Bitcoin Dominates the Crypto Landscape in 2024

In 2024, Bitcoin (BTC) has emerged as the focal point of the cryptocurrency market, capturing significant attention. However, the evolving regulatory landscape under the Trump administration may soon alter the dynamics, prompting a potential shift towards other assets. According to insights from Kaiko Research, a notable player in crypto data analysis, this shift could foster renewed interest in various segments of the market.

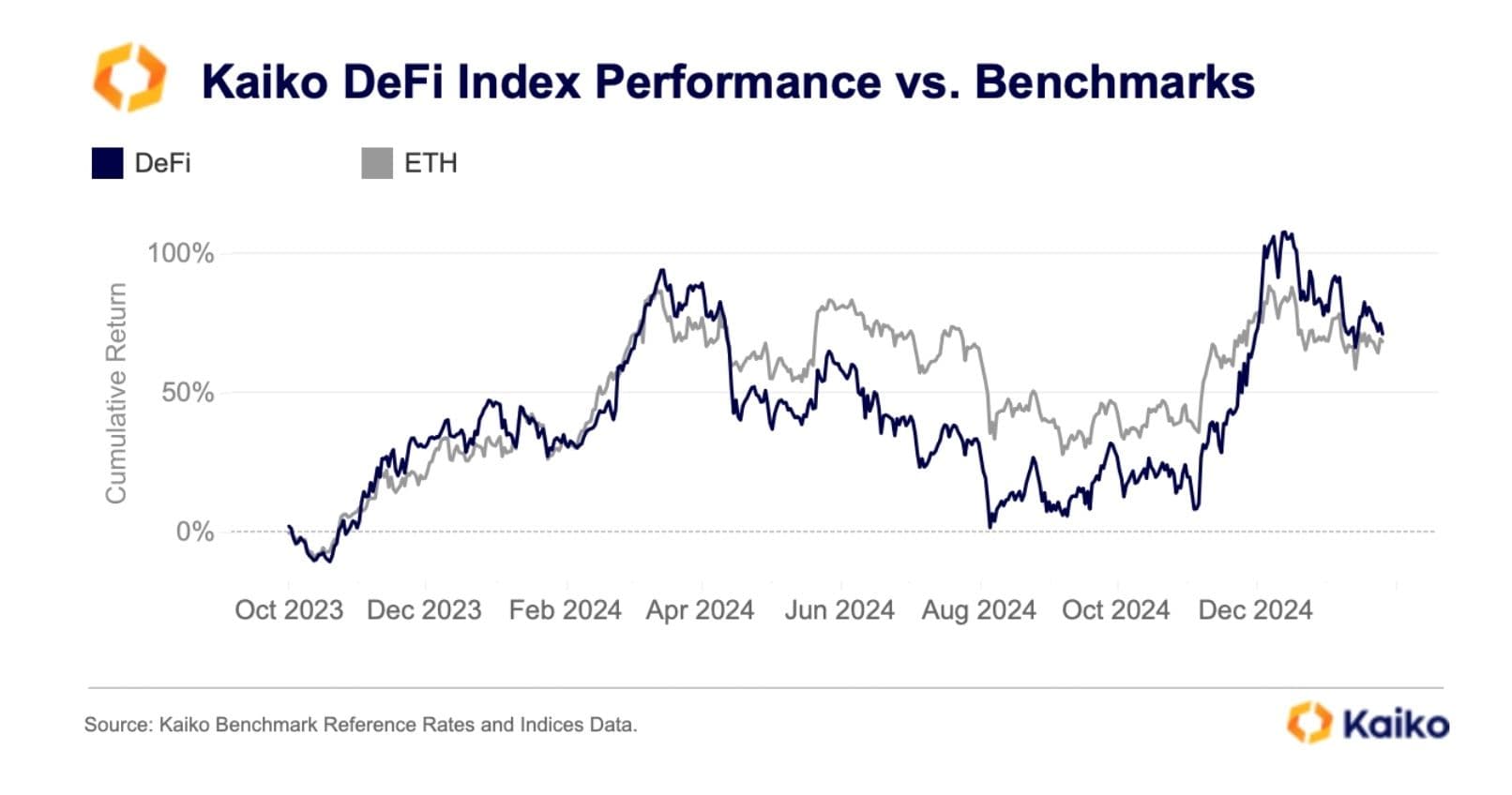

Interestingly, the decentralized finance (DeFi) sector is showing promising signs, with analysts Adam McCarthy and Dessislava Aubert highlighting its resilience in a recent report. Their analysis reveals that the company’s DeFi index (KSDEFI) has significantly outperformed ether (ETH) since its inception in October 2023, boasting impressive returns of approximately 75% during this period. This performance is particularly noteworthy given that the majority of the protocols within the index are built on the Ethereum platform.

According to the report, “This outperformance may persist into the latter half of 2025, as several assets within the index benefit from strong tailwinds.” This trend is indicative of a decreasing correlation between the DeFi index and ETH over time, suggesting that the decentralized finance sector is expanding beyond the confines of the Ethereum ecosystem.

The index comprises 11 DeFi tokens, with the most prominent being UNI, AAVE, and ONDO. The report identifies at least four of these tokens as having robust prospects for the remainder of the year, driven by favorable market conditions.

For instance, emerging regulatory developments in the United States may pave the way for decentralized exchange Uniswap and decentralized lender Aave to introduce fee switches for their respective tokens. This means that protocol fees could potentially be distributed to holders of UNI and AAVE, enhancing their value.

Furthermore, Ondo Finance, a tokenization protocol, is anticipated to gain traction as the trend of tokenization accelerates, particularly as traditional financial institutions continue to explore deeper integration with the crypto space. The report notes, “Regulatory constraints in key markets have been a significant hurdle since 2020, but they are only part of the challenge. DeFi has also faced structural issues, including high user friction due to fees and security concerns. However, with regulatory scrutiny easing, the sector now has abundant opportunities for growth.”