This week will be unusually interesting for both the stock and crypto markets due to many developments. How can the Fed rate decision, the FOMC meeting, the positive trend in the market affect the Bitcoin price? Let’s answer…

When and on what day will the Fed rate decision meeting be held?

The US central bank, the Fed, will announce the next Fed rate decision on Wednesday, March 22 at 9 PM. Due to the banking crisis that broke out in March, the Fed is expected to keep interest rates constant. Other important topics and developments starting with March 20 are as follows:

- Fed rate decision

- FOMC meeting

- FOMC press conference

- How will this week’s market conditions adapt to the ongoing Banking crisis?

Fed will stick to 25 basis points (bps) increase

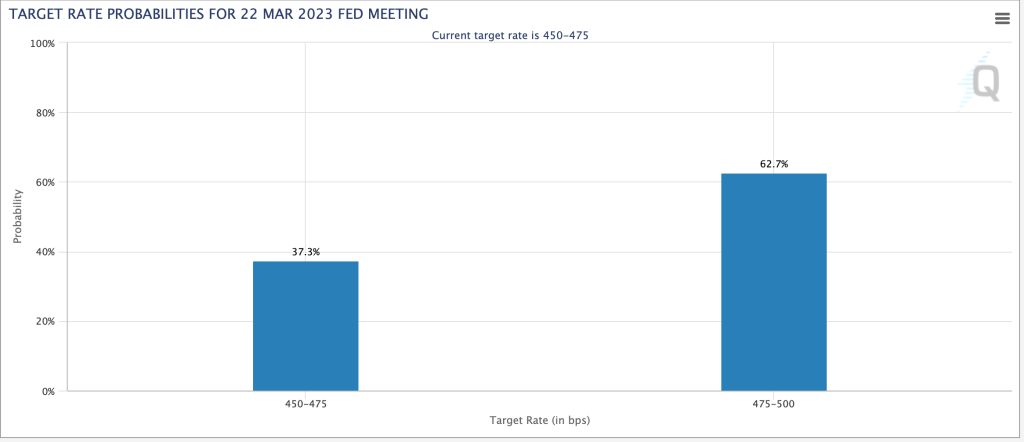

CME Group’s rate forecaster estimates the probability of a pause in rate hikes to be 37.3%, suggesting that rates are headed for a 25 basis point hike on March 22.

The frost situation of the crypto money market before the FED interest rate decision

- The 2020 COVID pandemic has caused a sudden halt in the global economy. To prevent a major global collapse, the Fed printed money to encourage spending, and other central banks did the same.

- As a result, the Fed’s balance sheet has grown tremendously, but so has inflation, which peaked at 9.1% in 2022.

- The Fed started rate hikes with 75 basis points, but eventually dropped to 50 basis points and is now at 25 basis points. This move was made to discourage spending, shrink their balance sheets and reduce inflation.

- The suddenness of the Fed’s rate hikes and cuts began to put pressure on banks.

- The collapse of the Silicon Valley Bank triggered a massive panic response from the public, which led to banks raiding other financial institutions and the onset of the banking crisis.

- The Fed stepped in to stop these events reminiscent of the 2008 financial crisis and save the institutions.

- This brings us to the present day, where speculations for a break in interest rate hikes continue.

The current situation

The Fed is currently faced with two conflicting ideas: raising interest rates to rein in inflation, and printing money/saving banks to prevent economic collapse. Doing one negatively affects the other.

Therefore, the March 22 interest rate will be crucial to see the direction the Fed will turn. To be more precise, the FOMC press conference scheduled to take place 30 minutes after the interest rate decision is key. Fed Chairman Jerome Powell’s responses will be crucial in determining how markets will react.

How can Bitcoin and altcoins react to developments?

Bitcoin price shattered the negative correlation with the US Dollar last week as investors bought large amounts of BTC due to stablecoin collapses. This move continued the bull rally that started in January 2023, forcing the pioneer crypto to tag $28,000.

So far, BTC seems to be acting independently, bringing back its safe haven, inflation protection, and uncorrelated asset narratives. The question investors should be asking themselves as they enter this week is, “Will this tie-down last?” If the answer is a strong yes, then they need to focus on where BTC is going next.

Also, the high-impact macroeconomic developments this week could trigger an immediate response. cryptocoin.comWe have compiled 11 developments to follow this week in detail in this article.