The ongoing battle between the U.S. Securities and Exchange Commission and prospective issuers of bitcoin (BTC) spot ETFs is dominating current crypto headlines. An approved bitcoin ETF would increase access and signal a bullish new chapter for crypto.

Investors who limit their exposure to the small concentration of mega-cap assets formed by bitcoin and ether, however, may not capture the full value proposition of digital assets in their portfolios.

Broadening the digital asset investment universe beyond the largest single assets empowers crypto portfolios in the following ways:

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Improving diversification

Both within crypto and in the context of an investor’s broader asset allocation, increasing the breadth of digital asset holdings may lead to better diversification characteristics while also avoiding the risks of single-token concentration.

Investors should consider the following two questions regarding the portfolio-level benefits of allocating to digital assets:

Below we look at rolling correlations of the top 25 crypto assets to explore these questions:

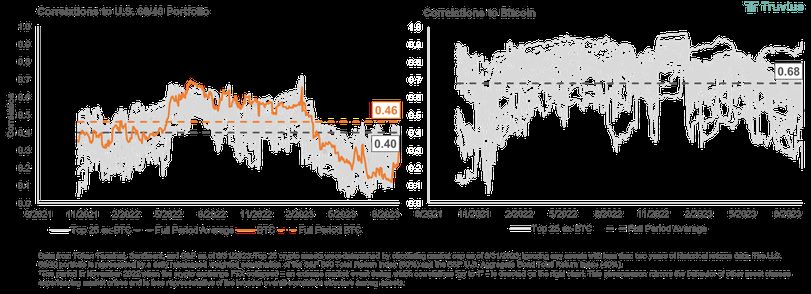

Figure 1: Rolling 60-day correlations to U.S. 60/40 portfolio (left) and to bitcoin (right), Aug. 1, 2021 to Aug. 31, 2023. Source: Truvius.

The chart on the left shows rolling correlations of daily returns for the 25 largest crypto tokens to a U.S. 60/40 stock/bond portfolio. Over the trailing two-year period, digital assets maintained strong diversification characteristics to traditional portfolios with full-period correlations of less than 0.50 for each crypto asset. This relationship is also more attractive when comparing the correlation of the full set of tokens to that of bitcoin, improving from 0.46 for BTC alone to an average of 0.40 across all top 25 assets.

The chart on the right shows correlations of non-BTC crypto assets to bitcoin. The variation of the correlations, along with modest overall levels, leaves the stigma that “all crypto is the same” looking largely unfounded. Exposure to a variety of crypto sectors and fundamental blockchain use cases may help drive this token diversification.

Accessing a broader set of active management strategies

Active crypto managers focusing only on bitcoin are mostly limited to timing the market – a uniquely challenging undertaking in any asset class. Tried and true relative value investment strategies, or strategies that compare assets to one another, from traditional finance may provide longer-term solutions for those seeking uncorrelated alpha in the space.

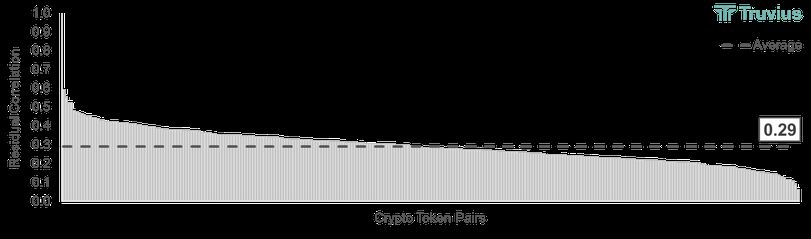

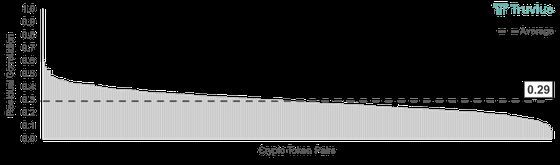

Effectively implemented relative value strategies call for both asset breadth and sufficient differentiation among those assets. Figure 2 takes returns for the top 25 crypto assets except BTC, controls for exposure to systematic risk (roughly approximated by bitcoin), and shows the correlations between each token pair’s residual returns (i.e., ETH vs. DOT, SOL vs. LTC, etc.):

Figure 2: Top 25 ex-BTC crypto token pair residual correlations, Aug. 1, 2021 to Aug. 31, 2023. Source: Truvius.

The goal of this chart is to see if the estimated idiosyncratic portion of each token’s returns is differentiated enough from one another to drive meaningful relative value comparison and allow active managers to benefit from increased breadth of the investment universe. The average residual correlation among the crypto asset pairs shown above is 0.29. All else equal, this suggests that on average much of the residual variation among these token pairs (up to approximately 90%) is unique, indicating a substantial amount of differentiation for relative value strategies to exploit.

Conclusion

Multi-asset crypto portfolios encompass a wide variety of fundamental use cases of blockchain technology, offering more robust diversification characteristics versus single-token concentration and unlocking relative value active management opportunities within and across crypto sectors.