According to crypto analyst Tony M, Bitcoin price macro potential is still very solid. In response to President Biden’s ‘debt write-off’ program, the analyst says investors may finally show courage once again in free markets. We have prepared the Bitcoin analysis for our readers along with Tony M’s market comments.

Will Bitcoin price get bid?

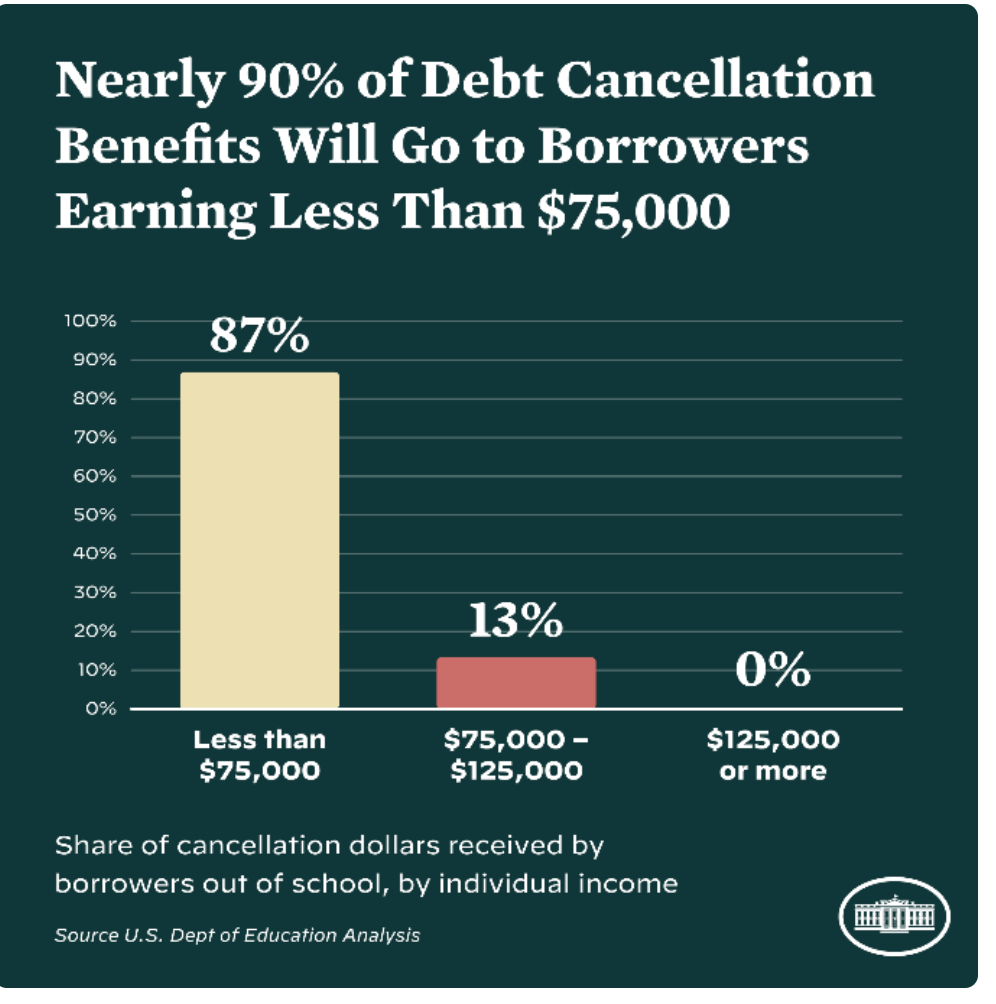

President Biden announced a college debt forgiveness program. After that, the Bitcoin price witnessed a shocking wave of positive market sentiment. According to the White House, the U.S. federal government will provide debt cancellation of up to $20,000 to recipients of Pell Grants and up to $10,000 to recipients of non-Pell Grants in loans held by the Department of Education.

The generous offer from POTUS will help the net income of nearly 45 million Americans. In theory it is expected to provide more liquidity to free markets such as cryptocurrencies, stocks and bonds.

Source: Whitehouse.gov

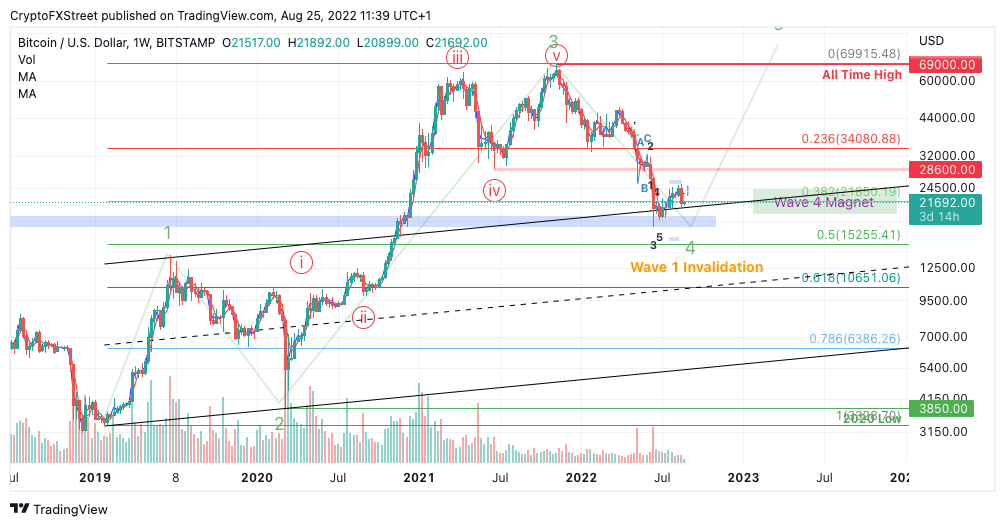

Source: Whitehouse.govSince the disastrous cryptocurrency sales in 2021, analysts have released several technical predictions that shed light on Bitcoin’s macroeconomic potential. Bitcoin price is down 38% from its all-time high of 69,000 according to the logarithmic chart. The leading crypto is trading at $21,657 as of August 26.

The Elliott Wave theory shows that the BTC price is in the 4th wave. Accordingly, wave 5 suggests price targets are between $80,000 and $120,000. Based on previous Bitcoin bull runs, the next rally is likely to go beyond these targets.

BTC 1-week chart

BTC 1-week chartIs a BTC bull run coming?

Many investors believe that a Bitcoin market floor may exist. BTC price has been hovering above a historic Elliot Wave Trend channel that has been playing an important role in Bitcoin since 2019. So techniques confuse this possibility. This is a distinctive signal for a market bottom. That’s because many markets have produced similar signs before a head-to-toe bull run.

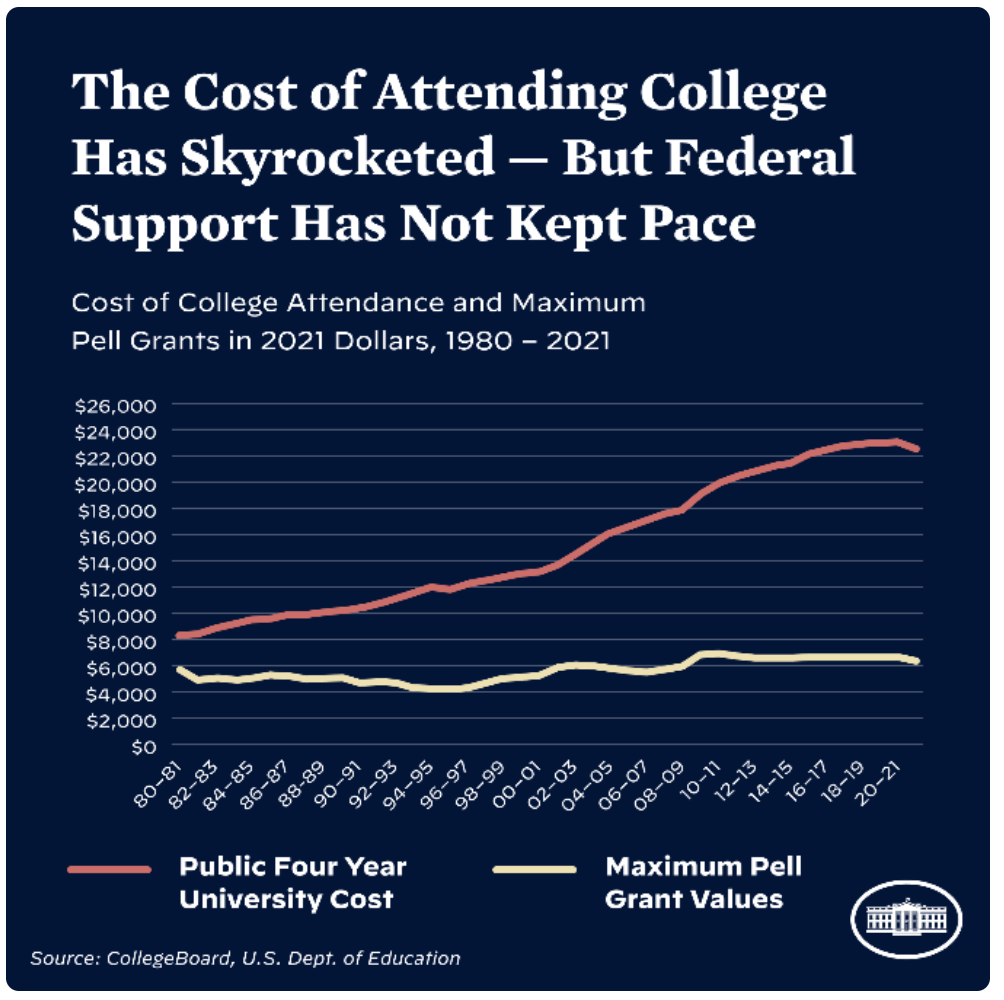

Meanwhile, while optimism is flowing, inflation is declining. Also, President Biden is freeing up capital for the average middle-class American. In this case, it is likely that high-capital investors who have stepped aside will begin to show courage once again. It’s possible that a Bitcoin bull run could help win the votes of millennials and millennials in an upcoming re-election.

Source: Whitehouse.gov

Source: Whitehouse.govHowever, markets are always evolving. Also, in retrospect, you can never be 100% sure that the bottom was actually defined. Therefore, the one dollar cost averaging approach is the safest way to invest in the Bitcoin price. The bull run scenario invalidation is tied to $13,880 remaining untouched in the future.