Kriptokoin.com –Warren Buffett and Berkshire Hathaway significantly reduced their positions in Wells Fargo by selling 100 million shares. Buffett, known as “Oracle of Omaha ,, continues to reduce the position of bank shares and strengthens the bull situation for Gold and Bitcoin (BTC).

Fox Business’s report on 5 September reported that Berkshire has 32 billion dollars of self -capital in Wells Fargo at some point. Investment holding currently has 3.3 %of Wells Fargo’s own capital, which corresponds to $ 3.36 billion.

Why did Buffett reduce Wells Fargo investment and how can this benefit Bitcoin?

Buffett is a billionaire who emphasized the importance of value investment and cash flow throughout his career. The investor usually results in consistent profitability; It prefers businesses with predictable and stable operations.

In July, Wells Fargo announced its first loss since the 2008 housing crisis and announced that it was a $ 2.4 billion loss. Following a three -month report, which was disappointed, the company said it would reduce its dividend share by 10 cents per share.

This month, Moody’s reduced his grade to negative, citing the slow process in the process of overhauling his management. Moody’s Analyst Allen Tischler said:

“The change reflects Wells Fargo’s actions more slowly than expected to complete the deficiencies of the former management, surveillance, compliance and operational risk management. Slow tempo focuses on the base of earnings and weakens the potential of earnings on the ground for challenging working conditions.”

Three -month damage, dividend reduction and intersection of the appearance of fall; Probably caused Buffett to turn his position.

However, Berkshire’s portfolio in recent months, the most persistently encountered, the investment in Barrick Gold. Buffett has invested in gold and Japanese trade companies while giving signals from the US banking sector.

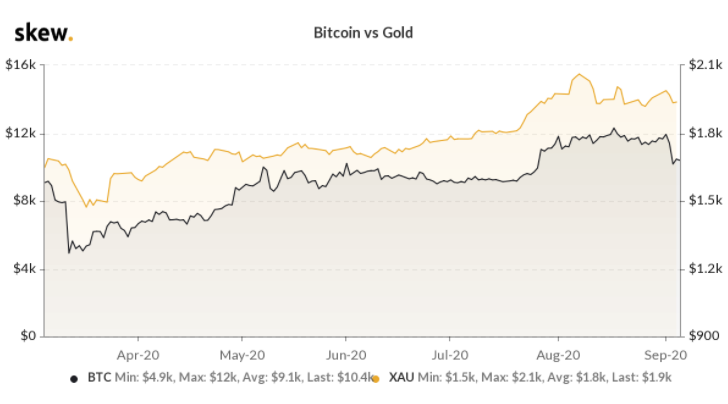

According to Cotelegraph, this decision shows that Buffett is looking for protection against security and inflation in terms of cash flow. Barrick Gold investment feeds the bull’s appearance in Bitcoin because it becomes natural to be perceived as a value store of BTC – especially since the collapse of March 2020, the tight correlation between gold and BTC.

Bitcoin and gold price. Source: Skew

Bitcoin and gold price. Source: SkewGold and Bitcoin interpretation from Winklevoss

Other important investors, including Winklevoss twins, believe that Bitcoin will compete with gold in the long run as “digital gold .. In particular, the upward potential makes BTC an attractive investment.

Cameron Winkelvoss, the founding partner of Gemini, said Bitcoin has already been a significant basis for gold and said:

“Bitcoin has created an important basis for gold – after its technical article, it increased to over 200 billion dollars in terms of market value in less than ten years.”

Max Keiser, the presenter of the Wall Street veteran and Keiser Report, said that Buffett believed that the leaving the dollar was a rise signal for the price of gold and bitcoin:

“Buffett’s heading to Japan with the gold investment confirms that the US dollar is largely out of the dollar.” Bitcoin – Gold – Silver will all reach new high levels in the near term. ”