According to analysts, it is a little early to talk about a breakout in the price of gold. However, some market analysts underline that the precious metal closed the week on a strong note.

Gold slumps after Powell’s hawk comments

It ends in relatively neutral territory on Friday. However, analysts see a small victory in what the market is not doing. The yellow metal, at least, hasn’t made it to new lows. Meanwhile, the US dollar rose to a 20-year high against a basket of global currencies. Back to the Juggernaut, the US dollar is crushing all global currencies except gold. The precious metal, on the other hand, managed to hold fast support at $1,700.

Gold also managed to hold on to rising bond yields. cryptocoin.com As you can follow, US 10-year interest rates rose to the highest level in two months with 3.5% this week. Markets see a 90% chance the Fed will raise rates by 75 basis points. Market expectations solidified after Fed Chairman Jerome Powell said the central bank would maintain its aggressive monetary policy stance “until the job is done.” Gold prices fell to session lows after Powell’s hawk comments. However, he eventually managed to find support.

“Gold has a long way to go to shine again”

Some analysts say that gold has been able to withstand rising bond yields and the momentum of the US dollar as investors once again begin to see it as an important safe-haven asset and inflation hedge. In dismal headlines this week, portfolio manager and Lead-Lag Publisher Michael Gayed noted that the United States could face a debt crisis as Treasury rates continue to rise.

Not just in the US, European Central Bank President Christine Lagarde raised the specter of recession after the ECB raised interest rates by 75 basis points. At the press conference, she said that a recession is not the ECB’s baseline scenario. However, he noted that they expect the eurozone economy to contract by 0.9% in 2023 as part of the bear scenario. Market analyst Neils Christensen comments:

While some investors are starting to see value in gold, there is still a long way to go to undo this summer’s loss. The bears are still in control of the market as they liquidate bullish gold bets. Gold still has a long way to go to shine again. But he’s holding on tight, at least for now.

Weekly gold technical analysis

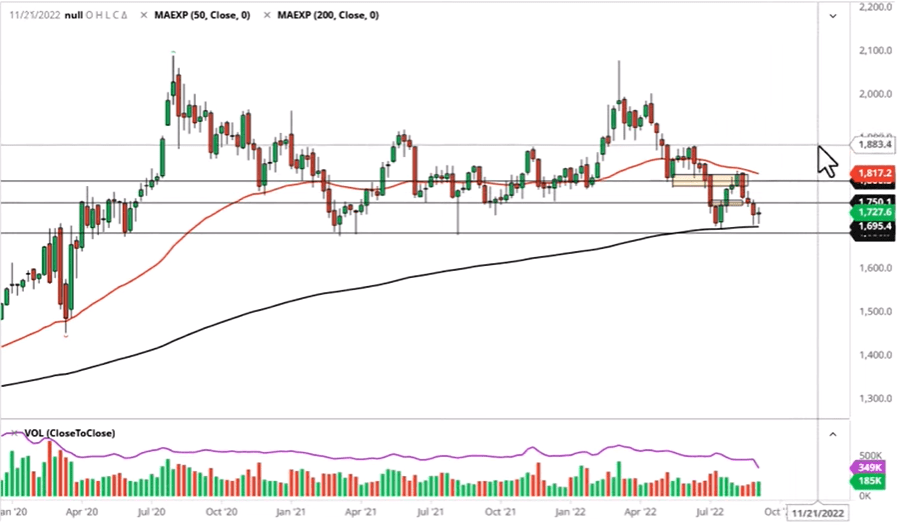

Technical analyst Christopher Lewis analyzes the technical outlook of gold as follows. Gold markets have bounced back and forth throughout the week to form a mildly supportive candlestick while hovering just above the 200-Week EMA. The market has been working in this area for a while. This shows we’re trying to create a bit of a double bottom. The $1,680 level is crucial for support. It is possible that we will see this market try to recover as long as we can stay there.

Regardless, it is important to remember that the gold market is very volatile and of course has many different effects. The most obvious will be interest rates in the US, which are generally rising. In other words, it looks like larger investors will continue to hold paper rather than store gold. However, if things turn upside down, it’s possible that gold will be one of the first markets to do so.

The $1,750 above level is likely to be a key resistance. If we break there, we could look at the $1,800 level. The $1800 level includes the 50-Week EMA. It’s possible that this will offer some resistance. This will almost certainly coincide with the US dollar giving up some of its gains. This obviously shows a bit of oversupply.

If we break below the $1,680 level, the gold markets will drop pretty hard. At this point, I predict the first target will be $1,600 and then possibly lower to $1,500. Regardless, markets don’t go in one direction forever. So I think there will be more “withering the rally” moves in the next few weeks.