Centralized Exchange is a third-party platform that is privately managed by a central organization and facilitates transactions of crypto assets between buyers and sellers.

What is Centralized Exchange (CEX)?

Centralized Exchange (CEX) is where users buy, sell or exchange cryptocurrencies. It is custody in nature, holding users’ funds or digital currencies in a digital wallet before centrally verifying transactions. CEXs usually charge a certain percentage of trading fees, regardless of trading volume. You can buy cryptocurrency with fiat currency or choose to exchange one cryptocurrency for another via an exchange. To facilitate payments, a CEX can work with commercial banks to allow direct bank transfers or payment by credit cards.

CEXs can also work with a central authority to ensure that transactions on the platform are not malicious or illegal, such as money laundering activities. A centralized CEX can provide security with cryptocurrencies and improve user experience with a wide range of services. These services make transactions more reliable, efficient and secure for users. They are also the main reasons why CEXs are more widely used among crypto users compared to decentralized or hybrid exchanges.

Despite the centralization of CEXs, the cryptocurrency used in transactions is still decentralized, meaning that CEX does not control the network or transactions for any crypto assets. CEX is a third-party platform operated by a centralized entity that serves to facilitate transactions between buyers and sellers.

How Does Centralized Exchange Work?

As a third-party platform, a CEX offers neutrality, security and efficiency in transactions of crypto assets among users. Therefore, users can choose to deposit their funds in a digital wallet on the exchange, rather than exchanging crypto assets among themselves. After taking custody of the funds, CEX will issue a corresponding amount of IOUs or credits to users. These debentures or loans are tracked by CEX as transactions are processed and converts them into real fiat currency at the point of withdrawal. This is done through the maintenance of an order book that records buy and sell orders between traders.

These buy and sell orders are essentially requests by users to buy or sell cryptocurrencies at a certain price. This is collected by CEXs whose platform can calculate, match and execute buy and sell orders between users. The ability of a CEX to process transactions quickly and efficiently makes it easy for crypto users to buy and sell crypto assets on the platform.

Centralized Exchange Limitations

Although stability and convenience are provided for transactions in CEX, the percentage charged as transaction fee from each transaction may increase depending on transaction volume. This may deter users from considering a CEX as a trading platform for crypto assets.

Also, CEXs often do not openly present their internal transactions to users. This lack of transparency can lead to malicious price and market manipulation. For a community of users who value the decentralization and transparency of transactions unaffected by a single entity, a CEX’s centralized control over funds and the ability to freeze or block them at will can be a cause for concern among users.

CEXs, the custodian of crypto assets for users looking to trade on the platform, are also widely targeted by attackers, whether inside or outside, resulting in over $292 million in losses in 2019. Such coordinated attacks and technical disruptions can lead to downtime in CEX services, resulting in loss of trading opportunities for users.

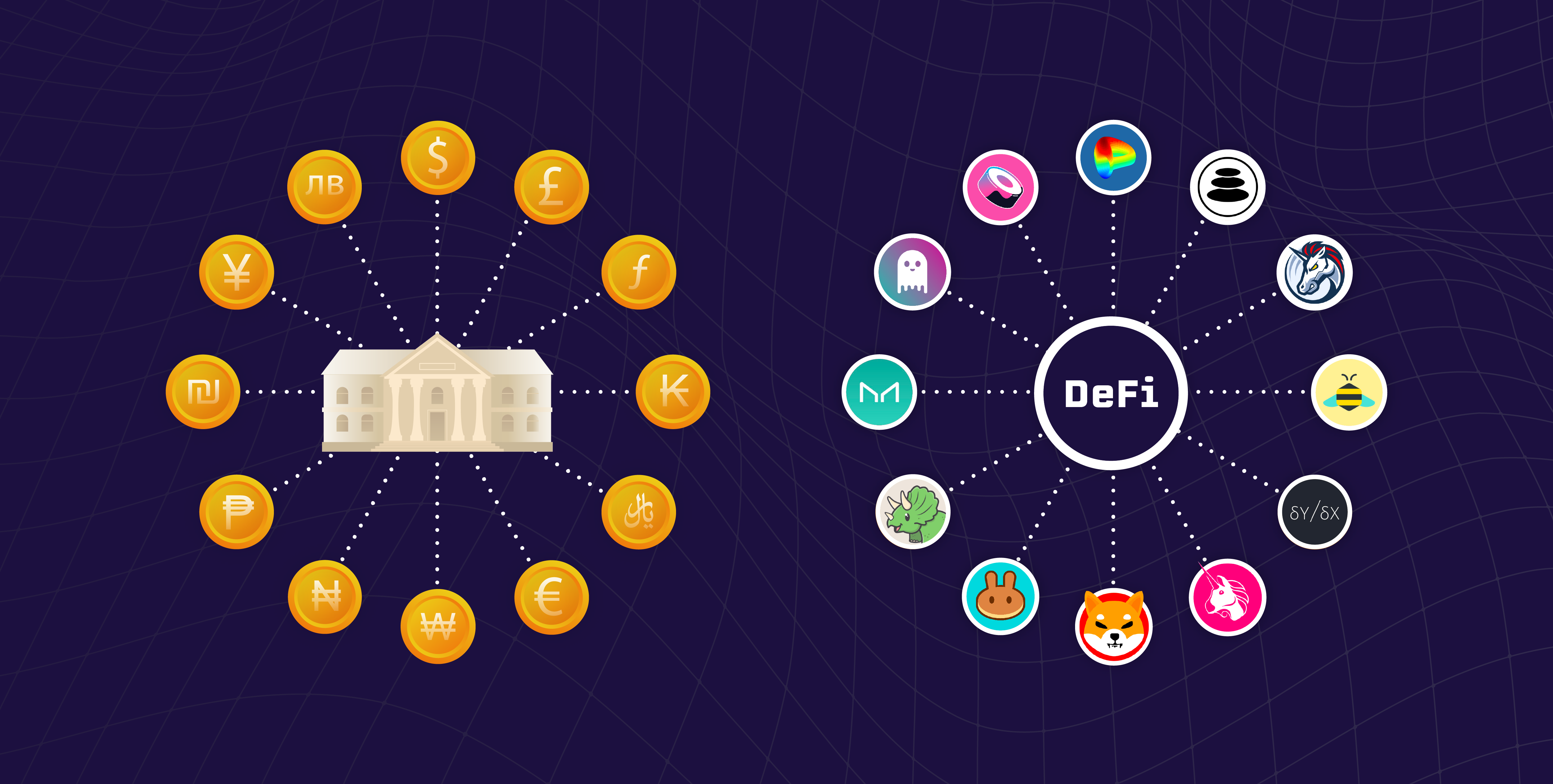

What are the Differences Between Centralized and Decentralized Exchanges?

Centralized exchanges can be used to trade from fiat to cryptocurrency and vice versa. They can also be used to trade between two different cryptocurrencies. While this seems to cover all potential types of transactions, there is still a market for another type of cryptocurrency exchange.

Decentralized exchanges are an alternative; it is often thought of as an “unsafe” environment. Such exchanges function as peer-to-peer exchanges. Assets are never held by an escrow service and transactions are based entirely on smart contracts and atomic swaps.

The key difference between centralized and decentralized exchanges is whether an intermediary is available. Decentralized exchanges are less common and less popular compared to centralized exchanges. However, there are always more decentralized exchanges and it is possible that centralized exchanges will be given a chance for their money in the future.

Fiat/Cryptocurrency Pairs

At this point, it’s more common for a centralized exchange to offer cryptocurrency/cryptocurrency pairing. This allows customers to trade bitcoin for ether tokens, for example. Fewer exchanges offer fiat/cryptocurrency pairs, allowing bitcoin for USD exchanges, for example.

However, some of the largest cryptocurrency exchanges in the world are those that offer these fiat/crypto currency pairs. One reason is likely to serve as a direct access point to the cryptocurrency market.

Since many investors in the space are relatively new to investing in digital currencies, they may be more likely to turn to such exchanges. Some of these exchanges are Coinbase, Robinhood, Kraken and Gemini.

Fundamentals of Centralized Exchanges

There are always new centralized cryptocurrency exchanges. However, not all will be successful and it is not uncommon for these exchanges to close. The success or failure of a change depends on many factors. However, one of the key components of success is transaction volume.

Generally speaking, the higher the trading volume levels, the lower the volatility and market manipulation likely to occur on that exchange. Volatility is a very important consideration. Due to the time required for transactions to be completed, the price of a particular token or cryptocurrency can vary between when the transaction is initiated and when it is completed. The higher the trading volume and the faster the transaction can be processed, the less likely this fluctuation is to be a problem.

Another important element of successful centralized change is security. While no exchange is completely immune to malicious activity like hacking, some are more secure than others.

The way an exchange responds to an event such as a hack is by no means certain. Some exchanges have worked hard to recoup customer losses, while others have been less successful. Still others have closed their shutters as a result of such attacks.

For investors looking to enter the cryptocurrency space, a centralized exchange is still the most common way to do so. When choosing an exchange, it’s important to keep in mind a number of factors that will affect the user experience, including which pairs are traded, how high the trading volume is, and the security measures that exchanges adopt to protect their customers.