The gold price remained above $2,000 throughout the week. It subsequently reached all-time highs on Friday afternoon. The precious metal also posted its first monthly close above the 2,000 level, supported by positive inflation data and dovish comments from Fed members, supporting the growing belief that the long-awaited big breakout could be coming soon.

Bulls maintain their strength in the gold survey!

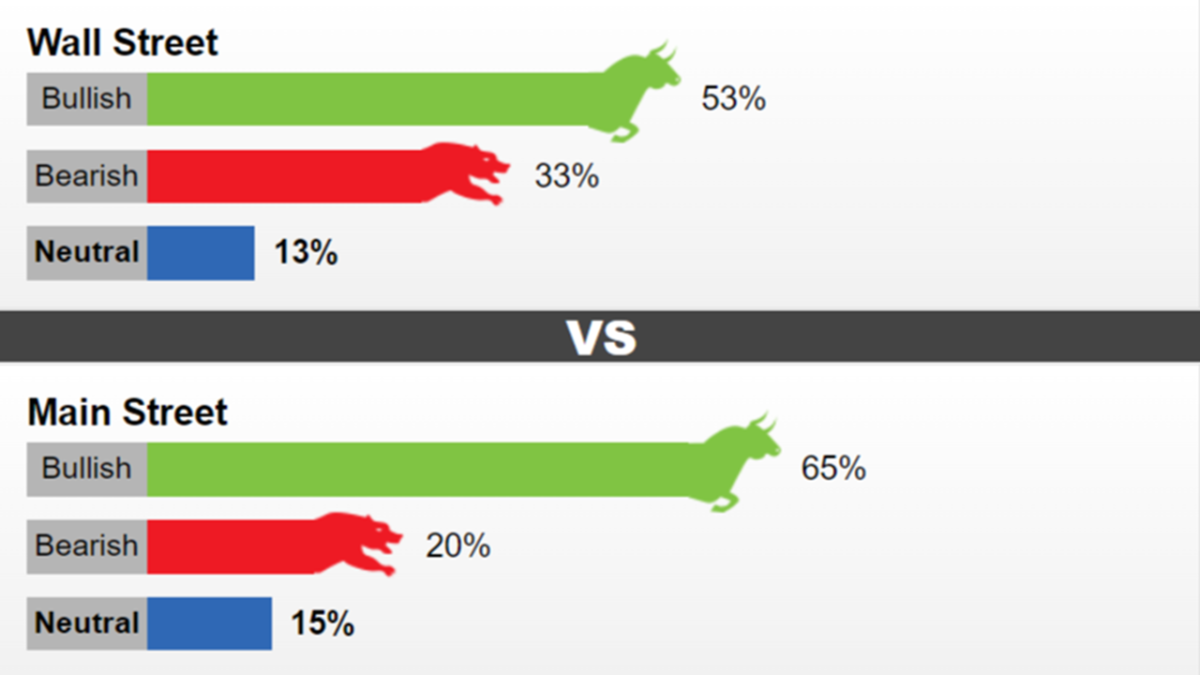

cryptokoin.com As you follow from , gold made a strong move on Friday. This keeps market players optimistic. The latest Kitco Weekly Gold Survey shows that retail investors remain optimistic about the week ahead. A slight majority of market analysts are also bullish on the yellow metal’s near-term prospects. 15 Wall Street analysts voted in this week’s Gold Survey. Eight analysts (53%) expect an increase in gold prices next week. 5 analysts (33%) predict a decrease in prices. The remaining 2 analysts (14%) remained neutral on gold for the coming week.

Meanwhile, participants cast 763 votes in Kitco’s online polls. Market participants remain optimistic about the gold price, as in the last two weeks. 495 retail investors (65%) expect gold to rise next week. Another 155 (20%) predict it will fall. 114 respondents (15%) remained neutral on the precious metal’s near-term prospects.

Adrian Day: Gold price will remain relatively calm!

Adrian Day, President of Adrian Day Asset Management, continues to maintain his neutral stance on gold. The analyst expects prices to remain relatively unchanged next week. In this context, Day comments:

Gold needs to digest the big rise at the beginning of October and especially at the beginning of November. Gold is vulnerable to negative developments here in the near term. But the odds are tilting markedly in gold’s favor for a strong move next year and beyond as central banks reach the end of their tightening cycle, even as economies slip into recession.

Adam Button: When gold exceeds this level, the rest is blue sky!

Adam Button, head of foreign exchange strategy at Forexlive.com, says interest rate cuts are coming. He also notes that the impact of the US dollar on the gold price is extraordinarily strong. Therefore, he states that its withdrawal should support the rally. In this regard, the analyst shares the following prediction:

US interest rates are at 5.50%. That’s a lot of disruption compared to some other places. So when you add that in, you can get a 15% rally in gold over the next two years just due to US dollar weakness. It’s almost mechanical. And gold is already at record levels in many other places. And technically, once it breaks through the $2,100 range, it will be blue skies. Today is December 1, gold buying day. December, January, February are the strongest seasonal trades I know of in terms of performance and consistency.

Mark Leibovit also expects a rise in gold

Mark Leibovit, publisher of VR Metals/Resource Letter, is still bullish on gold next week due to US dollar weakness. “As long as the US Dollar is in a downtrend, there is no room for doubt on the upside,” says Leibovit.

Ole Hansen: A correction for the gold price is in order for now!

According to Ole Hansen, head of commodity strategy at Saxo Bank, the gold price will trend downward next week. “There will be a correction towards $2,010 before moving higher before the end of the year,” Hansen says. In this regard, the analyst makes the following comment:

We maintain a bullish outlook for the gold price until 2024, with the belief that interest rates have peaked and Fed funds and real yields will begin to decline. However, with the large amount of easing already priced into the market, the chance of a straight rally is unlikely. Additionally, both silver and gold will continue to see periods where beliefs may be challenged.

Will we see a Santa Claus rally in gold?

Everett Millman, Chief Market Analyst at Gainesville Coins, believes gold prices will experience a seasonal rise on top of the recent rally. The analyst tends to agree that positive seasonality will continue. “We have had a ‘Santa rally’ for the gold price in each of the last six years,” Millman said. “Even though prices are really at the top of that range, I don’t think this will be any different.” says. Millman says he doesn’t actually see a strong headwind against gold. It indicates that economic data in the USA is quite strong. The analyst makes the following assessment:

We got an upward revision in GDP, third quarter PCE inflation came in a bit softer, and gold continued to rise despite that. I think if we were to experience a decline in the gold price, it would be in response to some strong data. The fact that this did not happen is, in my opinion, extremely encouraging for gold bulls and probably places a very strong support base below the gold price at the $2,000 level. (…) In my basic scenario, yes, we will probably experience a pullback next week. However, I think this will be much shallower than previous periods of decline for gold over the past year.

Colin Cieszynski: It is possible for gold to give up some of its gains!

SIA Wealth Management Chief Market Strategist Colin Cieszynski also expects gold to give up some of its recent gains next week. Cieszynski explains his view on the gold price as follows:

I think both gold and the US Dollar made big moves in November and a technical trading correction is expected. Yesterday’s Chicago PMI report pointed to a stronger-than-expected US economy. That could make it less likely that rate cuts will come as quickly as bond trading has priced in. So this could take some of the pressure off the dollar and take some of the wind out of gold’s sails.

Marc Chandler: He’s gone too far, it makes sense for him to step back!

Bannockburn Global Forex General Manager Marc Chandler also expects a pullback in gold next week. Falling yields and a weaker dollar helped push the precious metal higher, according to Chandler. But the analyst says the market has gone too far. Chandler expects the US dollar to continue the recovery it has seen over the last few sessions. He notes that this is more than just month-end positioning. Based on this, the analyst points to the following levels for the gold price:

I think a solid jobs report next Friday could push gold back towards $2,006 and then $1,992.

Darin Newsom: Newton’s First Law of Motion is valid!

Barchart.com Senior Market Analyst Darin Newsom remains bullish on gold’s prospects. The analyst’s view is based on the application of Newton’s First Law of Motion to markets. That is, a trending market will remain in that trend until prompted by an external force. This external power is usually investment money. The analyst continues his statement as follows:

Although the short-term trend for gold is upward, the market remains overbought and is in a possible double top position on its daily charts. Do investors have a reason to hold off on buying? As of now no. Until next week? Maybe, but we have to go with what we see in front of us.

Jim Wyckoff: Gold price techniques favor the bulls

Kitco Senior Analyst Jim Wyckoff also expects further rises for the gold price next week. “The short-term technical stance remains firmly bullish,” Wyckoff said. So it will steadily rise further,” he says.