Gold price recorded a new one-year low near $1,680 despite a weaker DXY. Precious metal and DXY react to their global negative relations. Meanwhile, the likelihood of a recession has increased as the US job market could suffer from low demand.

“Golden bears are free”

cryptocoin.com As you follow, the gold price is firmly settled below the psychological support of $ 1,700. The precious metal hits a new one-year low at $1,680.74. However, the precious metal is yet to show any signs of recovery. That’s why market analyst Sagar Dua expects further declines. The analyst makes the following assessment:

It is worth noting that the asset has broken the volatility contraction to the downside and the bears are free. The bright metal is poised to recap its yearly lows of $1,680.

On the dollar side, DXY failed to reverse the pullback to the upside. Therefore, DXY is facing south. According to the analyst, DXY faced roadblocks around 107.26 and gave up critical support at 107.00. The analyst notes that a decisive down move below Wednesday’s low of 106.39 will further strengthen the bears. Accordingly, according to the analyst, DXY will initially lower its cushion around 105.00.

Gold price and DXY move down together

Investors turned their back on the gold price despite the weakness in DXY. Usually, gold price and DXY carry an inverse relationship. Because losses on one asset yield gains for the other. This time, both entities are falling. Meanwhile, other currencies are performing stronger. In this environment, the analyst sees gold as a weaker asset. Because gold tested the lowest level of the last year.

Recession fears rise as Google halts hiring process

IT giant Google has stopped its hiring process for the past two weeks. Therefore, the probability of a recession increased. Despite massive rate hikes by central banks, price pressures are still far from control. The catalyst that empowered central banks to tighten their policies without hesitation was the tight labor market. Now, Google’s expectations of lower headcount in the coming quarters also point to lower job creation in the US. According to the analyst, the dual effect of a weak labor market and high inflation will affect the US economy.

“Gold price will remain vulnerable in hawk ECB betting”

Markets expect the European Central Bank (ECB) to announce an interest rate hike for the first time in 11 years. Therefore, the analyst says that the gold price will heat up more. The market is debating the scope of the rate hike. Think tanks believe the ECB will likely raise interest rates by 25 basis points (bps), as it would rather test the waters first. However, a 50 basis point rate is also open, as price pressures have exceeded the tolerance strength of households in Europe, according to the analyst.

S&P Global PMI will remain in focus

There is a light economic calendar this week. Therefore, the focus of investors will be the release of S&P Global PMI data. According to market consensus, economic catalysts are expected to perform poorly. Global Composite data appears at 51.7, which is lower than the previous version of 52.3. Manufacturing PMI is likely to slide to 52 versus 52.7 previously recorded. Also, the Services PMI is expected to show a slight correction to 52.6 versus the previous figure of 52.7. This is likely to hold back DXY and support other currency bulls.

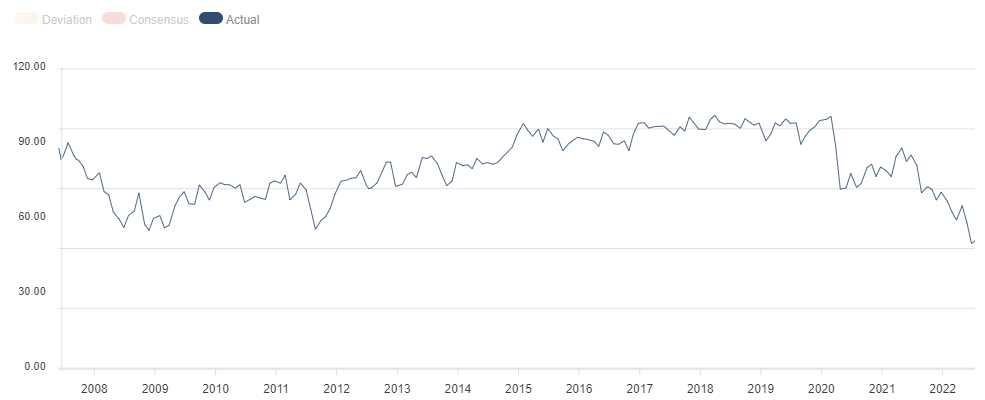

Gold technical analysis

Market analyst Sagar Dua draws the technical picture of gold as follows. Gold price broke down in the Ascending Triangle, which marks a downside trend and a contraction in volatility. The downward sloping trendline of the chart pattern outlined below was drawn from July 18 to $1,723.97. Horizontal support, on the other hand, settled at the June 14 low at $1,697.69.

The 50- and 200-period Exponential Moving Averages (EMAs) at $1,704.86 and $1,722.04, respectively, are down. This adds to the downstream filters. Meanwhile, the Relative Strength Index (RSI) (14) slipped into the 20.00-40.00 bearish range, which signals more bearish.