Considering the last two years when we entered the bear market, the issue that everyone, from those working in the sector to investors, thinks about most is when the next bull cycle will come. While the world continues to struggle with inflation, increasing interest rates and tightening monetary policies have resulted in liquidity outflows from risky markets. Of course, we did not have macroeconomic dynamics alone. Major disruptions in the cryptocurrency markets (FTX bankruptcy, Luna-UST crisis) caused a loss of confidence, and regulatory pressures from external forces created great uncertainty in the sector.

While it was at $ 32,000 in early 2023, we see Bitcoin at $ 26,000 as we approach the end of 2023. There are some good developments waiting for us in 2024. The most important of these is undoubtedly the Bitcoin Halving period. With the halving period, that is, every four years, the amount of reward given to miners for verifying transactions is halved, and the number of BTC in circulation in each block decreases. Thus, Bitcoin becomes deflationary. Immediately think of the supply-demand curve.

The total supply of Bitcoin is 21 million units. It is expected that all Bitcoins will be mined by 2140, but this is a very long time. In other words, we will not be able to see those days because it will take more than 100 years.

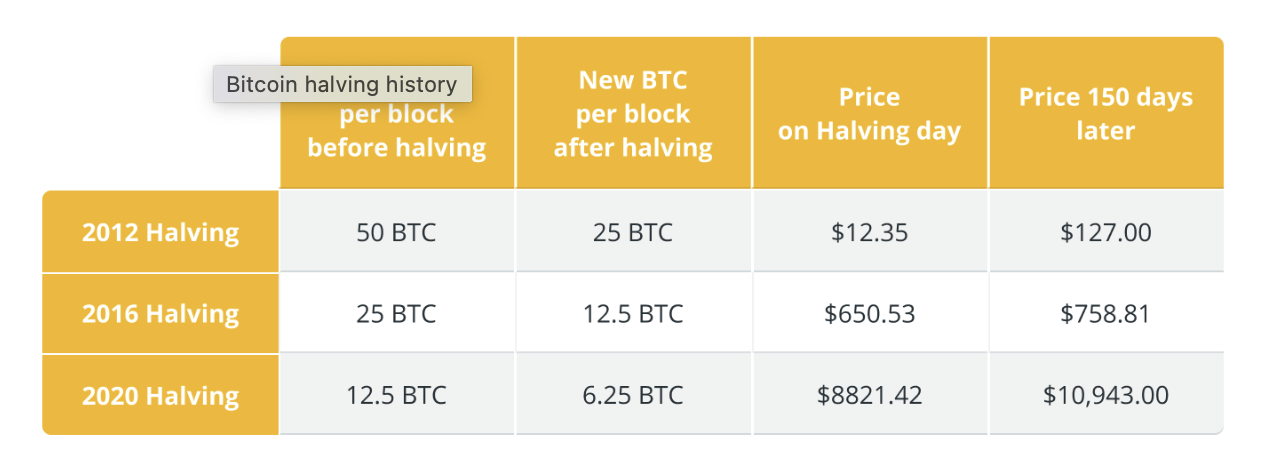

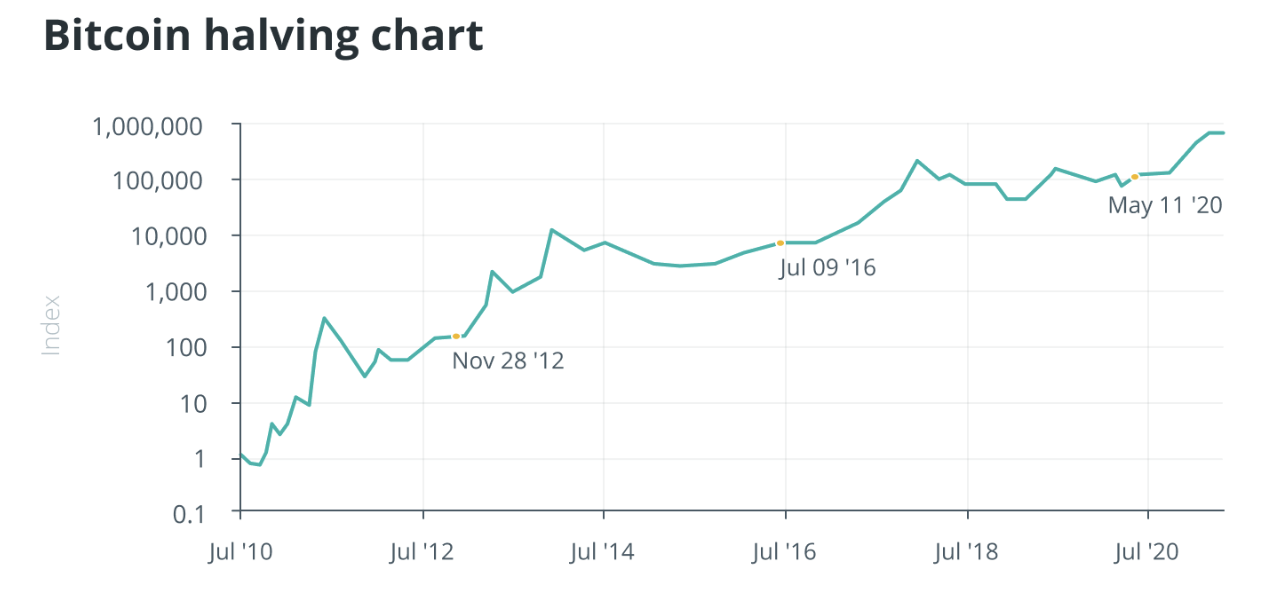

Bitcoin has experienced three halvings so far. The first of these was in 2012, and the block reward, which was 50 BTC in the first halving, decreased to 25 BTC. The second halving occurred in 2016 and the reward, which was 25 BTC, was reduced to 12.5 BTC. The third Bitcoin halving took place in 2020 and the block reward on the Bitcoin network decreased to 6.25 BTC. With the halving in 2024, the block reward on the Bitcoin network will decrease to 3,125 BTC.

So, what has happened during the halving periods so far and how has it affected the price? I will try to show you the situation with two graphs.

Both charts show positive trends, but this year the cryptocurrency market has experienced more pressure than ever before. So I’m not sure if this event alone will be enough for a new bull period. I also wanted to ask the Turkish crypto community about this issue and I compiled the opinions I received for you:

Sizce Kripto Boğası ne zaman ve hangi olayla gelecek?

Çok acil yorumları bekliyorum :p

— Ekin Albayrak 🇹🇷 (@EkinAlbayrak9) September 11, 2023

Generally,

- US Elections

- The USA takes inflation under control and starts reducing interest rates

- Completion of regulation processes

- New bull era dream

- Expecting another bottom from BTC

- FTX 2.0 reopening

So, if you ask me what I think, I think the halving period will add a nice acceleration, but it is not enough. The Spot BTC ETF process will undoubtedly add momentum, but we need to get rid of regulatory pressures first. It will also be important for states to switch to a monetary expansion policy because liquidity is not yet sufficient and does not transition to cryptocurrency markets.

No matter what happens, as a Bitcoin maximalist, I think long-term investors will be happy.