In a world of volatility and uncertainty, finding a solid foundation for understanding market trends can be a challenging endeavor. At this point, we come across CryptoQuant. It examines Bitcoin’s historical price cycles and the behavior of its short- and long-term holders. Thus, the platform sheds light on the current state of the cryptocurrency market. Now, the major analytics platform specializing in on-chain data analysis has made some explanations about the new trajectory for Bitcoin price.

CryptoQuant researched for Bitcoin price

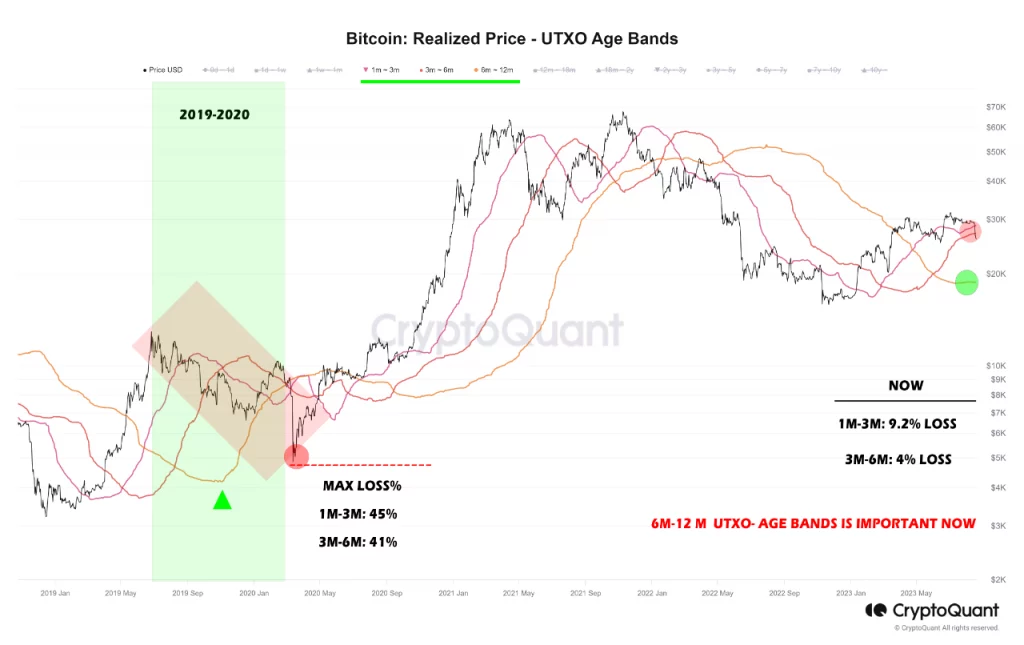

A recent report by CryptoQuant focused on challenging current market conditions by leveraging insights from previous Bitcoin price cycles to better understand the current scenario. The analysis primarily revolved around the actual price of Bitcoin held by both short-term (1-6 months) and long-term (up to 1-year) holders, providing a comprehensive view of the health of the market.

The comparison has been extended to the 2019 cycle, a period when the coronavirus spread globally and caused serious shock waves in the financial world. During this turbulent period, short-term Bitcoin holders (holding between 1-6 months) experienced a maximum loss of about 40-45%. Today, short-term losses are around 4-9%, indicating a more stable and flexible market atmosphere.

6-12 month old Bitcoin holders reviewed

An important aspect of the analysis was the examination of 6-12 month old Bitcoin holders, a segment that serves as a valuable metric for measuring market trends. This community provides insight into two critical factors:

- Realized Value Price Ratio: The report examined the ratio of the realized value price of Bitcoin held for up to one year to the current market price. This metric provides a clear indication of whether these owners are making a profit or a loss. Since Bitcoin enthusiasts watch this metric carefully, it helps them determine the profitability of their long-term investments in the face of short-term market fluctuations.

- Long Term Perspective: The analysis examines the price performance of Bitcoin, which has reached a maximum age of one year, measuring whether market conditions force investors to adopt a long-term view. This observation is crucial as it reflects the general confidence in Bitcoin’s trajectory.

The report suggests that the realized value must increase in order for the current market to survive potential drops in Bitcoin’s price. This shift would point to a dual motivation to hold Bitcoin, not only as a response to short-term losses, but also because of the prospect of long-term gains. The chart, which shows the average price, which is currently relatively flat, should take an upward trajectory in the coming months. This exchange will underline the dominance of Bitcoins held for a year and ultimately support the long-term bullish outlook for Bitcoin.