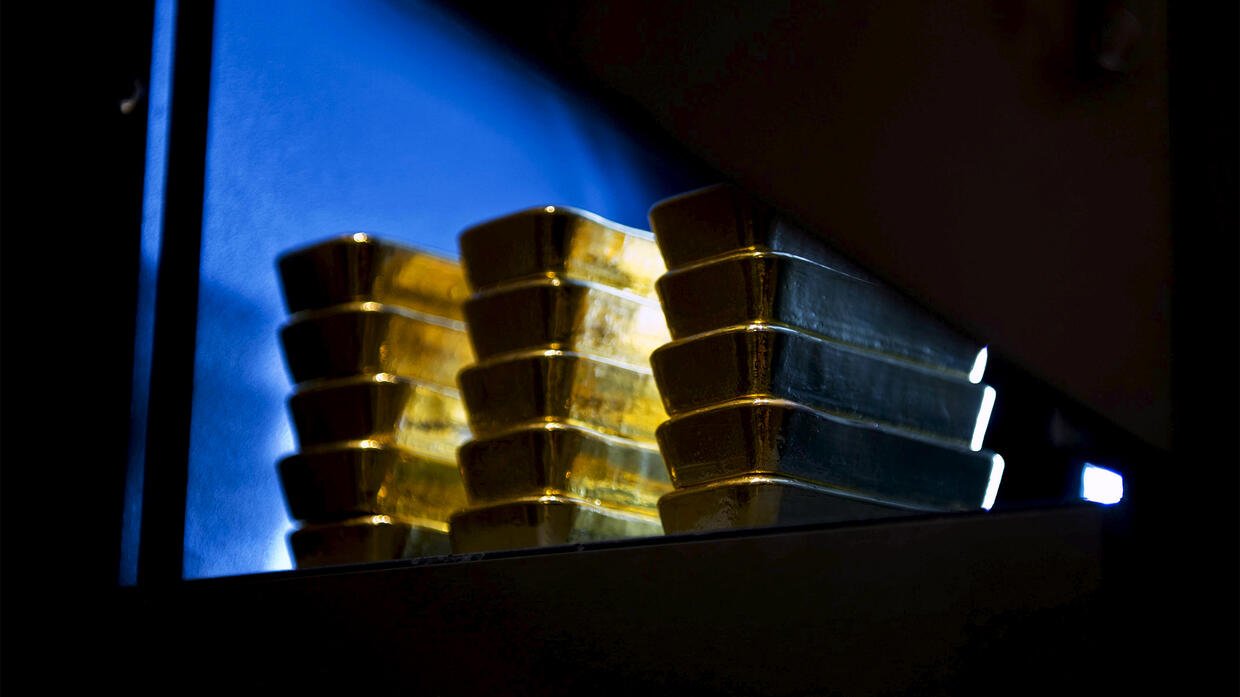

The price of gold is forced to evaluate the modest leap at the level of $ 1,970 on Friday. Therefore, on the first day of the new week, it is under some sales pressure. Analysts interpret the market and share their predictions.

The modest power of the US dollar creates pressure on the gold price

Kriptokoin.comAs you have followed, the Federal Reserve will further tighten its policies. This helped to get some purchase to the US dollar on Monday. Alyıca was seen as an important factor that pulled the gold price down on the second day. In fact, the markets seem to be convinced that the FED will continue to increase interest rates to prevent high inflation in the United States. In addition, a 25 BPS increase at the FOMC policy meeting in May has completely priced. In addition, the future of FED funds indicates the possibility of a small interest rate hike in June.

ŞAHİN Federal Reserve Expectations Supports Dollar

Bets have rose with the recent hawk comments made by a few Fed officials and positive US macro data showing that the world’s largest economy has maintained the resistance of the world’s largest economy. The flash version of the PMI survey of S&P Global showed that the general commercial activity in the US private sector expanded faster in April. Activities in the service sector grew at the highest speed of the third month in a row and at the highest speed of the last year. In addition, the US manufacturing sector indicator has been for the first time since October 2022.

Weak risk tone provides some support under the safe port

However, a softer tone around the US treasury bond returns prevents USD bulls from playing aggressive bets and supporting the price of gold. In addition, a new decline in stock markets contributes to limiting the downward movement of gold. Expectations for Fed’s further policy tightening fueled concerns about economic problems caused by increasing borrowing costs, which reduces investors’ appetite for more risky assets and increases the demand for traditional secure port assets, including gold.

There was no economic data from the US to the market on Monday. So the dollar was at the mercy of US bond returns. In addition, they will receive tips from wider risk sensitivity to capture short -term opportunities under the traders. However, the absence of a basic ground and meaningful intake mentioned above shows that the least resistance path for gold is in the lower direction.

Technical view of gold price

Market analyst Hareh Menghani evaluates the technical appearance of gold. From a technical point of view, the reduction -prone traders may expect some sales below the $ 1,969 zone before taking a position to extend the last withdrawal from the highest level of withdrawal from the highest level of one year. It is possible to shift gold to testing the next relevant support around $ 1,956-1,955. Thus, there is a possibility of falling to the lowest level of around $ 1,950.

On the other hand, any recovery attempt is likely to withdraw new sellers close to the psychological limit of $ 2,000. Thus, it is possible to be limited near the $ 2,010 barrier. A power that continues beyond the latter can trigger a new short circuit and increase the gold price beyond the $ 2,020 obstacle, around 2,047-2.049 dollars to the YTD summit on the road to 2,040 dollars.

Geopolitical risks and fears of recession support gold, but…

Market participants continue to focus on the Fed’s interest strategy to follow in the fight against increasing inflation. In this environment, gold prices remained in a narrow range on Monday. FXTM Senior Analyst Lukman Otuna says that gold prices are difficult to find direction because investors stay on the sidelines. “Geopolitical risks and fears of recession continue to support gold bulls. In this environment, the US expectation of more interest rate hikes has limited upward gains,” he says.

SAXO Bank Strategist Ole Hansen says that the gold market will need an even greater correction to trigger any compulsory long liquidation, and that the long gold remains above the support of $ 1,955 to $ 1,960, it continues to be a relatively small risk.

This means reverse winds for yellow metal

According to the CME Fedwatch vehicle, markets show the possibility of increasing the Fed’s interest rates by 25 basis as 90 %. The FED will hold its next policy meeting on May 2-3. Yeap Jun Rong, a market analyst in Ig, makes the following assessment:

Following the pioneering PMI data announced last Friday, there was a slight increase in US Treasury bond returns. This continues the downward pressure on gold prices. Fed’s interest expectations have been well fixed so far. However, more flexibility in economic conditions in the coming weeks may increase speculation for another interest rate hike in June or push interest rate cuts back to the timeline. This means reverse winds for yellow metal without returns.