Leading tokens ADA, MATIC, BNB and SOL were accused of being securities. All hell broke loose on Monday when the US Securities and Exchange Commission SEC sued Binance for misuse of client funds and 13 other Securities breaches. Then the situation got worse as the SEC sued Coinbase. The lawsuit took a huge toll on Binance, triggering a $700 million withdrawal. So, what’s next after the lawsuit against Binance and Coinbase?

Has SEC declared war on crypto with Binance and Coinbase lawsuit?

In the US, the SEC has made moves in the cryptocurrency space before. Also in March, the Commodity Futures Trading Commission (CFTC) filed a complaint against Binance and CEO CZ in a federal court in Chicago. The complaint alleges that Binance offers crypto futures and derivatives to US residents and does not register these offerings with the CFTC. Binance came under scrutiny for moving approximately $1.8 billion worth of assets to hedge funds between August and December 2022 without notifying customers. Despite previously telling customers that the tokens are 100 percent backed, this move has raised concerns about transparency and trust.

Interestingly, Binance saw this happen after the CFTC filed suit in March. And now market speculation indicates that CZ may step down as CEO and his successor, Richard Teng, may take over. Will Binance survive this lawsuit? The most crucial part of the case between the SEC and Binance is the claim that Binance Compliance Director Samuel Lim, who is also mentioned in the CFTC case, said to a colleague, “We operate as an unlicensed securities exchange in the USA, bro.” And that could get Samuel in trouble.

What were the charges?

Binance and its founder, Changpeng Zhao, abused clients’ funds and internally used market makers “owned and controlled” by CZ. It enabled manipulative trading on the Binance US platform, and also diverted user funds to a CZ-owned organization called Sigma Chain, which does “manipulative trading.” This inflates the trading volume on the crypto exchange. It should be noted that the case against Binance is a civil suit, not a criminal case, unlike FTX. So Binance can avoid the lawsuit just by paying a hefty fine.

Another accusation is that Binance and Binance.US offer unregistered securities such as BNB token and BUSD stablecoin to the public. The SEC also claims that Binance’s staking service violates securities laws. Binance and Zhao claimed that the company’s US subsidiary is independent. But regulators claimed that CZ controlled the company in the US behind the scenes.

Are your funds on Binance safe?

Data from Nansen.ai shows that exits from Binance reached $780 million in a 24-hour period. Despite the seemingly surprising net outflow showing no signs of slowing down, the Nansen data also shows that Binance’s stablecoin balance remains healthy. The exchange currently has a stablecoin balance of just over $8 billion. The seven-day output is $519 million, or roughly 6% of assets.

CryptoQuant pointed out that withdrawals are within historical norms. Everything seems to be under control right now. Binance CEO made his statements on the subject on Twitter and strongly denied the SEC’s claims. He calls the case baseless and plans to defend himself vigorously. He argues that the SEC’s actions are aimed at harming the industry and hindering innovation, emphasizing that Congress must establish a viable regulatory framework for cryptoassets.

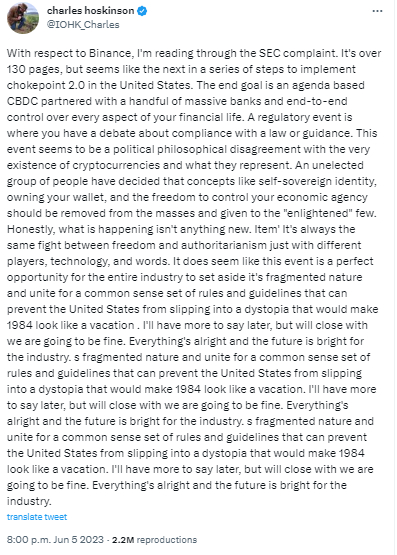

Additionally, Binance has issued an official response claiming that the SEC “aims to unilaterally define the crypto market structure.” CZ says they are ready to tackle the SEC “to the extent permitted by law” and calls for “to be strong together”. Cardano founder Charles Hoskinson also tweeted about the lawsuit. Charles noted that this is “nothing more than the bell of the people who have partnered with a handful of large banks and exercised end-to-end control over every aspect of your financial life. Charles also said, “We’ll be fine. All is well and the future is bright for the industry,” he said.

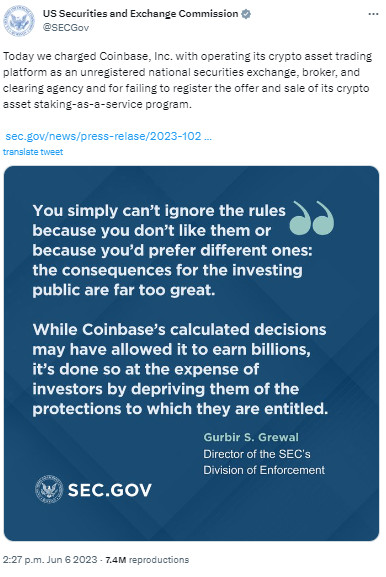

Apart from Binance, Coinbase is also facing lawsuit

Just hours ago, the SEC sued Coinbase. Shares of leading crypto broker Coinbase fell more than 10.5 percent to $57.69. Berenberg analyst Mark Palmer wrote in a note Monday that 37 percent of Coinbase’s assets are at risk. The news of the lawsuits had a significant impact on the cryptocurrency market, with Bitcoin and Binance’s BNB token experiencing notable price drops. The bearish trend in BTC remained strong.

The relative strength index (RSI) and moving average convergence divergence (MACD) indicators are currently in the bearish zone. This indicates that the downtrend is likely to continue. Therefore, it is important to watch the $26,750 level closely as it is likely to act as a key level for Bitcoin. Breaking below this level could allow investors to enter a strong sell position in Bitcoin. However, it should be noted that there is a lot of uncertainty.