Web 3.0 coin project Helium set out to revolutionize ‘decentralized wireless’ networks. But users who support this network find that the later they sign up, the less revolutionary their compensation is. The waves that investor Liron Shapira started in his Twitter thread about Helium caused a serious drop in the altcoin price.

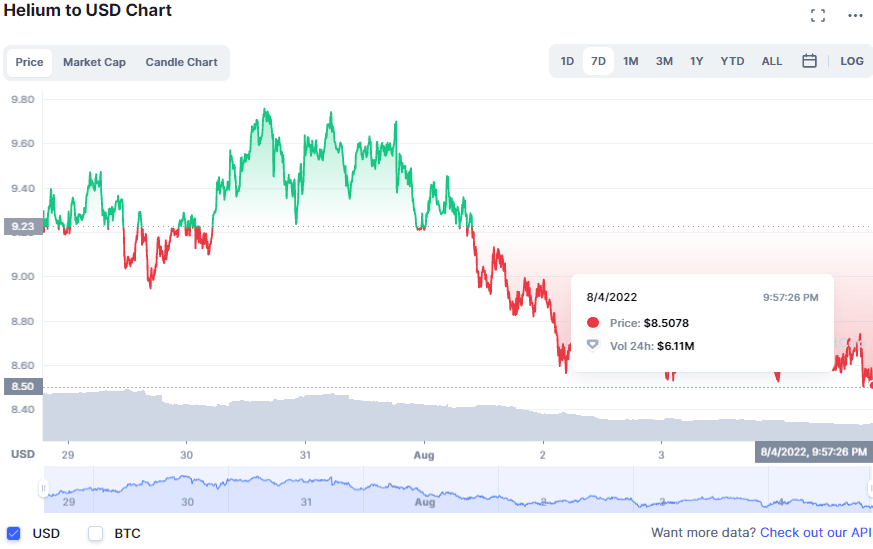

Altcoin price fell sharply after Helium (HNT) criticism

A recent review of the Helium Blockchain project by author and entrepreneur Liron Shapira sparked a heated discussion about the company’s long-term prospects. The core of Shapira’s message was that individuals who individually paid $500 or more to set up more than 900,000 ‘Helium Hotspots’ did not and probably never will see the financial rewards they expect. Behind these developments, the Web 3.0 coin price saw a serious decline. HNT is now below $9, from its November peak of $54.

What are Liron Shapira’s claims about the Web 3.0 coin?

Renowned retail investor Liron Shapira made serious criticisms of the Helium (HNT) platform in a series of messages on July 26. Shapira accused the company of only generating $6,500 per month in revenue for investors after investing hundreds of millions of dollars per month.

.@Helium, often cited as one of the best examples of a Web3 use case, has received $365M of investment led by @a16z.

Regular folks have also been convinced to spend $250M buying hotspot nodes, in hopes of earning passive income.

The result? Helium's total revenue is $6.5k/month pic.twitter.com/PyW6KPllvc

— Liron Shapira (@liron) July 26, 2022

In addition, Shapira claims that users who buy hotspot nodes for between $400 and $800 per month complain about low returns. He noted that instead of the expected profit of $100 per month, they only received about $20 per month.

However, the $20 profit is considered a temporary subsidy of $19.99 from investing in the development of the network and speculating on the value of the HNT token. According to Shapira, the real income of the investor drops to $0.01 per month.

Members of the r/helium subreddit have been increasingly vocal about seeing poor Helium returns.

On average, they spent $400-800 to buy a hotspot. They were expecting $100/month, enough to recoup their costs and enjoy passive income.

Then their earnings dropped to only $20/mo. pic.twitter.com/0jx2zLUaiA

— Liron Shapira (@liron) July 26, 2022

Helium’s founder replied, Shapira was not convinced!

In response to the thread, Helium founder Amir Haleem gave a lengthy message of his own addressing the criticism. He said on the subject:

So why pay only $6,500 worth of data? Unlike cellular networks, there aren’t millions of existing devices that can migrate to Helium. Best practices have not yet been created and it takes months or years to build them.

but now the applications are coming, and they’re awesome. how about a tracking device in the form of a sticker that can be attached to basically anything? it’s now here, and being deployed as we speak https://t.co/pfGJpK1HcV

— amir.hnt (🎈,🫡) (@amirhaleem) July 26, 2022

Meanwhile, Shapira is not convinced by Chief Haleem’s response. He reiterated his view that Helium was a failed project waiting to collapse, as the Helium team was building a Web3 bridge in the air.

Helium CEO Amir Haleem and investor Kyle Samani responded to my post about Helium. They did not deny the shocking data I shared. They also did not explain why the project failed so badly. However, I appreciate their willingness to have an open Web3 coin discussion. Necessary.

.@Helium's CEO @amirhaleem and investor @KyleSamani replied to my thread about Helium

They didn’t deny the shocking data I shared, or explain why the project failed so bad.

But I appreciate their willingness to have an open Web3 debate. Sorely needed.https://t.co/owbnlEYw0R pic.twitter.com/px5Gp2Frs5

— Liron Shapira (@liron) July 27, 2022