Gold prices caught the five-day downtrend around a one-week low. A risky mood, hawkish Fed bets keep golden bears hopeful ahead of key US CPI, FOMC minutes. Also, updates on Russian-Ukrainian, Sino-American struggles also become important to watch for fresh impulses. We have compiled the analyzes of two analysts on the route of gold for our readers.

Gold prices technical analysis

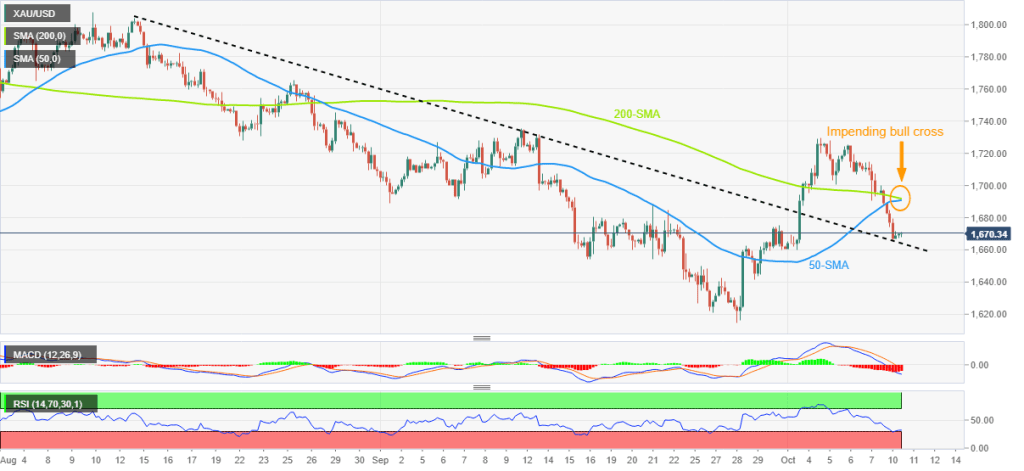

Market analyst Anil Panchal analyzes the technical outlook for gold as follows. Gold prices rebounded from the previous two-month resistance line. It currently supports around $1,664. In doing so, gold mimics a gold cross moving average pattern that attracts buyers. It is worth noting that the 50-SMA piercing the 200-SMA in the opposite direction can be considered a bullish cross or a golden cross.

The corrective bounce is also gaining support from the oversold RSI (14). This indicates further recovery towards the aforementioned SMA convergence around $1,691-92, respectively. However, gold buyers remain cautious until the price renews the monthly high of $1,730.

Alternatively, a downside break of the $1,664 reversal support is likely to lead the shorts south towards the $1,655 and $1,640 levels before highlighting the yearly lows around $1,615.

Gold prices four hour chart

Gold prices four hour chart“Strong dollar, rising interest rates, stingy Fed punishes gold”

cryptocoin.com As you follow, gold prices fell sharply near mid-day on Monday. Senior analyst Jim Wyckoff notes that the safe-haven metal has taken a hard hit. He notes that this was due to higher DXY, rising US Treasury yields and weaker crude oil prices. Meanwhile, the US Federal Reserve continues to insist on an aggressive tight monetary policy. This in turn acts as an anchor in the precious metals markets, according to the analyst.

Jim Wyckoff points out the following technical levels for gold. Technically, gold futures bears have a solid overall short-term technical advantage. Also, it gained new strength on momentum today. The bulls’ next upside price target is to produce a close above solid resistance at the October high of $1,738.70. The bears’ next short-term bearish price target is to push futures prices below solid technical support at the September low of $1,622.20. Initial resistance is at $1,700.00. Then it holds today’s high at $1,707.40. Initial support will be at $1,662.00 followed by $1,650.00.