Gold futures posted a fourth straight daily gain Tuesday as US economic data indicated that high inflation continued to produce economic headwinds. However, on Wednesday, gold was stalled by the move in US interest rates and the price slipped towards $1,850.

Edward Moya: While this is happening, gold must continue to be supported!

The US economy is not falling apart, but its weakness is much worse than expected, according to Edward Moya, senior market analyst at Oanda. A pair of surveys (S&P US services index and US manufacturing index) released on Tuesday showed US businesses grew at the slowest pace in several months in May, reflecting the effects of high inflation, continued supply shortages and some softening in customer demand. As we have covered in

Kriptokoin.com news, US new home sales in April also fell for the fourth month in a row with rising prices and rising mortgage rates since the pandemic. fell to the lowest levels. Edward Moya evaluates this situation as follows:

While the wall of worry on Wall Street continues to grow, it may not be possible to stop gold at the moment. Gold should continue to be bolstered as inflationary pressures intensify, China’s Covid situation remains a great mystery and corporate Americas outlooks continue to drop.

“Investor’s eye will be on FOMC minutes”

Mizuho economists believe that investors are more moderate after Fed Chairman Jerome Powell’s “post-meeting” They say they’ll watch the minutes of Wednesday’s two-day meeting of the Federal Reserve in May to help gauge whether the tone reflects a narrow or broad consensus of Committee members.

Economists have argued that investors are considering policy as a potential counterpoint to those who aggressively push the 3% to 3.5% rate by year-end when the Fed’s federal funds rate reaches 2%. They say they will look for clues as to whether they are willing to reevaluate.

“Yellow metal benefits from weak dollar and falling interest rates”

ActivTrades senior analyst Ricardo Evangelista noted in a note that gold has benefited from lower Treasury yields along with some dollar weakness . As it is known, gold price and DXY have an inverse price correlation. The analyst explains:

Treasury rates, which retreated from mid-May peaks, and the stabilization of the dollar, markets appear priced in the hawkish trend of the Fed, and some glimmers of hope for a brighter global economic outlook are helping gold .

TDS: Gold price recovery still on shaky ground

Gold continues to be supported around $1,860 as escalating economic concern gives life to the gold market Gold traders are increasingly questioning the Fed’s willingness to enter a recession, according to economists at TD Securities.

Economists note that the upside flow from CTAs, along with renewed growth in ETFs, is supporting the recovery. By contrast, if prices break north of the $1,900 level rather than a whiplash drop, the patterns turn even higher, seeing the recovery momentum of the closest trigger within the trend. Economists evaluate:

Fed Chairman Powell’s signaling that he is ready to sacrifice some economic growth to rein in inflation and that the Fed is comfortable taking more pain before it takes its foot off the brakes, which is ultimately worthwhile. The yellow metal recovery is still on shaky ground as it shows it will put pressure on the metals.

Pablo Piovano: Gold can now retest 200-day SMA

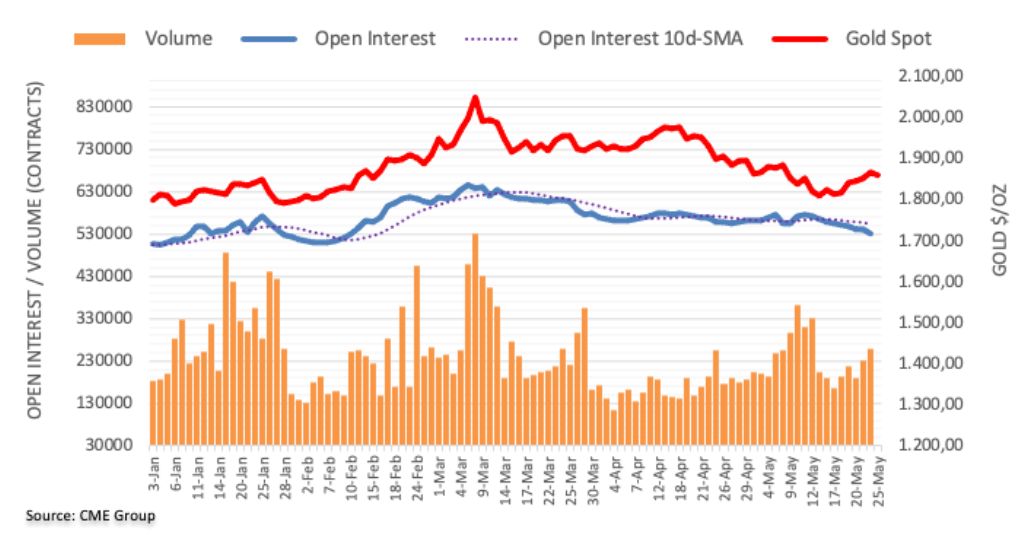

Open interest on gold futures markets, this time around approx. It shrunk for another session with 10k contracts. On the other hand, volume increased with almost 27,000 contracts in the second consecutive session.

Gold prices hit new multi-day highs around $1,870 on Tuesday amid falling open interest. However, further upside looks no longer in favor and could trigger a corrective move towards the 200-day SMA, which was originally $1,839, according to market analyst Pablo Piovano.