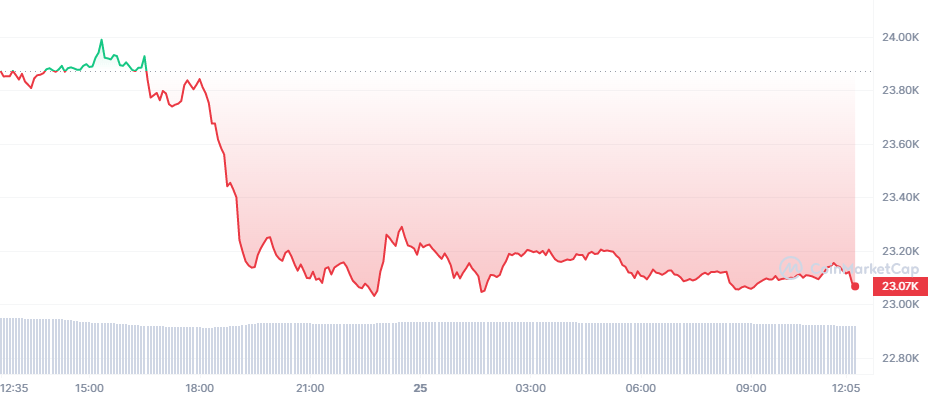

Bitcoin (BTC) price action stalled as BTC traded below $24,000 after it was partially cut off. cryptocoin.comWe have compiled Bitcoin price action developments for you.

BTC price action stalled

Bitcoin’s (BTC) price action stalled as the first cryptocurrency traded below $24,000 after this year’s momentum was partially interrupted by macroeconomic and regulatory factors.

Despite Bitcoin’s bearish trend, analyst Jim Wycoff argued on February 24 that the price action is no cause for alarm, noting that the bulls are still in check. According to the analyst, price stalling is a routine occurrence. In his statement, he said:

“March Bitcoin futures prices are near stability again in the early US trading hours on Friday. This week’s sideways price action or pause is routine and not bearish. The bulls continue to have an overall short-term technical advantage as there is a price rise present on the daily chart.”

Bitcoin corrects amid potential interest rate hikes

Bitcoin’s continued stagnation is associated with an increased likelihood of the Federal Reserve increasing interest rates following the release of January PCE data. The data revealed that the downward trend in inflation in the last few months has reversed, pointing to a possible upward trend in interest rates.

Compared to Economist estimates, the January PCE Price Index beat expectations, up 5.4% year-on-year, higher than the 5.3% reported in December. Instantly, BTC is trading at $ 23,067.

Before macroeconomic factors kicked in, Bitcoin had resisted, with the asset brushing aside any fallout from the United States’ renewed pressure on the crypto sector. Notably, despite pressure from regulators to staking and issuing stablecoins, Bitcoin regained its $25,000 position.

Despite the ongoing uncertainty, Jeremy Allaire, CEO of USDC stablecoin issuer Circle, stressed that Bitcoin is here to stay. In an interview with CNBC on February 24, Allaire supported Ethereum (ETH) for witnessing the network’s development activities. At the same time, he noted that USDC recorded growth despite last year’s market recession. Finally, he said in his statements:

“Bitcoin is here to stay. Over the past year, during the carnage, while cryptocurrencies fell a lot, USDC really grew… A digital dollar running on top of these blockchain networks has real utility and real value, giving us an indication of where the benefit is coming from as we move forward.”