The crypto market lost last week’s gains as Bitcoin and Ethereum prices failed to sustain key support levels ahead of the FOMC meeting on July 27. The crypto market has seen total liquidations of over $250 million, with nearly 80,000 traders liquidated in the past 24 hours. So what’s next? On the other hand, what levels will gold see? Here are the details…

How will the FED affect Bitcoin and Ethereum?

Rising fear this week raises the possibility of a 100 basis point rate hike by the Fed. The probability of a 75 basis point rate hike fell from 80 percent last week to 75 percent. While economists expect a 50-75 basis point rate hike, the Fed points to a slowdown in rate hikes after this month’s 75-100 basis points hike. Bitcoin (BTC) and Ethereum (ETH) prices dropped to $20,895 and $1,380 today, dropping below key psychological levels of $22.8k and $1500. According to data from Coinglass, around 80,000 traders have been liquidated in the last 24 hours. The total liquidation was approximately $250 million.

Among the top cryptocurrencies, Ethereum recorded the highest liquidation of over $109 million. Bitcoin (BTC) is trailing Ethereum with over $56 million in liquidation. Ethereum Classic (ETC), Solana (SOL), Polygon (MATIC), Ripple’s XRP, Avalanche (AVAX), Cardano (ADA), ApeCoin (APE), Optimism (OP), Stepn (GMT) and Dogecoin (DOGE) last 24 It is among the largest cryptos liquidated within the hour. Currently, Bitcoin (BTC) has seen $46.69 million long positions and $9.80 million short selling on crypto exchanges. Meanwhile, Ethereum (ETH) has witnessed $91.69 million long and $18.36 million short-term liquidity in the last 24 hours. Okex, Binance and FTX recorded the most liquidations.

Weak crypto and global stock markets suggest the Fed may surprise markets with a more aggressive rate hike as energy and food prices continue to rise. According to the CME FedWatch Tool, the probability of a 75 basis point rate hike is 76 percent. On the other hand, the 100 basis point increase probability is 24 percent. The Fed will likely look at energy, food and housing prices to decide on monetary policy. Crypto analysts expect Bitcoin and Ethereum prices to stay above the $20,000 and $1,200 levels despite the interest rate hike.

What to expect for gold?

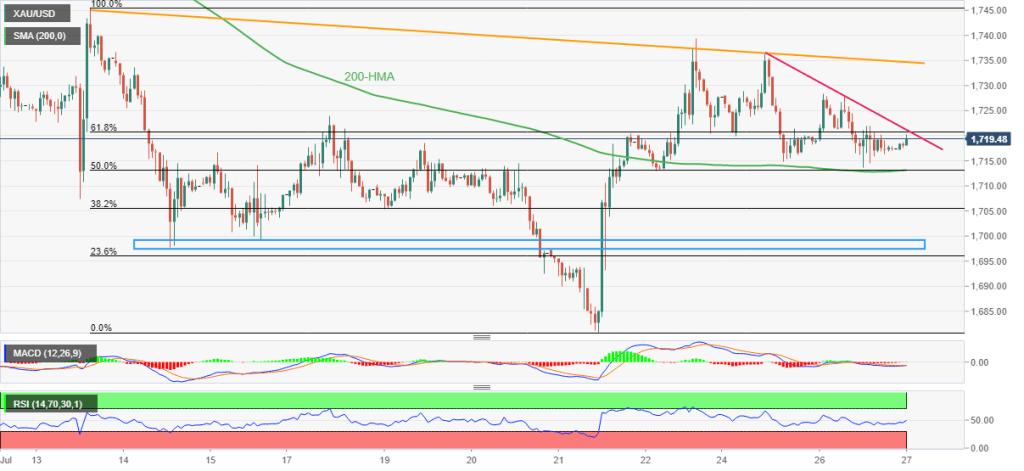

Gold price (XAU/USD) refreshes around $1,720 ahead of the Federal Open Market Committee (FOMC) meeting earlier on Wednesday. In addition to the pre-Fed consolidation, the cautious optimism of the market is helping gold catch the two-day downtrend. The US President’s readiness for a virtual meeting with his Chinese counterpart, Xi Jinping, on Thursday seems to have bolstered the cautious optimism of the market lately.

However, it’s worth noting that recession fears add to the Fed’s possible hawkish expectations of keeping XAU/USD prices under pressure. Fears of an economic slowdown intensified after the International Monetary Fund (IMF) cut its global growth forecast this year to 2.9 percent from 3.6 percent in April. Elsewhere, US Federal Reserve Consumer Confidence fell to 95.7 from 98.4 in July. Also, US New Home Sales fell to 0.59 million for June. Along the same lines, the Richmond Fed Manufacturing Index rose to its highest level since April.

Analilst noted these levels for precious metal

On Tuesday, Wall Street closed in the red, and while US Treasury yields show the biggest difference between 2-year and 10-year coupons since 2000, they remain heavily under pressure, underscoring the rush towards risk-security. Gold’s recovery is approaching the $1,720 hurdle, which includes the weekly resistance line, according to analyst Anil Panchal. However, the recovery moves lack courage as shown by the RSI and MACD.

An upside break of the $1,720 resistance confluence could lead XAU/USD towards a two-week resistance line near $1,735 before convincing the bulls. On the contrary, the 200-HMA and the 50% Fibonacci retracement level are capping the precious metal’s short-term decline at around $1,713. Following this, a sideways area around $1,700-1697 from July 14 could explore before leading gold sellers to an annual low of $1,680. Overall, gold prices continue to remain under pressure despite the recently easing bearish trend.