Bitcoin whales sent approximately 6,000 BTC to exchanges. That’s why the analyst expects further crashes for Bitcoin. Meanwhile, LINK whales collected $9.6 million worth of tokens in three days. According to Santiment, this also signals a rise in altcoin price.

Bitcoin whales took action

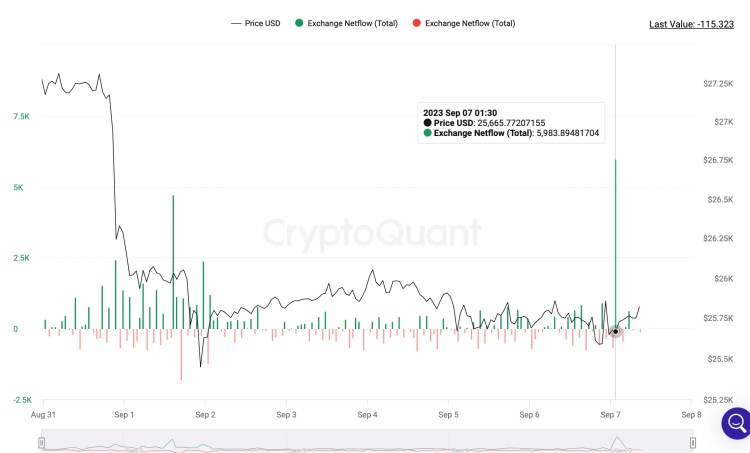

cryptocoin.com As you follow, the market has been moving in stagnant waters for a while. This calm is pushing some crypto whales to sell their tokens. In this regard, crypto whales sent approximately 5,983 BTC to central exchanges yesterday. It is possible to see this increase in the stock market net flow index of data analysis platform CryptoQuant. At the time of this writing, BTC is trading at $25,798. That makes this entry worth $155 million.

BTC Exchange Net Flow

BTC Exchange Net FlowA closer examination of this entry shows that the whales sent 5,470 BTC to Gemini, a US crypto exchange.

BTC Exchange Flow Gemini

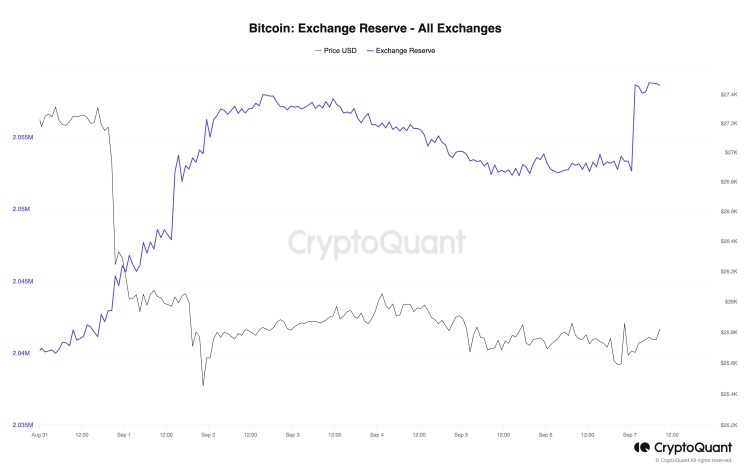

BTC Exchange Flow GeminiAccording to crypto data aggregator CoinGecko, 155 million Bitcoins correspond to 1.97% of Bitcoin’s 24-hour trading volume, which currently stands at $7.88 billion. Meanwhile, the supply on exchanges also showed a significant increase over the past week. Between September 1-7, 12,832 BTC was moved to centralized exchanges. Thus, it signaled a potential selling pressure.

BTC Exchange Reserve

BTC Exchange ReserveWhere will Bitcoin price go next?

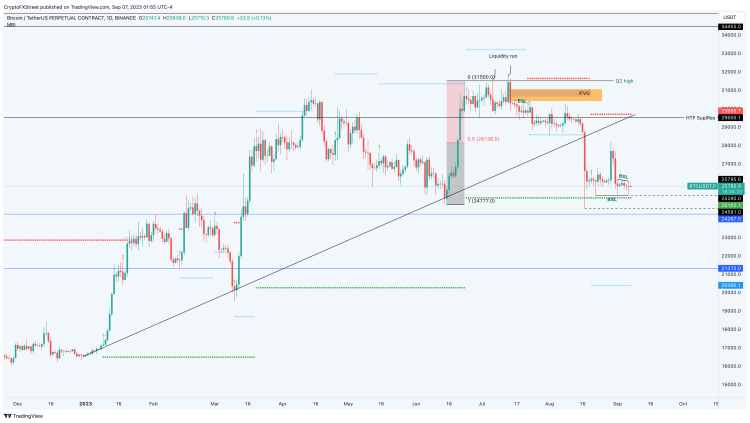

Crypto analyst Akash Girimath determines BTC’s route as follows. At the time of this writing, Bitcoin is trading around $25,780. Also, liquidity exists on both sides. Given the increase in exchange reserves and recent inflows, sell-side liquidity below $25,280 and $24,581 is likely to be swept away. A break of the support level at $25,142 will lead to a retest of another important support level at $24,267.

BTC 1 day chart

BTC 1 day chartOn the other hand, if Bitcoin price rises as high as $26,151 and gathers liquidity on the buy side, it could squeeze early bears. Any stop-loss placed below the above-mentioned level will invalidate the bearish argument. It is possible that a prolonged increase in bullish momentum could pave the way for BTC to retest the 200-day Simple Moving Average at $27,576.

Whales are adding to their LINK holdings!

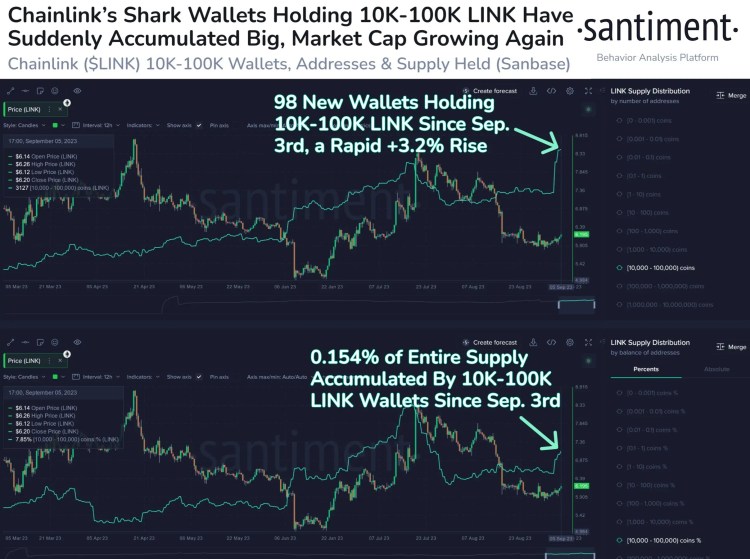

Crypto whales accumulating LINK has fueled a rally in LINK price in previous cases. This makes it an important metric for determining the direction of the altcoin price trend. According to data from crypto intelligence tracker Santiment, Chainlink whales purchased $9.6 million worth of tokens in a three-day period. This increased demand is likely to act as a bullish catalyst for LINK. Meanwhile, it is noteworthy that whales collect LINK while selling Bitcoin.

As you can see from the chart below, LINK accumulation by whales in the first week of June increased the altcoin price. In the two weeks following the increased demand, the LINK price increased by more than 20%. Similarly, whales also quickly collected LINK tokens in the third week of July. Thus, LINK brought its price close to $8.3. Santiment data shows that 98 new whale wallets have appeared on LINK since Monday. This means there was an increase of 3.2%. As of Thursday, there were 3,127 whale wallets holding between 10,000 and 100,000 LINK tokens.

Chainlink whale wallets are buying more LINK tokens. Source: Santiment

Chainlink whale wallets are buying more LINK tokens. Source: SantimentIt is possible to attribute the recent behavior of Chainlink’s major wallet investors to Swift’s announcement about its partnership with the protocol on August 31.