British economist John Maynard Keynes is the founder of Keynesian economics. Keynesian economics argues that demand drives supply and healthy economies spend or invest more than they save.

To create jobs and increase consumer purchasing power during a recession, Keynes argued that governments should increase spending, even if it means borrowing. Critics attack Keynesian economics for encouraging deficit spending, suffocating private investment, and causing inflation.

Who Was John Maynard Keynes?

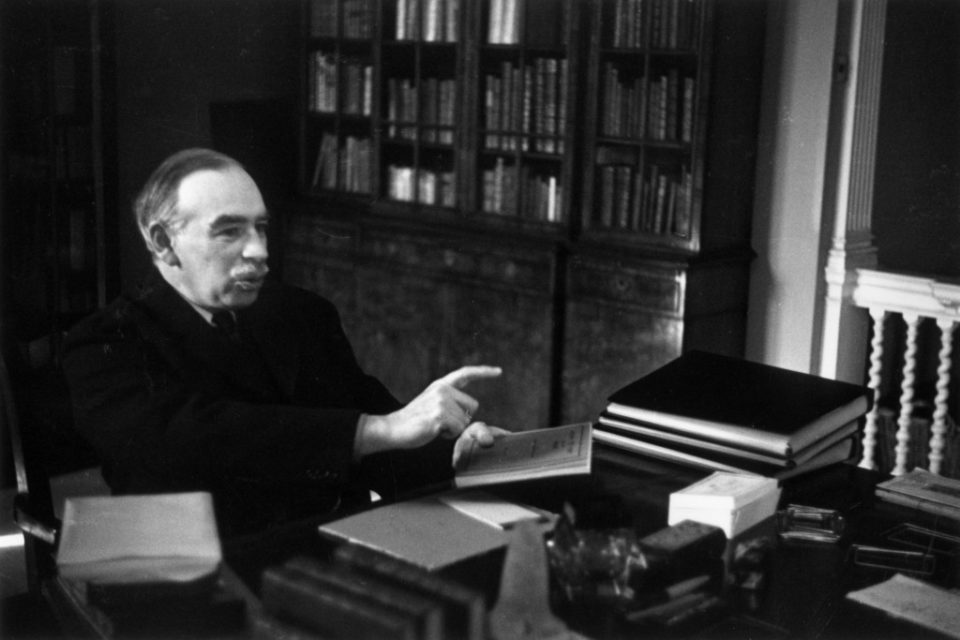

John Maynard Keynes (1883–1946), an early 20th-century British economist best known as the founder of Keynesian economics and the father of modern macroeconomics, studies how economies – markets and other systems that operate on a large scale – behave. One of the hallmarks of Keynesian economics is that governments must actively seek to influence the course of economies by increasing spending to stimulate demand, especially in the face of recession.

In his seminal work, considered one of the most influential economics books in history, he advocates government intervention as a solution to high unemployment.

Education and Early Career

Keynes’ early interest in economics stemmed largely from his father, John Neville Keynes, a lecturer in Economics at Cambridge University. One of Cambridge’s first female graduates, her mother was active in charity work for the poor.

Born into a middle-class family, he received scholarships from Eton College and Cambridge University, two of England’s most distinguished schools, where he earned a BA in mathematics in 1904. He had almost no formal education in economics.

Early in his career, Keynes worked on probability theory and taught Economics at Cambridge University as a Fellow of King’s College. Government roles ranged from official posts in the British Civil Service and the British Treasury to appointments to royal commissions on currency and finance, including his appointment as the Treasury’s financial representative at the Versailles peace conference that ended the First World War in 1919.

Advocacy of State Intervention in the Economy

Keynes’ father was a proponent of laissez-faire economics, an economic philosophy of free market capitalism that opposed government intervention. Keynes was a traditional believer in free market principles (and an active stock market investor) during his time at Cambridge.

However, after the stock market crash of 1929 triggered the Great Depression, Keynes came to believe that unrestricted free-market capitalism was fundamentally flawed and needed to be reformulated not only to function better on its own, but to outperform competitive systems such as communism.

As a result, he began advocating government intervention to reduce unemployment and correct the economic recession. He argued that in addition to government job programs, increased government spending was necessary to reduce unemployment. Even if it means a budget deficit.

What is Keynesian Economics?

Known as Keynesian economics, the theories of John Maynard Keynes center around the idea that governments should play an active role in their countries’ economies, rather than simply allowing the free market to prevail. Specifically, Keynes advocated federal spending to reduce setbacks in business cycles.

The most basic principle of Keynesian economics is that the driving force of an economy is not supply but demand. At the time, conventional economic wisdom held the opposite view: that supply creates demand. Since aggregate demand, aggregate expenditure and consumption by the private sector and government for goods and services, drives supply, aggregate expenditure determines all economic outcomes, from the production of goods to the employment rate.

Another fundamental tenet of Keynesian economics is that the best way to get an economy out of a recession is for the government to increase demand by injecting capital into the economy. In short, consumption (spending) is the key to economic recovery.

These two principles are fundamental to Keynes’ belief that demand is so important that a government should do so even if it has to go into debt to spend. According to Keynes, the government that boosts the economy in this way will stimulate consumer demand, which in turn will stimulate production and ensure full employment.

Critique of Keynesian Economics

Despite being widely adopted after the Second World War, Keynesian economics has received a lot of criticism since the ideas were first introduced in the 1930s.

One major criticism concerned the concept of big government. The expansion of federal initiatives that need to happen to enable the government to participate actively in the economy. Competing economic theorists such as those of the Chicago School of Economics argue that recessions and booms are part of the natural order of business cycles; direct government intervention only worsens the recovery process, and federal spending discourages private investment.

The most famous critic of Keynesian economics was Milton Friedman, an American economist known for advocating free market capitalism. Considered the most influential economist of the second half of the 20th century, as Keynes was the most influential economist of the first half, Friedman advocated monetarism, rejecting important parts of Keynesian economics.

Contrary to Keynes’s position that fiscal policy is more important than monetary policy to control the total money supply available to banks, consumers, and businesses to influence economic conditions, Friedman and other monetarists argue that governments aim at the rate of growth of the money supply to reduce economic growth. can promote stability. In short, Friedman and monetarist economists advocate control of money in the economy, while Keynesian economists advocate government spending.

For example, Keynes believed that an interventionist government could soften recessions by using fiscal policy to support aggregate demand, stimulate consumption and reduce unemployment, while Friedman criticized deficit spending and advocated smaller government and a return to the free market.

Keynesian and Laissez-Faire Economics

Keynesian economics, which advocates government intervention in the economy, is in sharp contrast to laissez-faire economics, which argues that the less government gets involved in economic affairs, the better for business and society as a whole.

Keynesian Economics Examples

new deal

The onset of the Great Depression in the 1930s significantly influenced Keynes’ economic theories and led to the widespread adoption of several of his policies.

To address the crisis in the United States, President Franklin Roosevelt enacted the New Deal, a series of government programs that directly reflect the Keynesian principle that even a free enterprise capitalist system requires some degree of federal oversight.

With the New Deal, the US government intervened to stimulate the national economy on an unprecedented scale, including creating several new agencies focused on providing jobs to unemployed Americans and stabilizing the price of consumer goods. Roosevelt also adopted Keynes’ expanded deficit spending policy to stimulate demand, including for public housing, slum clearance, railroad construction, and other major public works programs.

Great Recession Spending

In response to the Great Recession of 2007-2009, President Barack Obama took several steps that reflected Keynesian economic theory. The federal government bailed out debtor companies in various industries. It also protected Fannie Mae and Freddie Mac, the two major market makers and guarantors of mortgages and home loans.

In 2009, President Obama signed the American Recovery and Reinvestment Act, an $831 billion government stimulus package designed to save existing jobs and create new ones. It included tax breaks/credits and unemployment benefits for families; It also allocated spending on health, infrastructure and education.

COVID-19 Stimulant Controls

Following the COVID-19 pandemic in 2020, the US government under President Donald Trump and President Joseph Biden offered a variety of aid, loan forgiveness, and loan extension programs.

The US government also supported weekly state unemployment benefits and sent direct benefits to American taxpayers in the form of three separate, tax-free incentive checks.

Heritage

Since the 1930s, the popularity of Keynesian economics has risen and fallen, and theories have undergone significant revision since Keynes’s day. However, the school of economic thought he founded has left an indelible imprint on modern nations: the idea that governments have a role to play in business, even in capitalist economies.

Who Said Keynesian Economy Waste Your Way Out of Recession?

It was Milton Friedman who attacked the central Keynesian notion that consumption is the key to economic recovery as he tried to “spend his way out of the recession.” Unlike Keynes, Friedman believed that increasing government spending and increasing debt ultimately led to inflation—a rise in prices that devalued money and wages; this could be disastrous unless accompanied by fundamental economic growth. The stagflation of the 1970s was an example: it was a period of paradoxically high unemployment and low output, but also high inflation and high interest rates.

Was Keynes a Socialist?

It is difficult to describe Keynes as a socialist.

On the one hand, he showed interest in socialist regimes and advocated the presence of government in economic affairs. He certainly did not believe in allowing business cycles to explode and collapse without interference, or to allow private enterprise to run unbridled.

Keynes, on the other hand, fell short of arguing that governments actually seize and manage industries. He wanted central authorities to encourage, not control, production methods.

There is also evidence that he returned to the more traditional free-market capitalism towards the end of his life, as he contemplated ways to pull post-war Britain out of an economic vacuum. Shortly before his death in 1946, he told his friend, Secretary of State Henry Clay, that he found himself more confident in a solution he had “tried to get himself out of economic thinking two decades ago”: the invisible hand of Adam Smith.

What Did Keynes Mean by “We’re All Dead in the Long Run”?

When critics argued that Keynesian public finance and deficit spending support would lead to default in the long run, Keynes’ famous response was, “In the long run, we’re all dead.” In context, his point was that governments should solve problems in the short term rather than waiting for market forces to fix problems “when we all die” in the long run.

Did Keynes Predict the Rise of Nazi Germany?

During the 1919 Versailles Peace Conference, Keynes was an outspoken critic of the crippling economic measures that some high-ranking statesmen sought to impose on Germany. He left the conference early to protest, ignoring warnings that these harsh sanctions would likely result in an economic and political disaster for Europe.

Upon returning to England, he resigned from the British Treasury and summed up his arguments about the dangers of a peace treaty designed to crush Germany permanently in The Economic Consequences of Peace.

Within a year of its publication in 1920, Keynes’ book became a bestseller and strongly influenced public opinion that the Treaty of Versailles was unfair. The political and economic turmoil of the 1930s, World War II. Fueling the rise of fascism that erupted into World War II, Keynes’ early warnings began to sound like prophecy.

Final Words

John Maynard Keynes and Keynesian economics were revolutionary in the 1930s and, in the mid-20th century, World War II. He did much to shape economies post-World War II. His theories were hacked in the 1970s, revived in the 2000s and are still debated today.

The basic tenet of Keynesian economics is that the best way to get an economy out of a recession is for the government to increase demand by injecting capital into the economy. In short, consumption (spending) is the key to economic recovery.

Keynes is widely regarded as the most influential economist of the first half of the 20th century, while his most famous critic, the proponent of monetarism, Milton Friedman, is regarded as the most influential economist of the second half.

Keynes left an important legacy: the notion that governments have a role to play in the economic well-being of industries and people. The questions that remain are how big the role of government should be and how best to execute that role.