The gold market remained neutral once again, even as interest rates continued to rise. Investors and traders are trying to digest Fed Chairman Jerome Powell’s latest comments. According to market analyst Christopher Lewis, gold traders are currently confused.

“The data to come until the next meeting will be important”

cryptocoin.com As you follow, Jerome Powell gave a short speech at the annual central bank symposium in Jackson Hole. Powell actually managed to look hawk without saying anything new. Without real monetary policy guidance, market expectations are based on a 50/50 chance that the Fed will raise interest rates by 50 or 75 basis points next month. This uncertainty means that gold prices are likely to remain at $1,750.

Of course, many economists rejected Powell’s point of view even before he spoke. Kristina Hooper, chief investment officer of Invesco, pointed out in an interview that there is a lot of data between today and the next monetary policy decision on September 21. She noted that the next meeting was ‘a lifetime away’, she said.

According to Powell, interest rates will likely be higher for longer.

So if everyone is focusing on Powell’s comments, it’s possible that we’re missing an important piece of the puzzle. The US central bank has made it clear that it will monitor the data to determine its next move. So you have to look at the data.

Prior to Powell’s comments, the US Department of Commerce said the core Personal Consumption Expenditure Index (PCE) rose 4.6% in July, up from 4.8% year-on-year in June. Headline inflation fell even more sharply, up 6.3% from 6.8% reported in June. Energy prices continue to make the most significant contribution to falling inflation, down 4.8% last month.

If inflation continues to cool, the Fed will have enough room to slow the pace of rate hikes. However, even as the pace slows, a much anticipated pivot is still off the table. One of the things Powell pointed out is that interest rates will likely be higher for a longer period of time.

“Central bank gold demand will continue to support the market”

With economic conditions so volatile, we will have to pay attention to data that does not paint a very rosy picture. Tighter financial conditions caused by rising Fed Funds rates are starting to take effect. Last week, new home sales fell to their slowest pace since 2016. It’s about 30% down from July 2021. Thus, we saw a significant weakness in the US housing sector. At the same time, preliminary data from S&P Global Market Intelligence showed the manufacturing sector PMI dropped to a two-year low.

There is another data set that we should pay attention to while waiting for the deterioration of economic conditions. July seems to have been a busy month in terms of central bank gold demand. Krishan Gopaul, senior market analyst for Europe and the Middle East at the World Gold Council, said Qatar’s central bank bought 14.8 tons of gold last month. He also noted that he had increased the reserves to a record level of 72.3 tons. It also reported that the Central Bank of Uzbekistan bought 8.7 tons of gold in July. According to analysts, central bank gold demand will continue to provide critical support to the gold market.

Weekly gold technical analysis

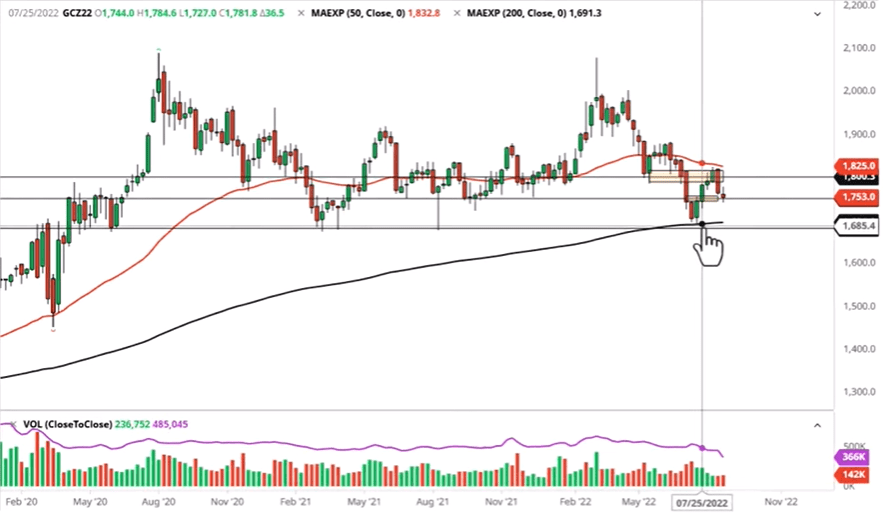

Market analyst Christopher Lewis analyzes the technical outlook for gold as follows. Gold markets continued to hang around the more than once significant $1,750 level. So it’s been a pretty choppy week. So I think it’s probably just a matter of time before I make some kind of decision. At this point, if we break below the weekly candlestick, we’ll probably drop enough to test the 200-Week EMA sitting around $1,700.

If we climb above the top of the candlestick, then it is possible for us to test the $1,800 level. But watch out for interest rates and of course the US dollar. Because both have a large negative correlation with gold. In this scenario, I think we are facing a situation where sooner or later we will see an explosive move. Of course, Jerome Powell was more hawkish in Jackson Hole than people expected.

If the US dollar and interest rates suddenly start to rise, this will push gold further, at least as an unexpected response. If we break below the 200-Week EMA, we are likely to see a larger move to the downside. I’m not sure we understand this. But it’s definitely something you should watch out for. Because it opens a big “closed door” in the market, it is possible to start a sizable sale. I think this is going to be a headline thing. It will likely drop gold to the $1,500 level. Regardless, it’s a very noisy market. That’s why you need to keep that in mind too.