US July CPI was 8.5%, below expectations. The slower-than-anticipated slowdown in inflation lowered the Federal Reserve’s aggressive rate hike expectations. In response to these developments, gold prices rose above the $1,800 level. Analysts look at the technical picture of gold and interpret the market.

Alex Kuptsikevich: Gold prices showed an interesting reaction

cryptocoin.com As you can follow, the US CPI data surprised the markets. After this data, gold made an upward attack first. However, he later turned his direction down. Alex Kuptsikevich, senior market analyst at FxPro, comments:

Gold prices showed an interesting reaction to the US CPI report. Gold slumped below $1,800 after an initial upside momentum, which could easily be explained by a falling dollar and increased demand for risky assets. This dynamic proves once again how strongly the bears defend this level. It’s not just a round level. It’s also the former support area from the beginning of the year.

Craig Erlam: The path to gold’s rise is still there!

Craig Erlam, Oanda’s senior market analyst, underlines the following in his note to clients:

It is not a foregone conclusion that the Fed will be much less aggressive in raising interest rates. But it’s possible for stock investors to stay a little aggressive here. The bullish path of gold is still there. But if stocks continue to bid for a while, it’s likely to take a little longer.

Goldman Sachs lowers its gold forecasts

Following the US CPI data, Goldman Sachs updated its forecasts. Bank strategists say the Fed has dispelled concerns about high inflation and weak economic growth. Therefore, the bank lowered its forecasts for the precious metal. Goldman lowered its 3, 6 and 12-month gold forecasts to $1,850, $1,950, and $1,950 from $2,100, $2,300, and $2,500, respectively. In a note, Goldman strategists led by Mihail Sprogis explain:

We expected nominal interest rates to rise with the Fed’s rate hikes. However, we did not expect inflation expectations to drop this much after the failure of the temporary narrative and high persistent inflation surprises. The main conclusion is that in the current tightening policy and persistent recession concerns, gold’s tactical direction will be determined by shifts in the Fed’s priority function between the fight against inflation and growth support.

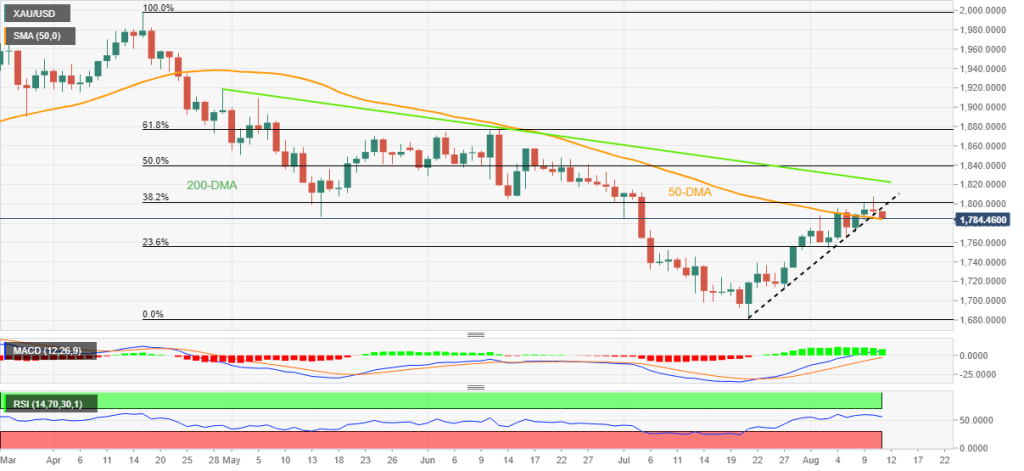

Gold prices technical analysis

Market analyst Anil Panchal illustrates the technical outlook for gold as follows. The bears attacked the 50-DMA cap towards Thursday’s European session. Hence, Gold price is holding lows near the intraday bottom around $1,784. In doing so, bullion pays homage to the Fed’s next move and the recent recovery of the US dollar.

A clear downside break of the three-week ascending support line, which is currently a resistance line around $1,795, joins the RSI retracement and MACD’s easing uptrend to anger the golden bears.

However, a daily close below the 50-DMA support near $1,784 is needed for gold price to extend its latest weakness to the 23.6% Fibonacci retracement level in the April-July period, or $1,755. On the contrary, an upside break from the resistance turning into the $1,795 support is not an open call to gold buyers. This is due to the presence of a downward sloping resistance line around $1,824 from late April.

Pablo Piovano: More corrections in the table

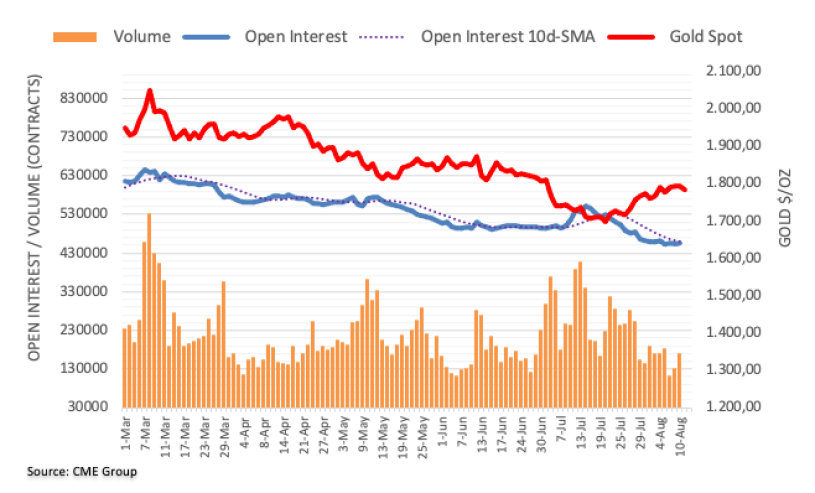

The latest data from CME Group for the gold futures markets showed that the short position rose by around 2.6k contracts on Wednesday. It also pointed out that it improves current erratic performance. Along the same lines, volume rose for the second consecutive session. This time around 40,000 contracts.

Gold prices passed the key $1,800 on Wednesday. However, it closed below this level and with modest losses. Market analyst, Pablo Piovano, says this move is in line with rising open interest and volume. According to the analyst, this was an indication that further declines could occur in the very near term.