Cryptocurrency analysts commented on the negative news and BTC metrics for Bitcoin! Here are 5 critical predictions for BTC price…

Mike McGlone explained: Bitcoin can affect bigger markets!

cryptocoin.com As we have reported, Mike McGlone, senior macro strategist at Bloomberg Intelligence, shared his latest views on the state of Bitcoin. McGlone believes that Bitcoin could lead the declines for risk assets, which is a sign that the impact of BTC is now contagious. McGlone emphasized that if the current slowdown in the prices of risky assets does not end, Bitcoin has the potential to pull down the volatile asset class. The expert’s comment came with the Bitcoin network’s congestion on Binance:

Bitcoin Could Pace Declines for Risk Assets –

If the worst isn't over for risk assets, #Bitcoin may lead the way lower. pic.twitter.com/UlEVjCEKwr— Mike McGlone (@mikemcglone11) May 8, 2023

Despite Bitcoin’s growth of around 70 percent this year, McGlone suggests this may be due to systemic bounces in the bear market. Bitcoin had a very volatile weekend. However, sentiment surrounding the leading crypto Bitcoin has waned as network congestion typically pushes investors to stay away from the protocol.

With Binance temporarily suspending transactions, there have been problems with many trading platforms. However, the vulnerability in the security of the Bitcoin network has rekindled issues about the potential success of smart contracts on the blockchain. However, Bitcoin’s resilience has made it stronger than most risky assets, and more investors are keeping an eye on Bitcoin as the anticipation of the blockage clears rises. On the other hand, the influence of Bitcoin continues to expand. As the Bitcoin network overcomes this congestion, the expert thinks that the impact of Bitcoin is now more contagious and will likely affect larger markets.

Christopher Whalen explains the impact of the banking crisis on Bitcoin price

On the other hand, fears that more banks will collapse after First Republic Bank’s recent collapse are still unwavering, and this fear has set a brighter picture for the crypto market. However, investors turned to Bitcoin. Earlier in the week, US regional bank stocks recovered somewhat in the premarket hours, sparking renewed hopes that the banking crisis would be over.

Cryptocurrency analyst Christopher Whalen said that large losses in the balance sheets of big banks could pose a big problem. He said an impending banking collapse could be avoided if the Federal Reserve changed its current monetary policy stance. Therefore, if the banking crisis continues, a jump in Bitcoin prices in the coming months may be a possible scenario. The analyst’s explanation is as follows:

Unless the Fed is willing to step back from its current policy and give the banks a little more respite, I don’t think we’ll be out of the woods. I think you’re going to see more banks fail.

However, Whalen states that many banks will be exposed to uncertainty. According to the analyst, due to the inverse correlation between bank stocks and Bitcoin price, the crypto market could be in a good position for a bull run in the next few quarters.

According to Pizzino, Bitcoin will rise above the negative news!

In another statement, Jason Pizzino states that Bitcoin will not be left behind by negative news. Bitcoin held its head high despite the threat of recession and banking collapses, according to the analyst. The analyst states that despite all the negative news, BTC is traded over $25,000, and that BTC may rise to the level of 30 thousand, 40 thousand and even 50 thousand dollars this year. However, the analyst states that even exchanges do not price negative news and display the highest prices.

According to Pizzino, investors expecting to bottom out probably won’t be able to. The analyst says that BTC surviving multiple bearish signals earlier this year means it could soon find itself in the $32,000 to $42,000 range. Here are the analyst’s words:

If people are expecting these low prices, what the market is telling us is that it won’t go down there at this point, especially after the double top is broken. When you have a huge macro bearish signal that fails at 50, which fails at $19,500, it fails on big bearish news such as the collapse of Silicon Valley Bank, then Credit Suisse, then Deutsche Bank, and then every other bank.

When this bearish signal fails and rises above it, it is most likely an upside signal and an upside macro signal. So what could happen from here? Maybe $32,000, maybe $34,000, maybe up to $42,000, we’ll see.

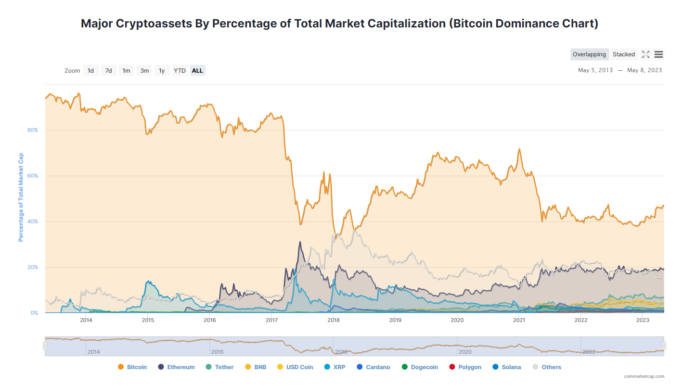

Jason Pizzino predicts a boom in BTC dominance!

Cryptocurrency analyst Jason Pizzino reiterated his belief in Bitcoin’s rise in his comments over a YouTube video. Pizzino predicts that the price of BTC will rise to between $30.5k and $35,000 in the coming weeks. However, stating that many investors may want to move their assets from altcoins to BTC, the analyst drew attention to a market dominance explosion for BTC.

CoinMarketCap data reveals that BTC has been trading at $28,178.48 after a 2.68 percent drop over the past 24 hours. BTC also experienced a 0.09 percent drop in market dominance from 47.08 percent.

BTC price strengthens resistance level

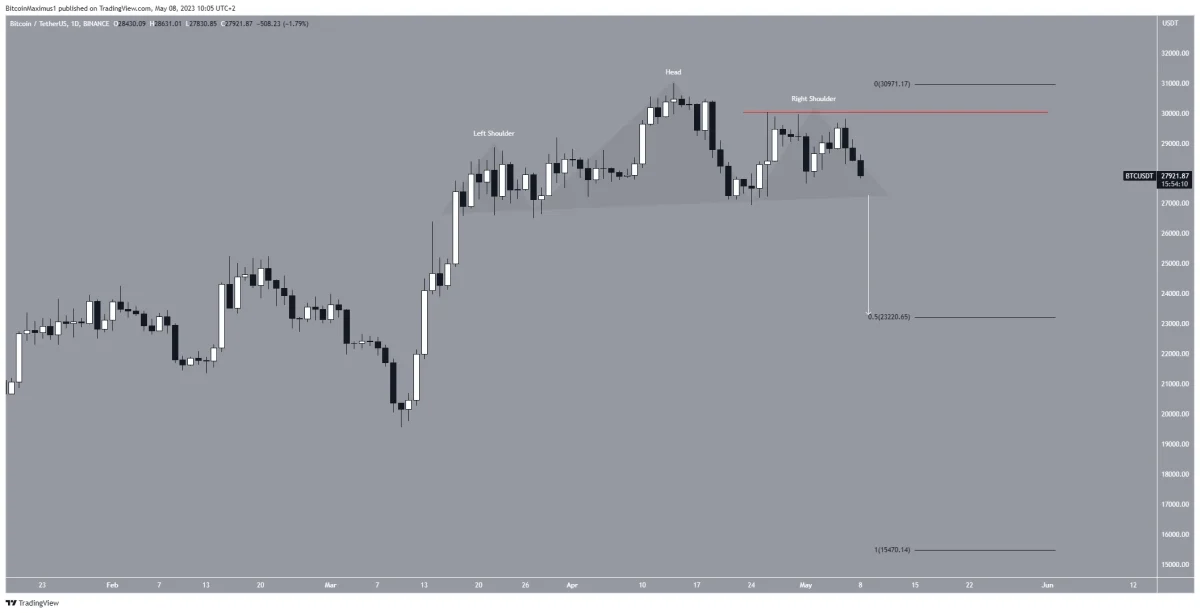

Since the beginning of April, BTC price action has been bearish. This is illustrated by the bearish engulfing candlestick pattern on April 17 and 24 and two rejections (red icons) in the weeks that followed. The move firmly confirmed the $29,800 area as resistance. The resistance area is present on the weekly timeframe. Thus, it makes it possible for a local peak to be reached.

The weekly Relative Strength Index (RSI) remains positive. The indicator is currently above 50 and rising. Current technical analysis on the daily timeframe shows that Bitcoin price predictions are bearish. This can be explained by the formation of the head and shoulders pattern, which is typically seen as a bearish pattern.

If the potential breakout in the leading crypto BTC price follows the entire height (white) of the formation, it could cause the digital asset to drop to a minimum of $23,400. This is aligned with the 0.5 Fib retracement support level (black). According to the Fibonacci retracement principle, after a significant price change in one direction, the price usually retraces partially or returns to a previous price level before continuing in its original direction.

Despite this bearish forecast, if the price rises above the right shoulder (red line) at the $30,000 level, it will indicate that the trend is not in a bearish direction. Instead, it could lead to an increase towards the next long-term resistance at $36,500.