Which altcoins will stand out on Binance? Who will draw the bull model? These are perhaps the most frequently asked questions by cryptocurrency enthusiasts. We also focused on these coins. Let’s take a look at our article.

Those who draw a bull model in altcoins

The first cryptocurrency we want to emphasize is SAND among altcoins. SAND, which has an important place among altcoins, has been attracting attention since May 22. Accordingly, there was a significant increase in whale accumulation in the Sandbox network. This supports the forecast for a rise in SAND prices. The red line in the chart below indicates the group of whales holding between one million and 10 million tokens. Accordingly, the chart shows how whales started buying around May 22. Since then, they have added 6.92 million SAND tokens to their wallet balance.

cryptocoin.com When we look at it as a whole, the newly added 6.92 million tokens are worth about 3.5 million dollars. The fact that the whales are so invested indicates that they are preparing for some bullish action. In summary, the surge in network activity and the accumulation wave among whale investors will affect the price of SAND. In this case, there are chances that the price is above $0.60.

Polygon (MATIC) draws a bull pattern

Among altcoins, the price of Polygon (MATIC) is currently trading sideways with great respect for the pennant formation that has been present since the beginning of May. There are several attempts to the upside for a breakout. Also, with some minor dips on the downside, the final result is in favor of the bulls. There is printing on the top. A breakout, however, could prompt a rapid rally to $0.96 with a 10% added value in the process.

Polygon price has been acting quite regularly within the pennant ranges that have formed on the chart since the beginning of May. The pennant is pushing the bears and bulls towards each other in a slow trend with lower highs and higher lows. A break is possible at any moment. Also, it looks like the bulls will eventually win.

The current level is $0.89, which MATIC must cross to break the upper red descending trendline. Therefore, it must rise above this level. In case of a breakout, more bulls will flock to the rally. This in turn will mean an increase of up to $0.96 with a 10% gain.

Render Token at key level

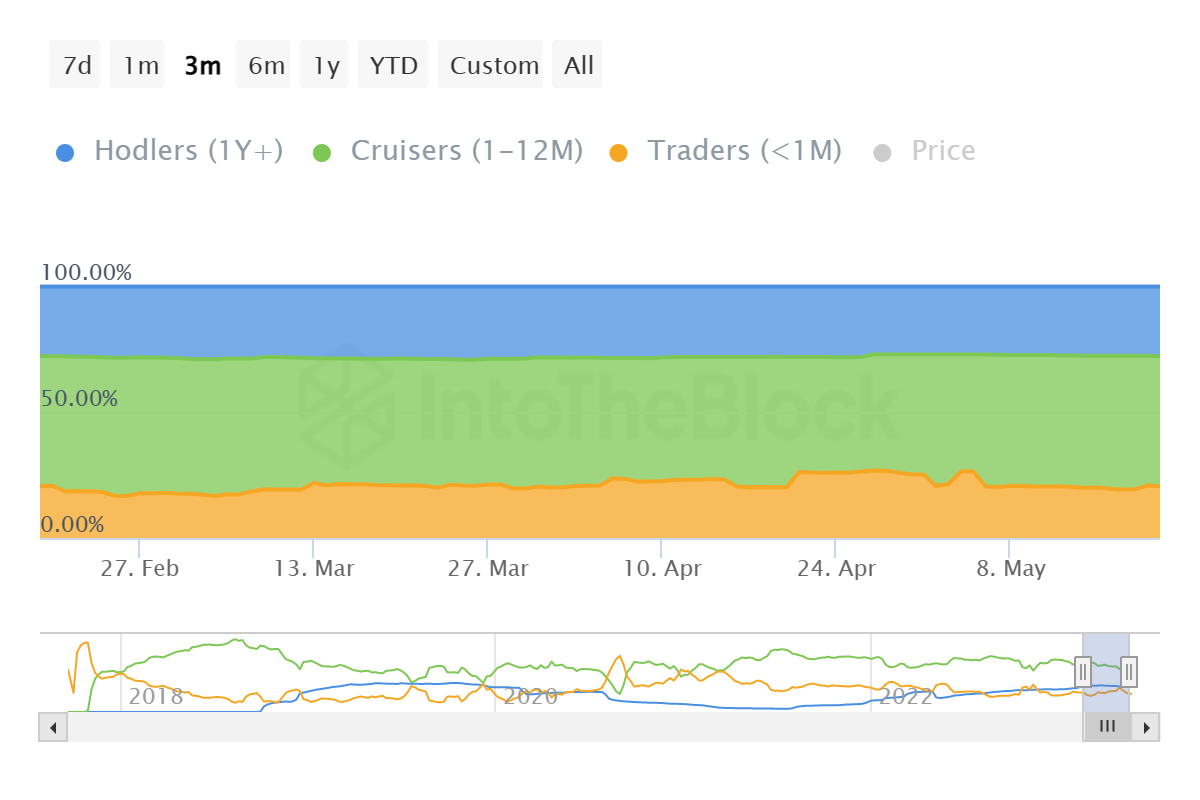

RNDR price has been moving upwards since the beginning of the year. The price climbed above the $2.10 horizontal resistance area at the end of April. However, unable to go further, the price fell below this level on 8 May. Before the drop, there was a bearish cross on the RSI (green line). A downtrend occurs when the momentum increase is not accompanied by a price increase. It also often causes a downtrend reversal.

Traders use the RSI as a momentum indicator. Thus, they determine whether a market is overbought or oversold. On the other hand, they decide whether to save or sell an asset accordingly. If the RSI value is above 50 and the trend is up, the bulls are in an advantageous position. However, if the value is below 50, the reverse is true.

Despite the initial drop, RNDR price within altcoins has increased since May 11, reclaiming the $2.10 area in the process. During this time, the RSI broke out of the downtrend trendline. Both of these are generally considered bullish signs that lead to upward moves. After the RNDR took off, it hit a year high of $2.42 on May 20.

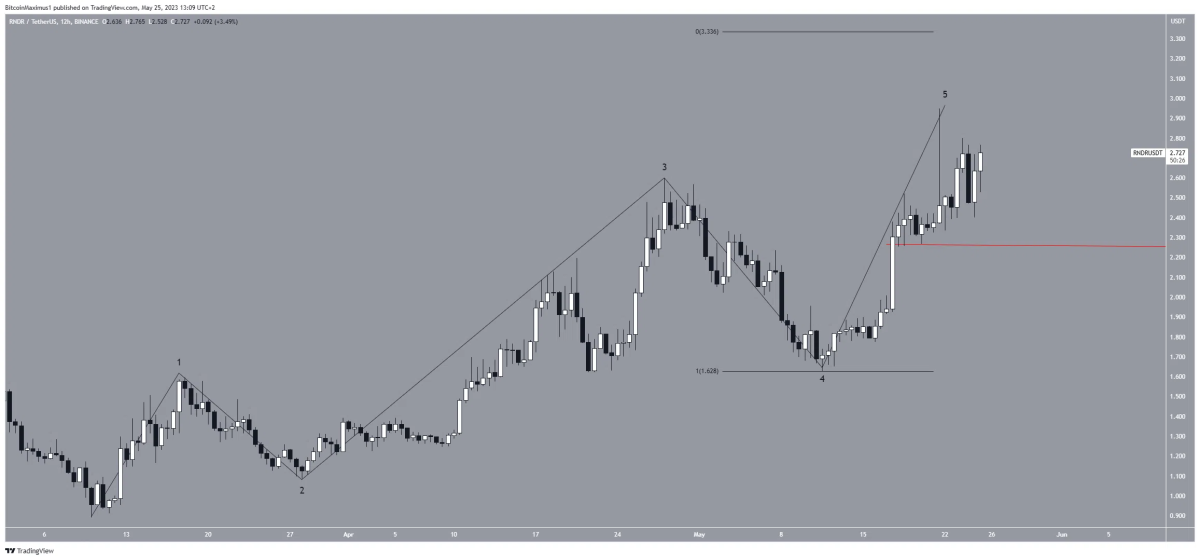

Technical analysis from the 12-hour time frame gives a bullish RNDR price prediction mostly due to the number of waves. However, it also indicates that a peak may be reached soon. Since the beginning of March, the RNDR has been stuck in a five-wave upward move (black). It is currently in the fifth and final wave of this increase. The most likely target for the top of the move is $3.30. This ensures that the fifth wave is the same length as the combination of waves one and three. Additionally, the level coincides with long-term resistance on the daily timeframe.

This, despite the bullish RNDR price prediction, a drop below the $2.26 local low (red line) means that a high has occurred and a correction has begun. In this case, there are chances that the price is near the $1.65 support area.

Impressive move expected for Shiba Inu

Among altcoins, Shiba Inu (SHIB) has an impressive target of capturing an increase in price once the markets recover. Because the next bull run could coincide with the launch of several projects aimed at supporting the asset’s price movements. In light of speculation that the price will rise to $0.01, many sources have evaluated the asset’s potential to meet this price target.

Last year, Finder, a leading FinTech benchmarking platform, surveyed up to 55 fintech experts and industry leaders to get their views on Shiba Inu’s future price movements. The survey shows that the asset will reach $0.00004930 by 2025.

Half of those surveyed (around 50%) say they are unsure of Shibarium’s potential impact on SHIB’s price action. On the other hand, 25% believe that Shibarium will contribute to the Shiba Inu price increase. One of the survey participants, Alexander Kuptsikevich, a senior financial analyst at FxPro, states that SHIB will reach $0.0001 by 2025.

However, Changelly, a crypto exchange, has a more bearish outlook for the Shiba Inu. In one of their detailed analysis, Changelly predicted that SHIB could only hit a maximum price of $0.00002694 by 2025. Changelly believes the asset could only reach $0.00017 in 2030.

Additionally, Telegaon, a reputable analytics resource focusing specifically on stocks and crypto, also expressed its opinion. In a report released last Monday, Telegaon has drawn several projections for the price of SHIB from 2023 to 2050. The analysis predicted that the asset will have a maximum price of $0.0000316 and an average price of $0.0000239 this year.

Prospects for Cardano in Altcoins

Cardano price, traded at $ 0.358, reached the lowest level of the month. However, it is still higher than the March low of $0.304. Altcoin’s high correlation with Bitcoin prevented it from falling excessively. But ADA has also found support from its investor base. During the week, Cardano whales attracted attention with their trading volumes. They have been quite active, reaching an annual high of $16 billion. Transactions exceeding $100,000 were last this high in June 2022.

Its activities have been increasing since the first quarter and throughout April. The spike in this situation is a bullish sign for the altcoin. This is because the lack of activity in the network tends to leave the cryptocurrency’s price action dependent on external factors. No major development events are currently observed in Cardano. Therefore, the potential for a faster recovery mostly depends on its investors.

ADA holders expecting profits are also not selling, as seen in the balance held by mid-term holders. These investors, who hold more than 51% of the entire circulating supply, did not take any sell positions, arguing that sales were minimal.

Therefore, a bullish outlook from retail investors and whale addresses could support Cardano price recovery. ADA needs to rally 10% to fix profits. It also needs to turn the critical resistance marked at $0.395 by the 200-day Exponential Moving Average (EMA) into a support base. This will allow the token to eventually break the historically tested barrier of $0.42 and move towards the 2023 high of $0.450.

However, the bearish trend in broader market cues means trouble for the third-generation cryptocurrency. Among altcoins, this could leave Cardano price vulnerable to a drop to the March low of $0.304.