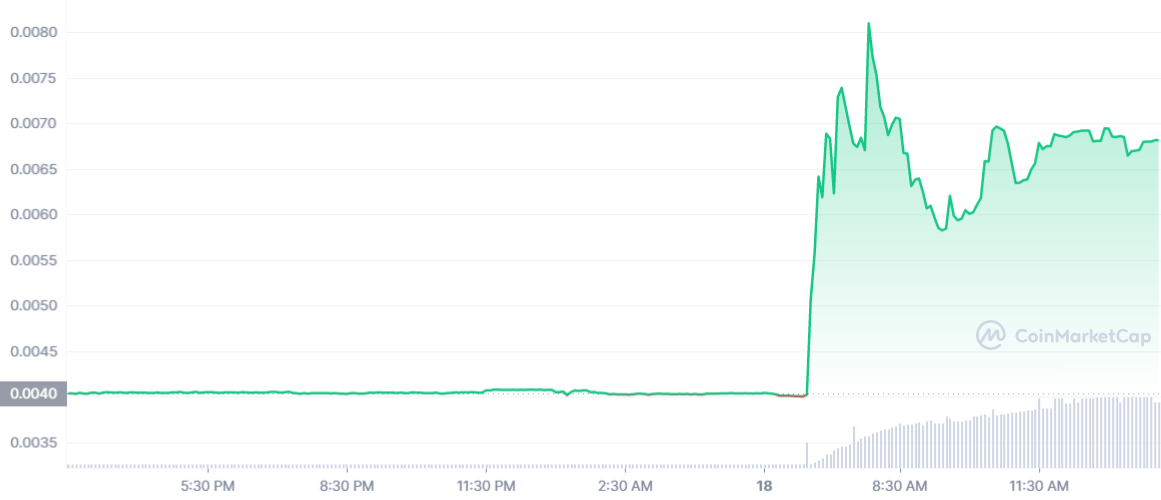

Tokens of the lending application Apricot Finance, which was launched in 2021, surged on Tuesday despite the lack of any recent technical upgrade and little chatter on its social media forums.

An unintended anomaly caused the surge instead. Apricot Finance’s APT tokens – which surged some 70% in the past 24 hours – share the same ticker as Aptos’ native APT tokens.

Aptos launched on Monday and its tokens are slated to be offered on major crypto exchanges Binance and FTX.

That didn’t stop traders from taking bets on the existing APT. Trading volumes on Apricot’s APT jumped from under $70,000 on Monday to over $2.2 million on Tuesday afternoon, with prices continuing to increase at writing time. The tokens are traded on Gate and LATOKEN, two medium-tier crypto exchanges.

Apricot’s APT tokens jumped on a similar ticker name. (CoinMarketCap)

However, there was no increase in the Total Value Locked (TVL) on Apricot, which remained unchanged at $5 million.

Meanwhile, some community members warned others from buying into the hype. “Keep buying the wrong one,” said one member on the CoinMarketCap forum. “Guys binance will list APTOS (APT). Not the one on the Gate exchange which is called Apricot Finance. Be Careful,” said another.

As such, there’s a long way to go for APT holders: the token prices are down over 95% from last year’s peak of 30 cents, a time when platform TVL was $300 million.