The crypto currency market is generally following a negative course by experiencing a total of $ 125 billion in the last 24 hours. However, some Altcoin projects have attracted the attention of investors with remarkable price movements despite this decline in the market.

Altcoin projects that gained the most value on February 5, 2025

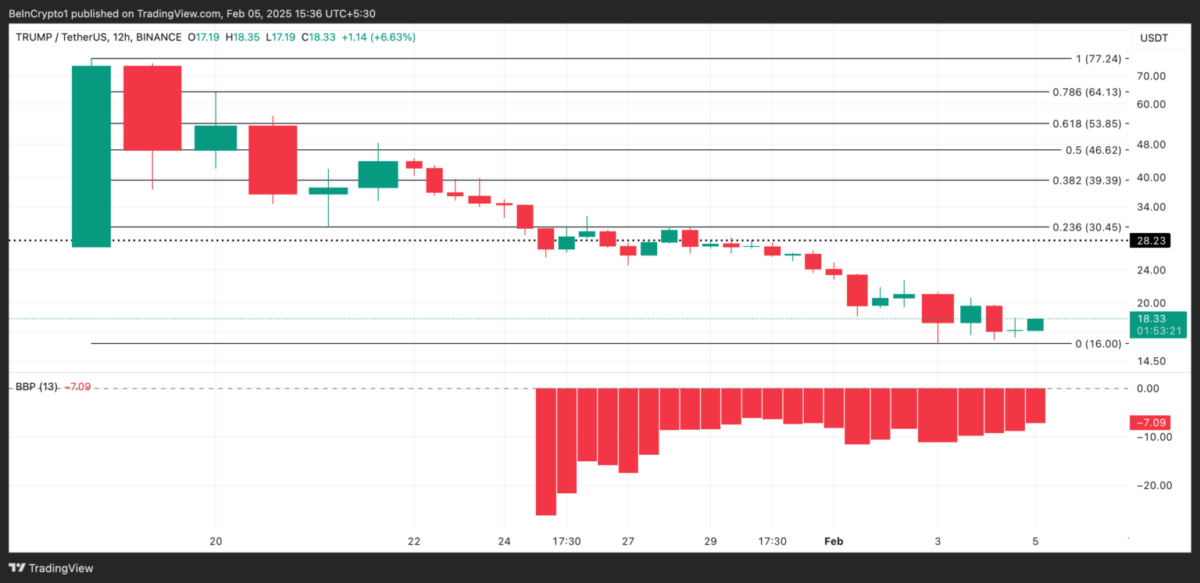

Trump Coin (Trump)

Former US President Donald Trump associated with Solana -based breast Coine Trump, today was one of the most sought -after subcoins. The reason for this is that another token, Melania, which has gained a double -digit value in the last 24 hours, is one of the most rising assets of the market.

Trump was traded at $ 18.33 during writing and recorded an increase of 6 %in the last 24 hours. However, despite this rise, technical indicators show that sales pressure continues.

For example, the Elder -Ray index is at -7.09. This indicator measures the purchase and sale pressure of an asset, and the negative values show the dominance of the sellers. If the sales pressure increases, the Trump price may decrease to $ 16.

On the other hand, if the buyers gain strength, token may rise to $ 28.23.

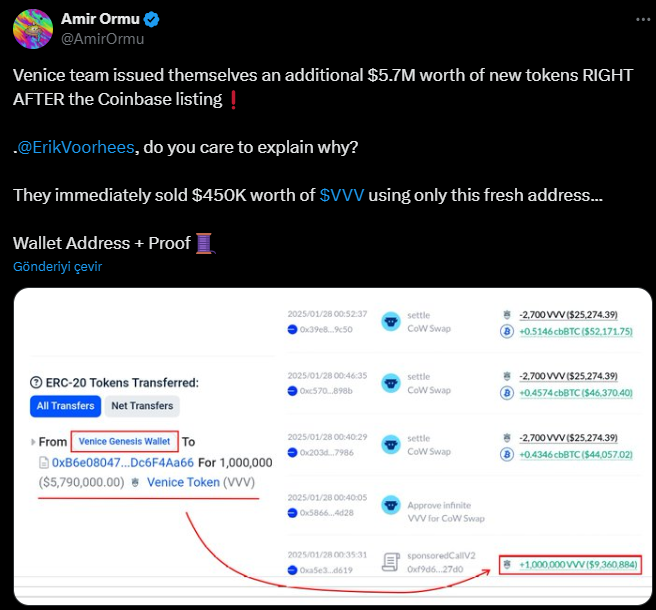

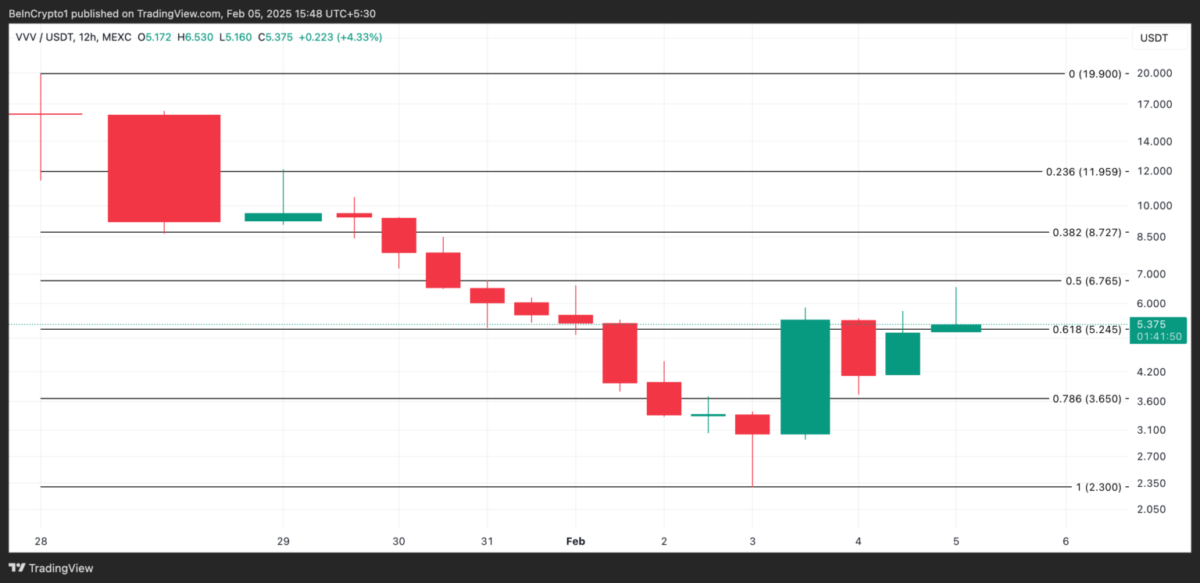

Venice Token (VVV)

VVV, which increased by 44 %in the last 24 hours, has become one of the most talked about subcoins of the day. However, there are some discussions behind this rise.

Crypto Analyst Ormu, X (formerly Twitter) shares on his shares, the developer team after the coinbase listed illegally to them illegally allocated VVV token worth $ 5.7 million. Allegedly, the team sold 450,000 dollars of these tokens through a new wallet.

Although these claims are not yet verified, the price of the VVV continues to rise. If this trend continues, the token can reach $ 6.75. However, it may decrease to $ 3.65 with a possible price correction.

Solana (left)

Solana (left), another prominent subcoin today. Currently traded at $ 205.13, the left has decreased less than 1 %in the last 24 hours. However, in the last week, he lost 12 %value and kept up with the overall decrease trend in the market.

Technical analysis indicators also show that the decline tendency may continue. According to the directional motion index (DMI) data, the positive direction index (+DI) is below the level of negative direction index (-DI). This shows that the decline tendency is still dominant.

If this persists, the left price may fall below the critical $ 200 level and decrease to $ 187.71. However, if the market conditions improve and the investor interest increases, the left can rise up again to $ 229.03.