Investors are digesting hawk comments from Federal Reserve Chairman Jerome Powell. They also expect a series of US economic data this week to shed light on inflation and the labor market. In the midst of this wait, the golden week started by keeping its place. Analysts interpret the market and share their forecasts.

Even being stable in this environment is positive news for gold!

Spot gold held steady at $1,914.59 on Monday. U.S. gold futures rose 0.1% to $1,942.10. Jerome Powell said at the annual meeting in Jackson Hole, Wyoming, on Friday that the Fed may need to raise interest rates further to cool inflation, which is still very high. Carlo Alberto De Casa, market analyst at Kinesis Money, comments:

Even if the gold price did not move up, it remained relatively stable. However, even being stable in this environment can be considered positive news.

This provides some relief for the yellow metal.

cryptocoin.com As you follow, gold is struggling to find direction as the rise in the dollar keeps gains under control. Meanwhile, the benchmark 10-year Treasury bond yields fell from the highest levels in recent years. This gave some relief to the coiled metal. Yeap Jun Rong, a market strategist at IG, evaluates the latest developments as follows:

The general view is that market participants were already priced in for a hawkish result ahead of Powell’s speech. This provides room for some relaxation with little surprises. Re-accelerating inflation concerns about the resilience of the US economy are driving bets on a rate hike in November.

Interest rates continue to be a burden on gold

This week’s agenda will be the US core PCE inflation and the August nonfarm payrolls report. Along with these, a series of economic data will come. These data will likely provide more clarity on the strength of the economy. In a note, KCM Trade Chief Market Analyst Tim Waterer underlines the following:

While Powell’s comments did not contribute to the momentum of Treasury yields, they remain historically high. Therefore, they continue to act as a burden on the gold price.

Key levels to watch for bright metal prices

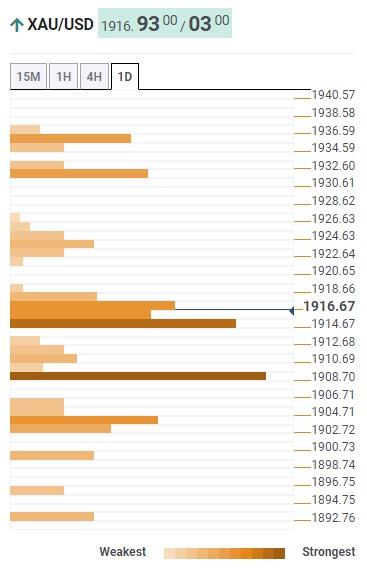

Market analyst Anil Panchal takes a picture of gold via Technical Confluence Dedector. Buyers have been hesitating lately. However, our indicator , It shows that gold remains comfortably firm above the $1,910 key support. However, the indicated support combination includes the 5-DMA, Fibonacci 23.6% one-day and 38.2% one-week, as well as Bollinger’s lower band on the hour time frame.

Prior to that, the middle of the Bollinger in the four-hour game joins the Fibonacci by 61.8% in a day and 23.6% in a week. Thus, it restricts gold’s downside movement around $1,915. It is worth noting that on the four-hour chart, the previous month’s low and the lower line of the Bollinger indicator were close to $1,903 at the latest, followed by the $1,900 threshold acting as the last defense of gold buyers.

Technical Confluence Detector

Technical Confluence DetectorMeanwhile, the convergence of the previous week’s high and the one-day R1 Pivot Point to $1,923-24 provides an immediate recovery for the gold price. Following this, the 50-DMA joins the Pivot Point R2 one-day and R1 one-week, highlighting $1,933 as the key resistance for gold bulls. Finally, the $1,935-36 zone, which consists of the four-hour 200-SMA and the one-month Fibonacci 61.8%, is likely to test the gold buyers before giving them control.

Potential recovery in cards for gold

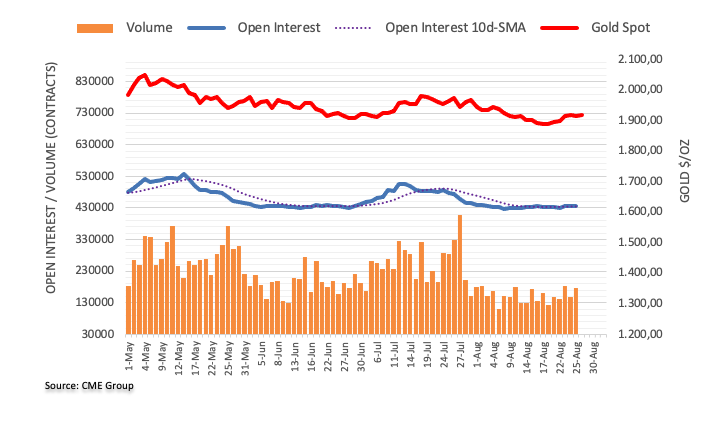

CME Group’s latest data on the gold futures markets noted that traders’ open interest on Friday dropped by just 575 contracts, adding to the previous day’s decline. Instead, volume reversed the previous daily decline. Thus, approximately 31k contracts increased, keeping the erratic performance in place for now.

The small decline in gold prices on Friday was due to the marginal decrease in open interest. According to analyst Pablo Piovano, this points to a recovery in the short term. Meanwhile, things change if gold convincingly surpasses the 200-day SMA ($1,910). In this case, the precious metal will change to a constructive appearance.