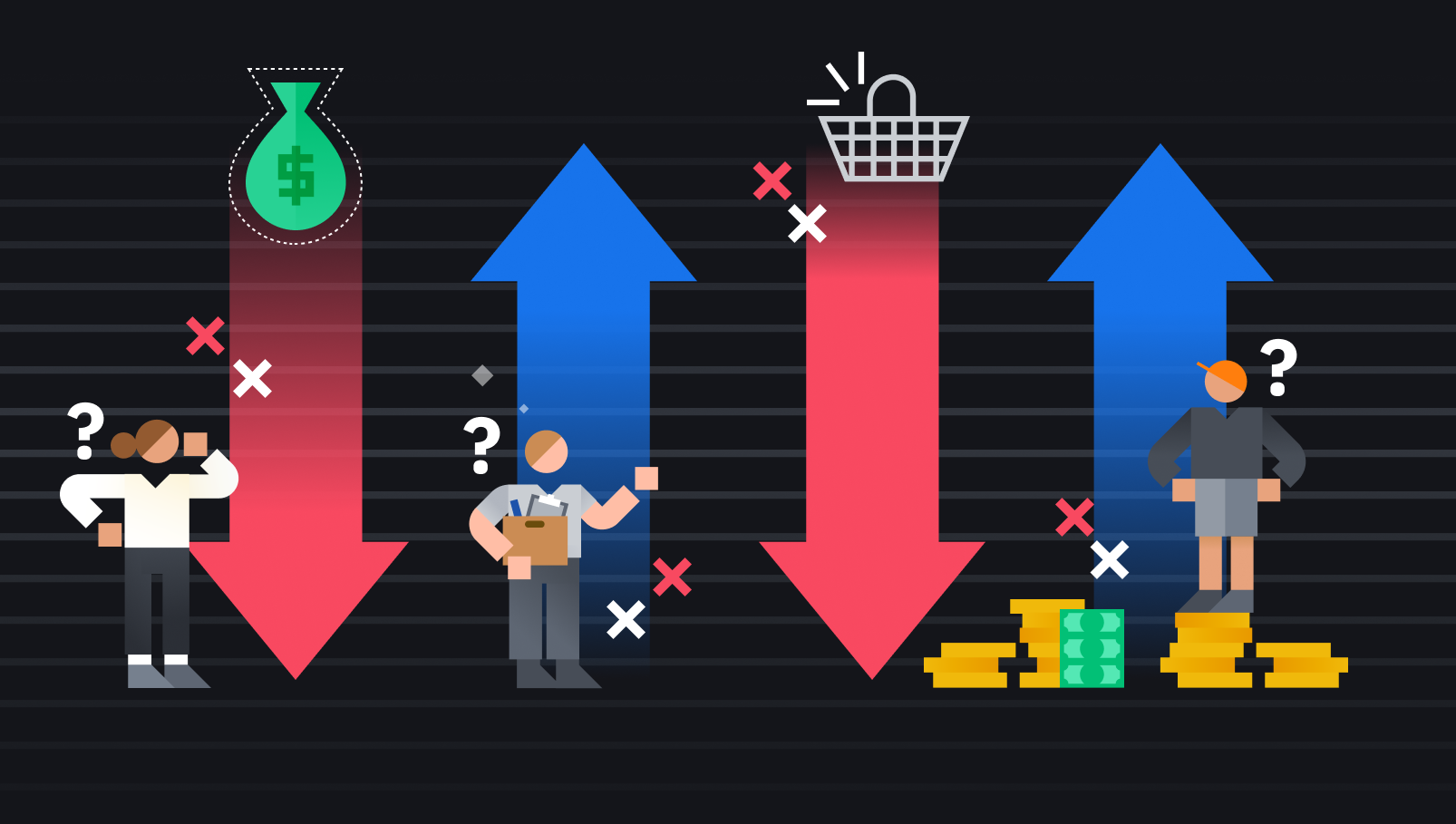

Stagflation occurs when an economy experiences high unemployment rates along with recession or negative growth (recession) and rising prices (inflation). There are strategies to combat recession and inflation individually, but as these are conflicting effects, the combination of the two makes stagflation difficult to control.

On the one hand, recession or negative growth can be addressed by increasing the money supply, making it cheaper for companies to borrow money (lower interest rates). More money available leads to expansion and higher employment rates, which can effectively prevent or combat a recession.

In contrast, economists and policy makers often try to control rising inflation by reducing the money supply to slow the economy. This can be done by raising interest rates, making it more expensive to borrow money. Businesses and consumers borrow less and spend less, and decreased demand stops prices from rising.

However, when an economy experiences stagflation, we have the worst of both sides: a recession with high inflation.

What is Stagflation?

Stagflation is a macroeconomic concept first mentioned by British politician and Finance Minister Iain Macleod in 1965. Its name is a combination of recession and inflation and describes an economy experiencing high unemployment combined with minimal or negative economic growth and rising consumer prices (inflation).

Typical economic controls used to tackle each condition individually can worsen the other and make it harder for a government or central bank to deal with stagflation. Generally, high employment and growth are positively correlated with inflation, but this is not the case with stagflation.

Economic growth is usually measured by a country’s gross domestic product (GDP), which is directly related to employment rates. When GDP does not perform well and inflation rises, severe stagflation can lead to a wider financial crisis.

Stagflation and Inflation

Stagflation, as we have seen, is a combination of inflation and economic recession or negative growth. Although inflation can be defined in different ways, it usually refers to an increase in the prices of goods and services. We can also define inflation as the decrease in the purchasing power of a currency.

Why Does Stagflation Occur?

In short, stagflation occurs when the purchasing power of money declines, while at the same time the economy slows down and the supply of goods and services decreases. The exact causes of stagflation vary depending on the historical context and different economic views. There are various theories and views that explain stagflation differently, including the monetarist, Keynesian, and neoclassical models.

Conflicting monetary and fiscal policy

Central banks manage the money supply to influence the economy. These controls are known as monetary policy. Governments also directly affect the economy with their spending and tax policies, known as fiscal policy. However, a conflicting combination of fiscal and monetary policy can lead to runaway inflation and slow economic growth. Any combination of policies that reduce consumer spending while increasing the money supply can eventually lead to stagflation.

For example, a government can raise taxes, leaving its population with less disposable income. The central bank may simultaneously engage in quantitative easing (“printing money”) or lowering interest rates. While government policy negatively affects growth, the central bank increases the money supply, which often leads to inflation.

Introduction of fiat currency

Previously, most major economies pegged their currencies to some gold. This mechanism was known as the gold standard, but after World War II. It was widely abandoned after World War II. The abolition of the gold standard and its replacement with fiat currency removed all constraints on the money supply. While this may make it easier for central banks to control the economy, it also risks damaging inflation levels by causing higher prices.

Increase in procurement costs

A sharp increase in the cost of production of goods and services can also cause stagflation. This relationship is especially true for energy and is known as a supply shock. Consumers also suffer from the rise in energy prices, which is typically driven by oil prices.

Stagflation is more likely to occur if the cost of producing goods is higher and prices rise and consumers have less disposable income due to heating, transportation, and other energy-related costs.

How to Fight Stagflation?

Combating stagflation is achieved through fiscal and monetary policy. However, the exact policies implemented depend on the school of economic thought.

monetarists

Monetarists (economists who believe that controlling the money supply is most important) will argue that inflation is the most important factor to control.

In this scenario, a Monetarist (monetarist) will first reduce the money supply, which will reduce overall spending. This leads to less demand and lower prices for goods and services. The downside, however, is that this policy does not stimulate growth. Growth should be addressed later through loose monetary policy along with fiscal policy.

supply-side economists

Another school of thought is to increase supply in the economy by reducing costs and increasing efficiency. Price controls on energy (where possible), efficiency investments and generation subsidies will help reduce costs and increase the economy’s aggregate supply. This lowers prices for consumers, stimulates economic output, and reduces unemployment.

free market solution

Some economists believe the best cure for stagflation is to free it up. Supply and demand will eventually adjust to rising prices as consumers cannot afford the goods. This fact will lead to a decrease in demand and lower inflation.

The free market will also allocate labor efficiently and reduce unemployment. However, this plan can take years or decades to work successfully, leaving the population in adverse living conditions. As Keynes once said, “in the long run we are all dead.”

stagflation

stagflationHow Can Stagflation Affect the Crypto Market?

It is difficult to fully describe the precise effects of stagflation on crypto. However, assuming that other market conditions remain the same, we can make some basic assumptions.

Minimal or negative growth

A barely growing or shrinking economy leads to stagnating income levels or even a decline. In this case, consumers have less money to invest. This could lead to a decrease in crypto buying and an increase in sales as retail investors need access to money for day-to-day spending. Slow or negative economic growth also encourages large investors to reduce their exposure to higher-risk assets, including stocks and cryptocurrencies.

Government measures against stagflation

Typically, a government will first try to control inflation and then deal with the problem of growth and unemployment. Inflation can be controlled by reducing the money supply, one method by raising interest rates.

This reduces liquidity as people keep their money in banks and borrowing becomes more expensive. With an increase in rates, high-risk and high-return investments are less attractive. As such, crypto may see a drop in demand and prices during times of rising interest rates and low money supply.

When a government gets inflation under control, it will likely want to stimulate growth. This is typically done through quantitative easing and a reduction in the interest rate. In such a scenario, the effects on the crypto markets will likely be positive due to the increase in the money supply.

increase in inflation

Many investors argue that Bitcoin can be a good hedge against rising inflation rates. With higher, rising inflation, keeping your wealth in fiat without earning interest lowers its intrinsic value. To avoid this, many have turned to Bitcoin to maintain their long-term purchasing power and even make a profit. This is because investors see BTC as a good store of value due to its limited issuance and supply.

Historically, this hedging strategy may have worked well for investors who have accumulated Bitcoin and other cryptocurrencies over the years. Especially during or after periods of inflation and economic growth. However, using crypto as a hedge against inflation may not work well on shorter timeframes, especially during periods of stagflation. It’s also worth noting that there are other factors at play, such as the increased correlation between crypto and exchanges.

Stagflation in the 1973 oil crisis

In 1973, the Organization of the Arab Petroleum Exporting Countries (OPEC) declared an oil embargo on a certain group of countries. This decision was a reaction to the support given to Israel in the Yom Kippur war. With the dramatic drop in oil supply, oil prices rose, leading to supply chain shortages and higher consumer prices. This resulted in a large increase in the rate of inflation.

Central banks in countries such as the USA and the UK have lowered interest rates to stimulate growth in their economies. Lower interest rates make it cheaper to get loans and encourage spending rather than saving. However, the typical mechanism for reducing inflation is to lower interest rates and encourage consumers to save.

Many western economies have experienced high inflation and a stagnant economy, as oil and energy costs make up a large portion of consumer spending and the fall in interest rates has not sufficiently stimulated growth.

Final Words

Stagflation presents a unique situation for economists and policy makers as inflation and negative growth often do not occur together. While recession-fighting tools often cause inflation, strategies to control inflation can lead to slow or negative economic growth. Therefore, in times of stagflation, it is worth considering the macroeconomic context and its multiple factors such as money supply, interest rates, supply and demand, and employment rate.